fastquant allows you to easily backtest investment strategies with as few as 3 lines of python code. Its goal is to promote data driven investments by making quantitative analysis in finance accessible to everyone.

- Easily access historical stock data

- Backtest and optimize trading strategies with only 3 lines of code

* - Both Yahoo Finance and Philippine stock data data are accessible straight from fastquant

pip install fastquant

R support is pending development, but you may install the R package by typing the following

# install.packages("remotes")

remotes::install_github("enzoampil/fastquant", subdir = "R")

All symbols from Yahoo Finance and Philippine Stock Exchange (PSE) are accessible via get_stock_data.

from fastquant import get_stock_data

df = get_stock_data("JFC", "2018-01-01", "2019-01-01")

print(df.head())

# dt close

# 2019-01-01 293.0

# 2019-01-02 292.0

# 2019-01-03 309.0

# 2019-01-06 323.0

# 2019-01-07 321.0

library(fastquant)

get_pse_data("JFC", "2018-01-01", "2019-01-01")

Note: Python has Yahoo Finance and phisix support. R only has phisix support. Symbols from Yahoo Finance will return closing prices in USD, while symbols from PSE will return closing prices in PHP

The data is pulled from Binance, and all the available tickers are found here.

from fastquant import get_crypto_data

crypto = get_crypto_data("BTC/USDT", "2018-12-01", "2019-12-31")

crypto.head()

# open high low close volume

# dt

# 2018-12-01 4041.27 4299.99 3963.01 4190.02 44840.073481

# 2018-12-02 4190.98 4312.99 4103.04 4161.01 38912.154790

# 2018-12-03 4160.55 4179.00 3827.00 3884.01 49094.369163

# 2018-12-04 3884.76 4085.00 3781.00 3951.64 48489.551613

# 2018-12-05 3950.98 3970.00 3745.00 3769.84 44004.799448

Note: Support for backtesting in R is pending

Daily Jollibee prices from 2018-01-01 to 2019-01-01

from fastquant import backtest

backtest('smac', df, fast_period=15, slow_period=40)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 102272.90

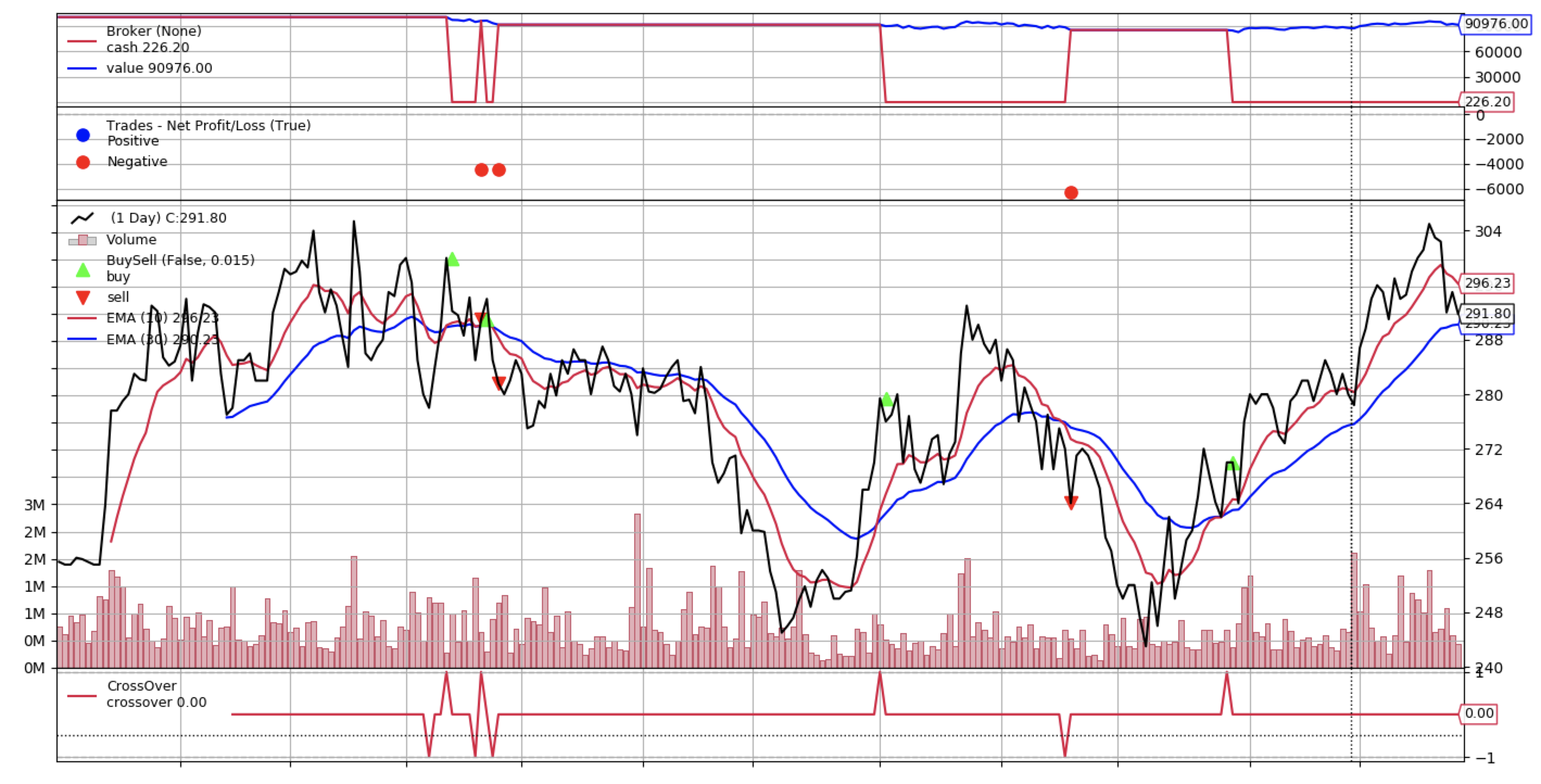

Daily Jollibee prices from 2018-01-01 to 2019-01-01

from fastquant import backtest

res = backtest("smac", df, fast_period=range(15, 30, 3), slow_period=range(40, 55, 3), verbose=False)

# Optimal parameters: {'init_cash': 100000, 'buy_prop': 1, 'sell_prop': 1, 'execution_type': 'close', 'fast_period': 15, 'slow_period': 40}

# Optimal metrics: {'rtot': 0.022, 'ravg': 9.25e-05, 'rnorm': 0.024, 'rnorm100': 2.36, 'sharperatio': None, 'pnl': 2272.9, 'final_value': 102272.90}

print(res[['fast_period', 'slow_period', 'final_value']].head())

# fast_period slow_period final_value

#0 15 40 102272.90

#1 21 40 98847.00

#2 21 52 98796.09

#3 24 46 98008.79

#4 15 46 97452.92

| Strategy | Alias | Parameters |

|---|---|---|

| Relative Strength Index (RSI) | rsi | rsi_period, rsi_upper, rsi_lower |

| Simple moving average crossover (SMAC) | smac | fast_period, slow_period |

| Exponential moving average crossover (EMAC) | emac | fast_period, slow_period |

| Moving Average Convergence Divergence (MACD) | macd | fast_perod, slow_upper, signal_period, sma_period, sma_dir_period |

| Bollinger Bands | bbands | period, devfactor |

| Buy and Hold | buynhold | N/A |

| Sentiment Strategy | sentiment | keyword , page_nums, senti |

backtest('rsi', df, rsi_period=14, rsi_upper=70, rsi_lower=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 132967.87

backtest('smac', df, fast_period=10, slow_period=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 95902.74

backtest('emac', df, fast_period=10, slow_period=30)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 90976.00

backtest('macd', df, fast_period=12, slow_period=26, signal_period=9, sma_period=30, dir_period=10)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 96229.58

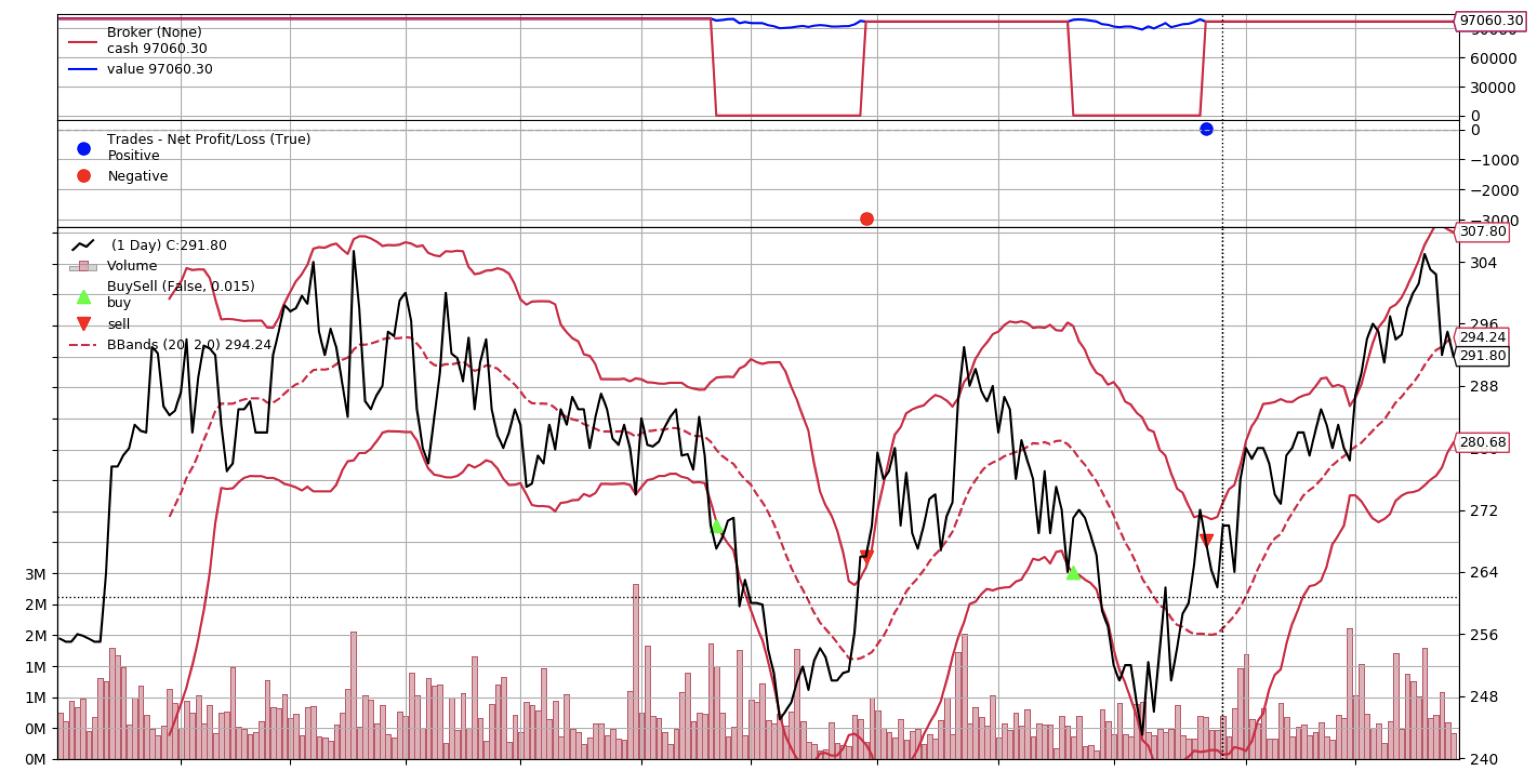

backtest('bbands', df, period=20, devfactor=2.0)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 97060.30

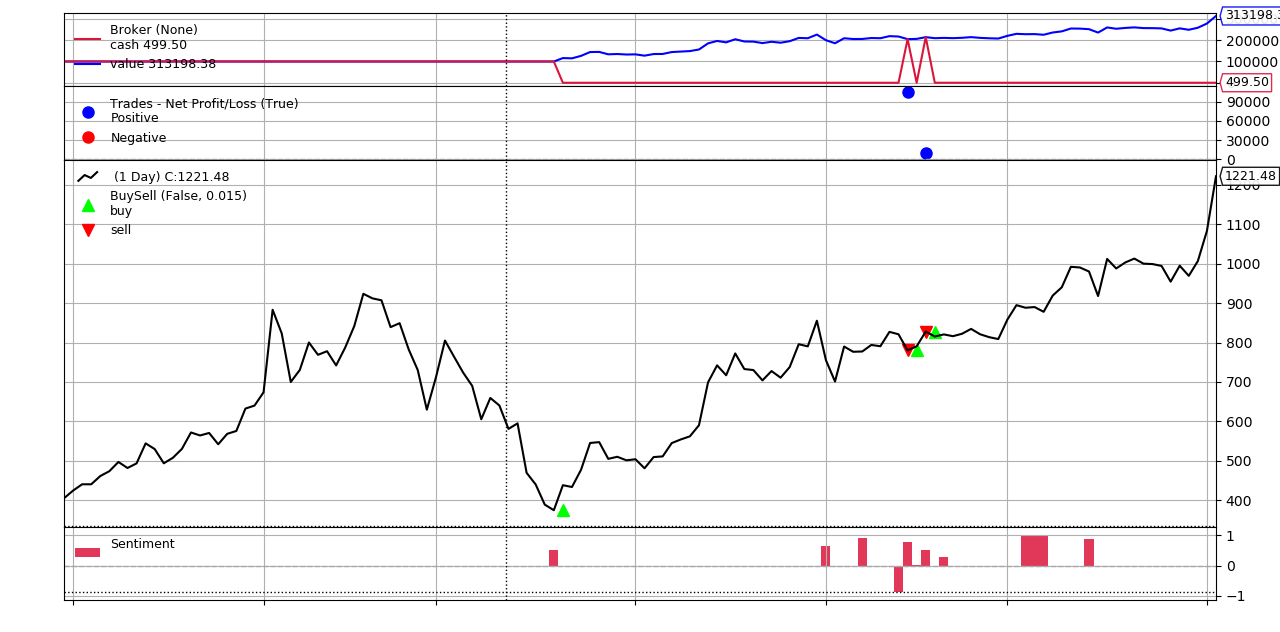

Use Tesla (TSLA) stock from yahoo finance and news articles from Business Times

from fastquant import get_yahoo_data, get_bt_news_sentiment

data = get_yahoo_data("TSLA", "2020-01-01", "2020-07-04")

sentiments = get_bt_news_sentiment(keyword="tesla", page_nums=3)

backtest("sentiment", data, sentiments=sentiments, senti=0.2)

# Starting Portfolio Value: 100000.00

# Final Portfolio Value: 313198.37

Multiple registered strategies can be utilized together in an OR fashion, where buy or sell signals are applied when at least one of the strategies trigger them.

df = get_stock_data("JFC", "2018-01-01", "2019-01-01")

# Utilize single set of parameters

strats = {

"smac": {"fast_period": 35, "slow_period": 50},

"rsi": {"rsi_lower": 30, "rsi_upper": 70}

}

res = backtest("multi", df, strats=strats)

res.shape

# (1, 16)

# Utilize auto grid search

strats_opt = {

"smac": {"fast_period": 35, "slow_period": [40, 50]},

"rsi": {"rsi_lower": [15, 30], "rsi_upper": 70}

}

res_opt = backtest("multi", df, strats=strats_opt)

res_opt.shape

# (4, 16)

See more examples here.