Machine learning for portfolio management and trading with scikit-learn

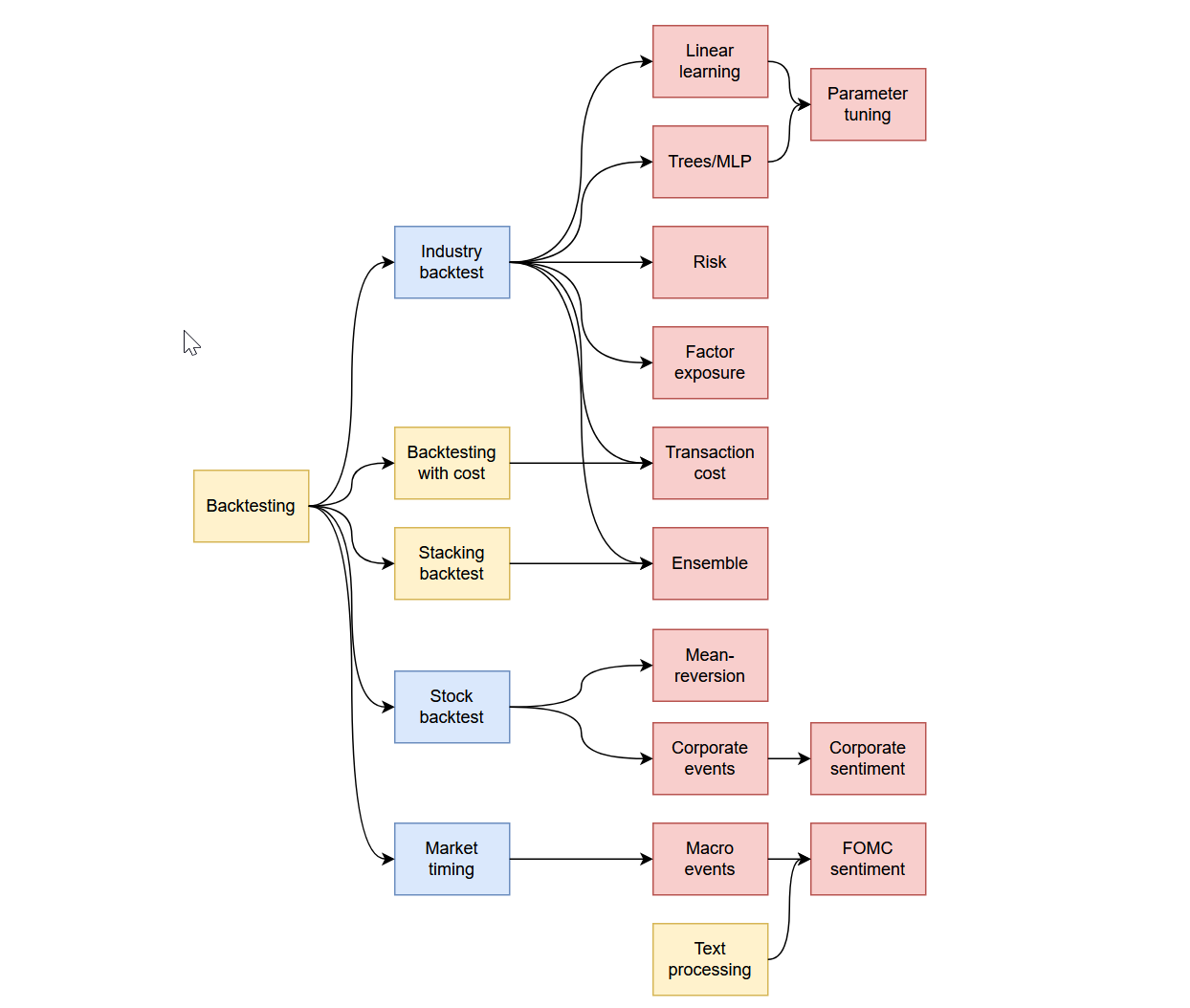

This repo contains a set of python notebooks that cover topics related to machine-learning for portfolio management as illustrated by the figure below.

The concatenation of all notebooks as a single pdf file can be found here.

An example to run a simple backtest with learning using a Ridge estimator:

from sklearn.pipeline import make_pipeline

from sklearn.preprocessing import StandardScaler

from skfin import Ridge, MeanVariance, Backtester

from skfin.datasets import load_kf_returns

from skfin.plot import line

estimator = make_pipeline(StandardScaler(with_mean=False),

Ridge(),

MeanVariance())

returns_data = load_kf_returns(cache_dir='data')

ret = returns_data['Monthly']['Average_Value_Weighted_Returns'][:'1999']

transform_X = lambda x: x.rolling(12).mean().fillna(0).values

transform_y = lambda x: x.shift(-1).values

features = transform_X(ret)

target = transform_y(ret)

bt = Backtester(estimator, ret).train(features, target)

line(bt.pnl_, cumsum=True, title='Ridge')git clone https://github.com/schampon/skfin.git

cd skfin

./create_env.sh