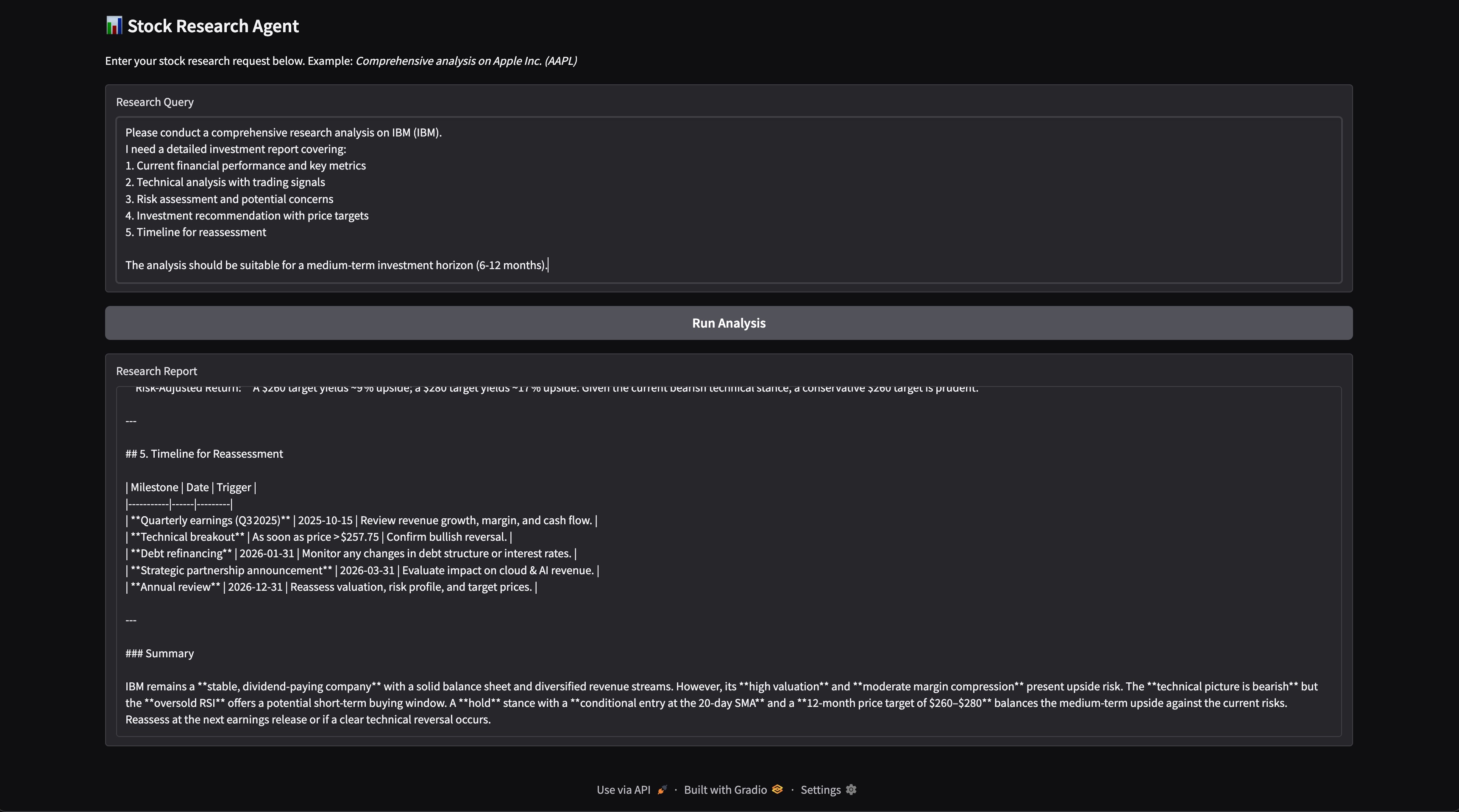

A sophisticated AI-powered stock research agent built with LangChain DeepAgents that provides comprehensive financial analysis comparable to professional analysts.

This project demonstrates how to build advanced AI research capabilities using LangChain's DeepAgent framework. Unlike simple chatbots, this system employs specialized sub-agents, systematic planning, and comprehensive tool integration to deliver professional-grade stock analysis.

- 🎯 Multi-Perspective Analysis: Combines fundamental, technical, and risk analysis

- 🤖 Specialized Sub-Agents: Expert analysts for different aspects of research

- 📊 Real-Time Data: Live stock prices, financial statements, and technical indicators

- 🔄 Systematic Workflow: Structured research methodology

- 🖥️ Web Interface: User-friendly Gradio interface

- 📈 Professional Reports: Investment recommendations with price targets

- ⚡ Fast Analysis: Reduces research time from hours to minutes

┌─────────────────────────────────────────────────────────────┐

│ User Interface (Gradio) │

└─────────────────────┬───────────────────────────────────────┘

│

┌─────────────────────▼───────────────────────────────────────┐

│ Master DeepAgent Orchestrator │

├─────────────────────────────────────────────────────────────┤

│ Planning Tool | Virtual File System | System Prompt │

└─────────────┬───────────────────────────────────┬─────────┘

│ │

┌─────────▼──────────┐ ┌──────▼──────────┐

│ Sub-Agents │ │ Financial Tools │

│ │ │ │

│ • Fundamental │ │ • Stock Price │

│ • Technical │ │ • Financials │

│ • Risk Analysis │ │ • Technical │

└────────────────────┘ │ Indicators │

└──────┬──────────┘

│

┌──────────▼──────────┐

│ Data Sources │

│ │

│ • Yahoo Finance │

│ • Real-time APIs │

│ • Market Data │

└─────────────────────┘

- Python 3.8 or higher

- Ollama (for local LLM hosting)

-

Clone the repository

git clone https://github.com/yourusername/deepagent-stock-research.git cd deepagent-stock-research -

Install dependencies

pip install -r requirements.txt

-

Set up Ollama

# Install Ollama (if not already installed) curl -fsSL https://ollama.ai/install.sh | sh # Pull a model ollama pull gpt-oss

-

Run the application

python researchagent.py

-

Open your browser Navigate to

http://localhost:7860

Create a requirements.txt file with:

deepagents

langchain-ollama

langchain-core

yfinance

gradio

pandas

numpy# Example query

query = """

Conduct a comprehensive analysis of Apple Inc. (AAPL) for a 6-month investment horizon.

Include:

1. Current financial performance

2. Technical analysis with trading signals

3. Risk assessment

4. Investment recommendation with price targets

"""- Portfolio Analysis: "Compare AAPL, MSFT, and GOOGL for portfolio allocation"

- Sector Research: "Analyze the technology sector outlook for Q1 2025"

- Risk Assessment: "Evaluate the risks of investing in Tesla (TSLA)"

- Technical Analysis: "Provide technical analysis and entry points for NVDA"

# Customize the LLM model

ollama_model = ChatOllama(

model="your-preferred-model", # e.g., "llama2", "codellama"

temperature=0, # Adjust for creativity vs consistency

)@tool

def custom_analysis_tool(symbol: str) -> str:

"""Your custom analysis logic here."""

# Implementation

return results

# Add to tools list

tools = [

get_stock_price,

get_financial_statements,

get_technical_indicators,

custom_analysis_tool # Your custom tool

]# Add new specialized sub-agent

esg_analyst = {

"name": "esg-analyst",

"description": "Evaluates Environmental, Social, and Governance factors",

"prompt": """You are an ESG specialist..."""

}

subagents = [fundamental_analyst, technical_analyst, risk_analyst, esg_analyst]=== STOCK RESEARCH REPORT ===

APPLE INC. (AAPL) INVESTMENT ANALYSIS

Generated: 2025-08-13 23:28:00

EXECUTIVE SUMMARY

Current Price: $184.12

Recommendation: BUY

Target Price: $210.00 (12-month)

Risk Level: MODERATE

FUNDAMENTAL ANALYSIS

• Revenue (TTM): $385.7B (+1.3% YoY)

• Net Income: $96.9B

• P/E Ratio: 28.5x (Premium to sector avg: 24.1x)

• ROE: 147.4% (Excellent)

• Debt-to-Equity: 1.73 (Manageable)

TECHNICAL ANALYSIS

• Trend: BULLISH (Price > SMA20 > SMA50)

• RSI: 62.3 (Neutral-Bullish)

• Support Levels: $175, $165

• Resistance Levels: $195, $205

RISK ASSESSMENT

• Market Risk: MODERATE (Tech sector volatility)

• Company Risk: LOW (Strong balance sheet)

• Regulatory Risk: MODERATE (Antitrust concerns)

[Full detailed report continues...]

This tool is for educational and research purposes only. It does not constitute financial advice. Always consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

- LangChain Team for the DeepAgent framework

- Yahoo Finance for providing free financial data APIs

- Gradio Team for the excellent UI framework

- Ollama for local LLM hosting capabilities

If you find this project useful, please consider giving it a star ⭐️ on GitHub!

Built with ❤️ using LangChain DeepAgents

Transform your investment research with the power of specialized AI agents.