将收益率进行对数化处理得到收益率序列,对收益率序列进行JB检验,ADF检验和ARCH-LM(10)检验

对各收益率序列先建立ARMA模型拟合序列的条件均值(按照 AIC准则选择最佳的ARMA模型进行拟合)

用GARCH(1,1)拟合收益率的残差序列,并对GARCH的残差进行ADF,BDS检验和CvM检验

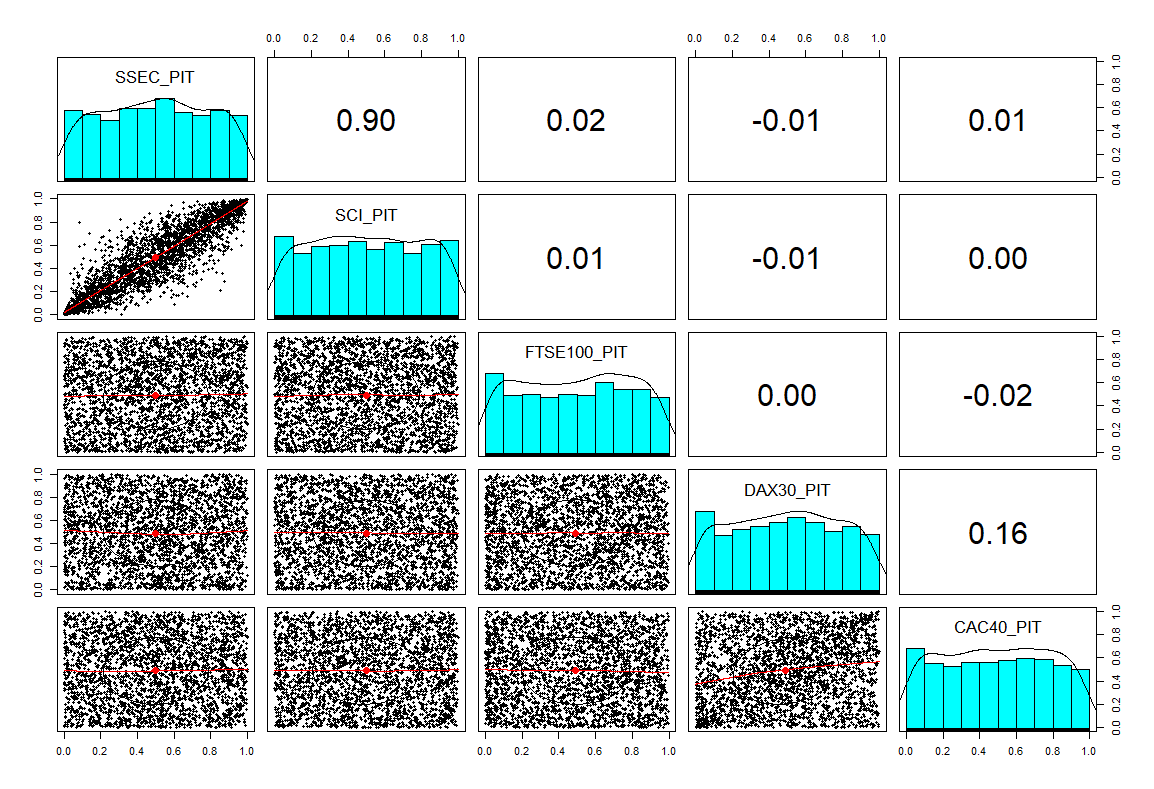

对残差序列进行标准化处理再进行概率积分变换(假设为t分布)。然后计算任意两国股指序列间的Kendall系数,得到配对图

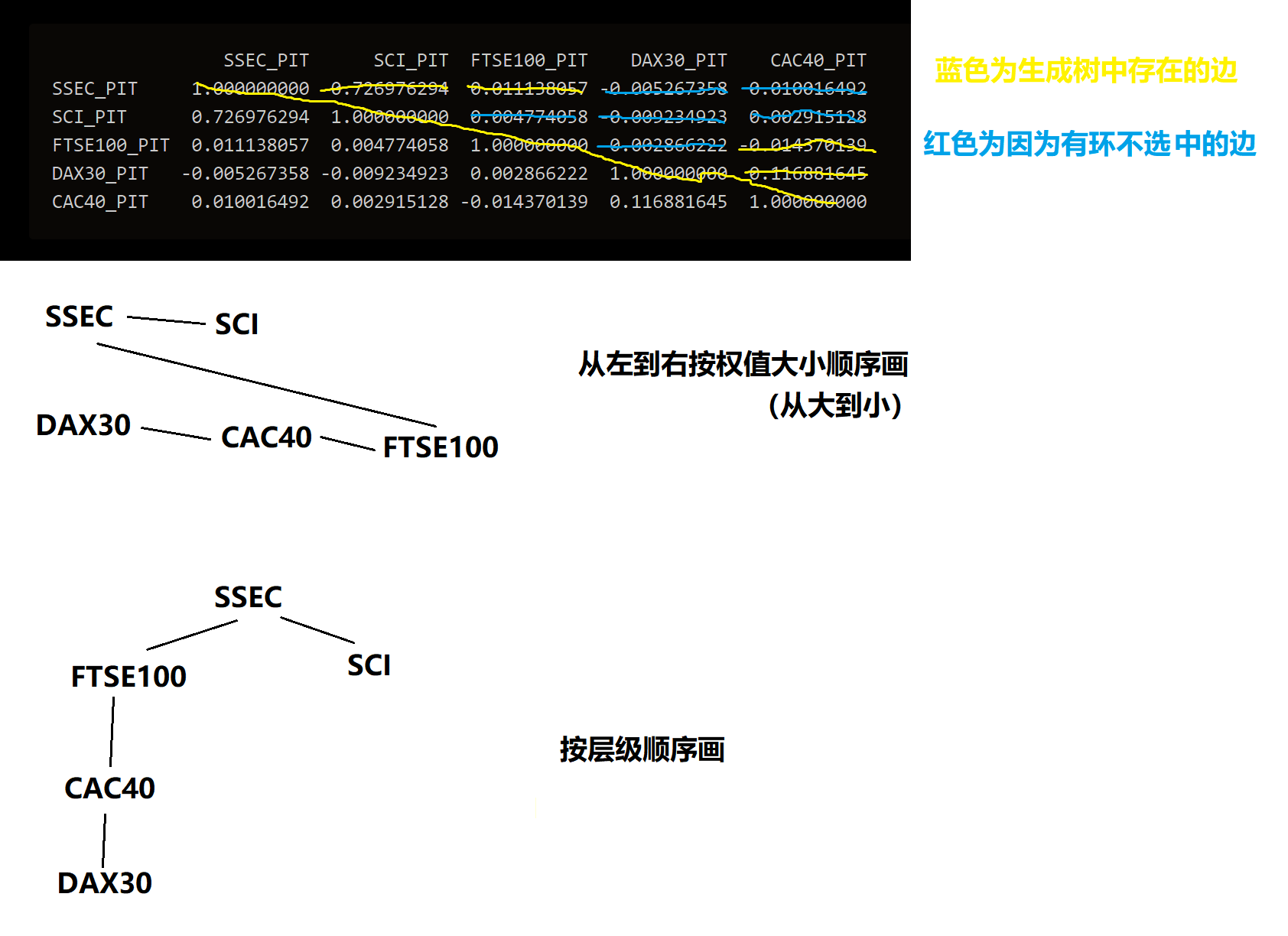

构建Copula树:每个节点是一个股指收益率序列,根据极大似然估计及AIC准则确定树中每条边对应的Copula函数类型。以第四步计算的相关性作为边权值,建立最大生成树

评价最大生成树中每条边(对应一个Copula模型)的拟合结果(用AIC、BIC和loss值三个指标)

对收益率

- JB检验: Jarque_beraResult(statistic=5922.418016821695, pvalue=0.0)

- ADF检验: (-9.840797680673846, 4.7594468861661446e-17, 27, 2889, {'1%': -3.432615531267606, '5%': -2.8625409589326205, '10%': -2.5673028391515254}, -21733.928302635803)

- ARCH效应检验:Chi-squared = 380.56, df = 10, p-value < 2.2e-16

- JB检验: Jarque_beraResult(statistic=1922.9291939615061, pvalue=0.0)

- ADF检验: (-14.2597311275576, 1.4334971007230296e-26, 13, 2903, {'1%': -3.4326045958386953, '5%': -2.862536129260207, '10%': -2.567300267867621}, -20574.45350851521)

- ARCH效应检验:Chi-squared = 357.91, df = 10, p-value < 2.2e-16

- JB检验: Jarque_beraResult(statistic=13094.463375384035, pvalue=0.0)

- ADF检验: (-16.826211955918293, 1.167669855767656e-29, 12, 3017, {'1%': -3.4325193312999036, '5%': -2.8624984712561274, '10%': -2.567280219110819}, -23969.535430552045)

- ARCH效应检验:Chi-squared = 698.07, df = 10, p-value < 2.2e-16

- JB检验: Jarque_beraResult(statistic=7339.559305081821, pvalue=0.0)

- ADF检验: (-16.327113802190908, 3.08674593815361e-29, 10, 3033, {'1%': -3.4325078777082796, '5%': -2.8624934125717725, '10%': -2.567277525930013}, -22658.135809125994)

- ARCH效应检验:Chi-squared = 552.41, df = 10, p-value < 2.2e-16

- JB检验: Jarque_beraResult(statistic=8109.087761470604, pvalue=0.0)

- ADF检验: (-20.10586187025487, 0.0, 7, 3065, {'1%': -3.432485329568554, '5%': -2.8624834537243493, '10%': -2.5672722239727066}, -22955.17483627421)

- ARCH效应检验:Chi-squared = 542.23, df = 10, p-value < 2.2e-16

ARIMA最优模型

ARIMA(5,0,3) with zero mean

Coefficients:

ar1 ar2 ar3 ar4 ar5 ma1 ma2 ma3

0.2987 -0.952 0.1237 0.0157 -0.0173 -0.2660 0.9336 -0.0781

s.e. 0.7602 0.158 0.7119 0.0465 0.0267 0.7602 0.1328 0.7043

sigma^2 = 3.146e-05: log likelihood = 10984.84

AIC=-21951.67 AICc=-21951.61 BIC=-21897.87

ARIMA(1,0,1) with zero mean

Coefficients:

ar1 ma1

-0.8882 0.9166

s.e. 0.0421 0.0364

sigma^2 = 4.716e-05: log likelihood = 10391.47

AIC=-20776.95 AICc=-20776.94 BIC=-20759.01

ARIMA(5,0,5) with zero mean

Coefficients:

ar1 ar2 ar3 ar4 ar5 ma1 ma2 ma3

-0.1726 0.2969 -0.3699 0.3401 0.7752 0.1639 -0.3170 0.3652

s.e. 0.0850 0.0714 0.1144 0.0638 0.0748 0.0814 0.0646 0.1123

ma4 ma5

-0.3882 -0.7517

s.e. 0.0619 0.0880

sigma^2 = 1.966e-05: log likelihood = 12123.78

AIC=-24225.56 AICc=-24225.47 BIC=-24159.38

ARIMA(0,0,0) with zero mean

sigma^2 = 3.161e-05: log likelihood = 11452.01

AIC=-22902.01 AICc=-22902.01 BIC=-22895.99

ARIMA(0,0,0) with zero mean

sigma^2 = 3.081e-05: log likelihood = 11600.13

AIC=-23198.25 AICc=-23198.25 BIC=-23192.22

用GARCH拟合ARIMA最优模型的残差

- GARCH

Estimate Std. Error t value Pr(>|t|)

mu 1.269e-04 7.230e-05 1.755 0.07920 .

omega 2.527e-07 8.340e-08 3.030 0.00245 **

alpha1 5.609e-02 8.540e-03 6.567 5.12e-11 ***

beta1 9.378e-01 8.659e-03 108.308 < 2e-16 ***

shape 4.580e+00 4.070e-01 11.255 < 2e-16 ***

- ADF检验:Dickey-Fuller = -13.721, Lag order = 14, p-value = 0.01(实际比这个小)

- BDS检验

Epsilon for close points = 0.0028 0.0056 0.0084 0.0112

Standard Normal =

[ 0.0028 ] [ 0.0056 ] [ 0.0084 ] [ 0.0112 ]

[ 2 ] 4.9865 7.0757 9.0644 10.4787

[ 3 ] 7.2637 9.9598 12.0665 13.7297

p-value =

[ 0.0028 ] [ 0.0056 ] [ 0.0084 ] [ 0.0112 ]

[ 2 ] 0 0 0 0

[ 3 ] 0 0 0 0

- CVM检验:omega2 = 962.98, p-value < 2.2e-16

- GARCH

Estimate Std. Error t value Pr(>|t|)

mu 1.385e-04 9.827e-05 1.409 0.15883

omega 5.991e-07 1.867e-07 3.208 0.00133 **

alpha1 5.881e-02 8.714e-03 6.749 1.49e-11 ***

beta1 9.292e-01 1.004e-02 92.556 < 2e-16 ***

shape 5.683e+00 6.067e-01 9.366 < 2e-16 ***

- ADF检验:Dickey-Fuller = -13.723, Lag order = 14, p-value = 0.01(实际比这个小)

- BDS检验

Epsilon for close points = 0.0034 0.0069 0.0103 0.0137

Standard Normal =

[ 0.0034 ] [ 0.0069 ] [ 0.0103 ] [ 0.0137 ]

[ 2 ] 4.0122 5.6464 7.7869 9.8539

[ 3 ] 6.4152 8.3825 10.9933 13.2679

p-value =

[ 0.0034 ] [ 0.0069 ] [ 0.0103 ] [ 0.0137 ]

[ 2 ] 1e-04 0 0 0

[ 3 ] 0e+00 0 0 0

- CVM检验:omega2 = 960.45, p-value < 2.2e-16

- GARCH

Coefficient(s):

Estimate Std. Error t value Pr(>|t|)

mu 2.744e-04 5.851e-05 4.690 2.74e-06 ***

omega 6.905e-07 1.672e-07 4.129 3.64e-05 ***

alpha1 1.370e-01 2.068e-02 6.622 3.56e-11 ***

beta1 8.305e-01 2.431e-02 34.161 < 2e-16 ***

shape 6.059e+00 6.654e-01 9.105 < 2e-16 ***

- ADF检验:Dickey-Fuller = -13.919, Lag order = 14, p-value = 0.01(实际比这个小)

- BDS检验

Epsilon for close points = 0.0022 0.0044 0.0066 0.0089

Standard Normal =

[ 0.0022 ] [ 0.0044 ] [ 0.0066 ] [ 0.0089 ]

[ 2 ] 12.0353 12.6627 12.8609 13.2519

[ 3 ] 16.0576 16.4353 16.3417 16.5075

p-value =

[ 0.0022 ] [ 0.0044 ] [ 0.0066 ] [ 0.0089 ]

[ 2 ] 0 0 0 0

[ 3 ] 0 0 0 0

- CVM检验:omega2 = 1005, p-value < 2.2e-16

- GARCH

Estimate Std. Error t value Pr(>|t|)

mu 3.512e-04 7.154e-05 4.909 9.17e-07 ***

omega 5.466e-07 1.692e-07 3.230 0.00124 **

alpha1 1.147e-01 1.819e-02 6.303 2.92e-10 ***

beta1 8.777e-01 1.813e-02 48.398 < 2e-16 ***

shape 4.999e+00 4.935e-01 10.129 < 2e-16 ***

- ADF检验:Dickey-Fuller = -14.072, Lag order = 14, p-value = 0.01(实际比这个小)

- BDS检验

Epsilon for close points = 0.0028 0.0056 0.0084 0.0112

Standard Normal =

[ 0.0028 ] [ 0.0056 ] [ 0.0084 ] [ 0.0112 ]

[ 2 ] 10.0683 9.4842 9.8153 9.2503

[ 3 ] 14.4560 13.5235 13.6332 13.3037

p-value =

[ 0.0028 ] [ 0.0056 ] [ 0.0084 ] [ 0.0112 ]

[ 2 ] 0 0 0 0

[ 3 ] 0 0 0 0

- CVM检验:omega2 = 1014.8, p-value < 2.2e-16

- GARCH

Estimate Std. Error t value Pr(>|t|)

mu 3.409e-04 6.835e-05 4.987 6.12e-07 ***

omega 6.014e-07 1.647e-07 3.652 0.000261 ***

alpha1 1.372e-01 2.021e-02 6.791 1.11e-11 ***

beta1 8.548e-01 1.933e-02 44.210 < 2e-16 ***

shape 5.192e+00 4.897e-01 10.604 < 2e-16 ***

- ADF检验:Dickey-Fuller = -14.861, Lag order = 14, p-value = 0.01(实际比这个小)

- BDS检验

Epsilon for close points = 0.0028 0.0056 0.0083 0.0111

Standard Normal =

[ 0.0028 ] [ 0.0056 ] [ 0.0083 ] [ 0.0111 ]

[ 2 ] 12.7196 11.4585 11.0073 10.0493

[ 3 ] 18.3638 16.3068 15.1014 13.9452

p-value =

[ 0.0028 ] [ 0.0056 ] [ 0.0083 ] [ 0.0111 ]

[ 2 ] 0 0 0 0

[ 3 ] 0 0 0 0

- CVM检验:omega2 = 1014.6, p-value < 2.2e-16

SSEC_PIT SCI_PIT FTSE100_PIT DAX30_PIT CAC40_PIT

SSEC_PIT 1.000000000 0.726898701 0.010906220 -0.005301217 0.009875415

SCI_PIT 0.726898701 1.000000000 0.005022354 -0.009410330 0.002810261

FTSE100_PIT 0.010906220 0.005022354 1.000000000 0.002791451 -0.014208841

DAX30_PIT -0.005301217 -0.009410330 0.002791451 1.000000000 0.114052574

CAC40_PIT 0.009875415 0.002810261 -0.014208841 0.114052574 1.000000000

- SSEC-SCI: family = t, rotation = 0, parameters = 0.99, 4.97(边权值0.726976294)

- DAX30-CAC40: family = bb1, rotation = 180, parameters = 0, 6.56(边权值0.116881645)

- FTSE100-CAC40: family = t, rotation = 0, parameters = 0.97, 5.07(边权值-0.014370139)

- SSEC-FTSE100: family = t, rotation = 0, parameters = 0.97, 5.07(边权值0.011138057)

上一步建立的copula模型指标:

- SSEC-SCI:AIC -9105.955 BIC -9093.998

- DAX30-CAC40: AIC -5490.886 BIC -5478.929

- FTSE100-CAC40:AIC -5622.067 BIC -5610.11

- SSEC-FTSE100: AIC -4696.484 BIC -4684.528

以上模型负对数似然都是收敛到负无穷