Portfolio

Modern portfolio theory - Wikipedia

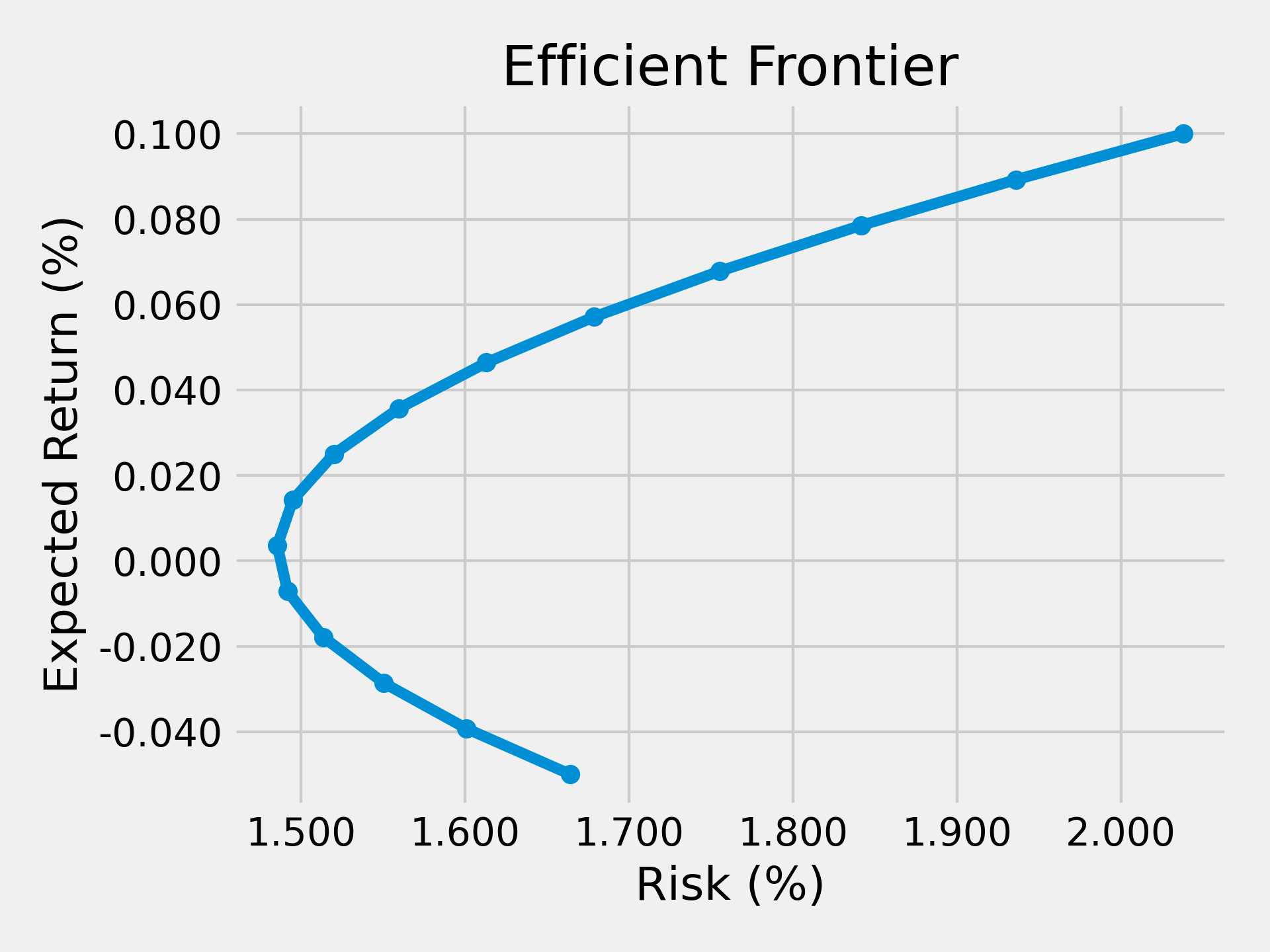

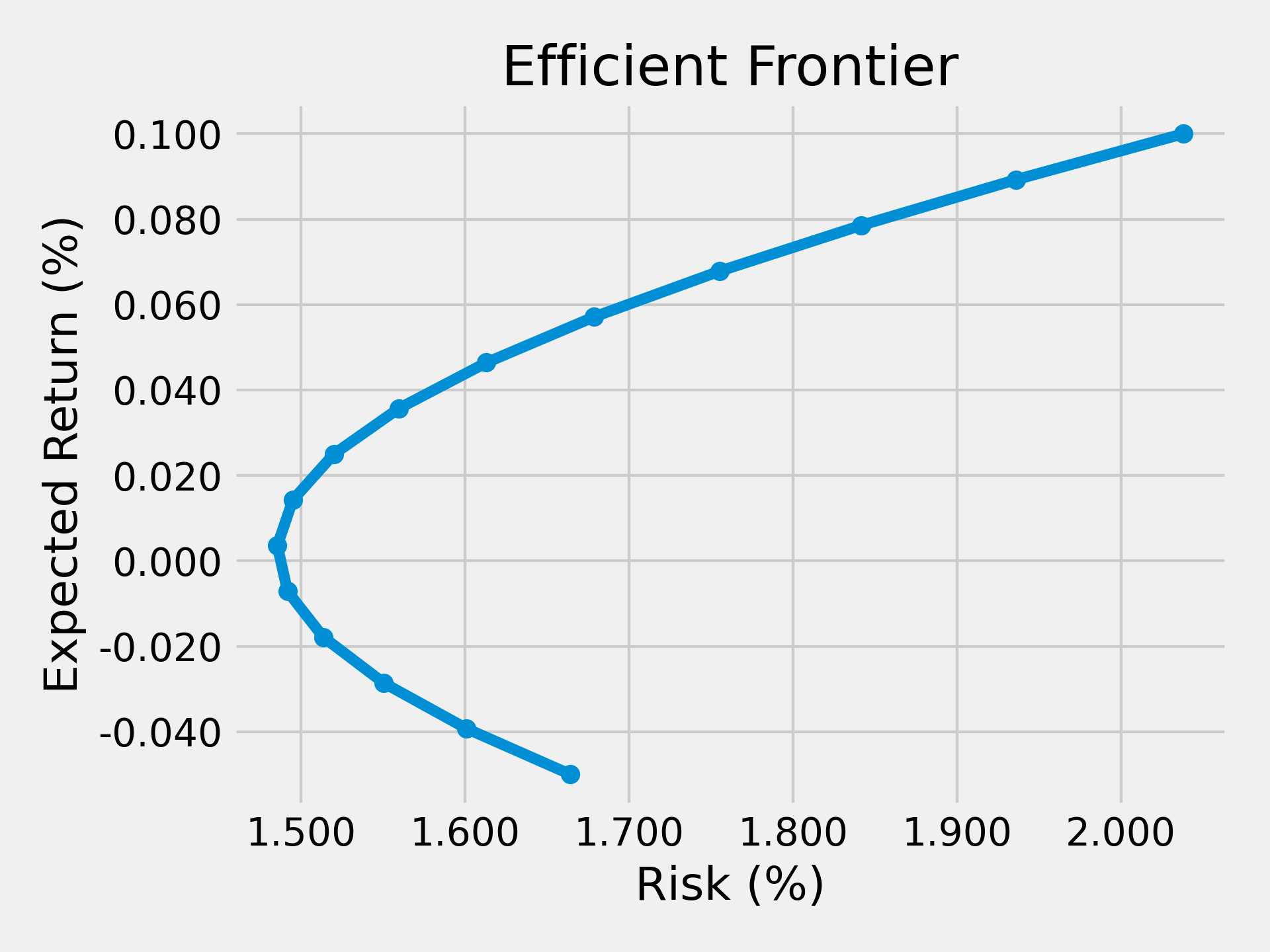

Efficient Frontier

Model

$$

\begin{split}

\min_{\boldsymbol{w}} ~ & ~ \sigma_P^2 = \sum_i\sum_j w_i w_j \sigma_i\sigma_j \\

\text{s.t.} ~ & ~ \boldsymbol{w}^\top \boldsymbol{1} = 1 \\

~ & ~ \boldsymbol{w}^\top \boldsymbol{\mu} = \mu_P \\

\end{split}

$$

Usage

# you can specify your favorite arguments

bash frontier.sh

# or use default arguments

python frontier.py

Result

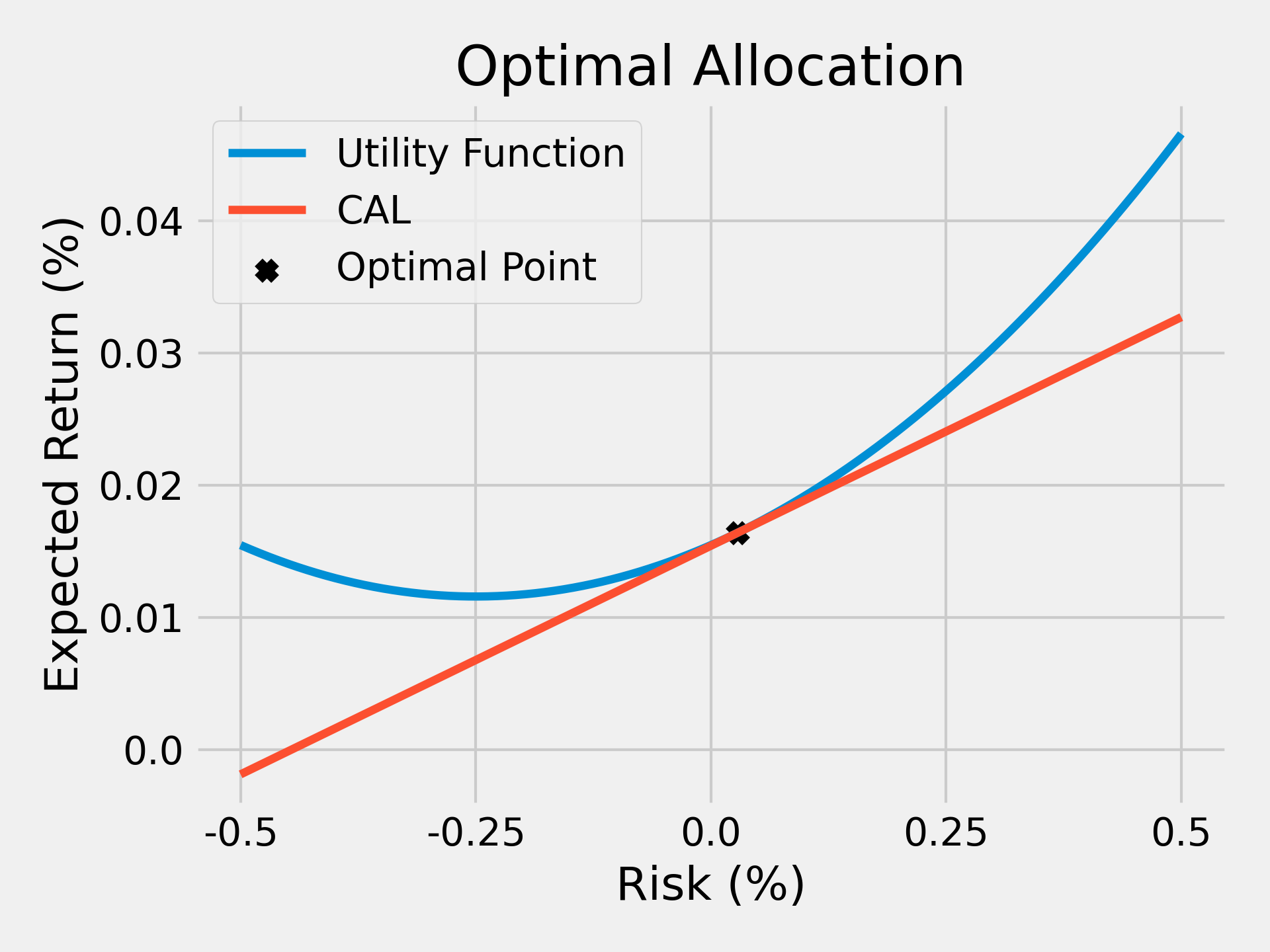

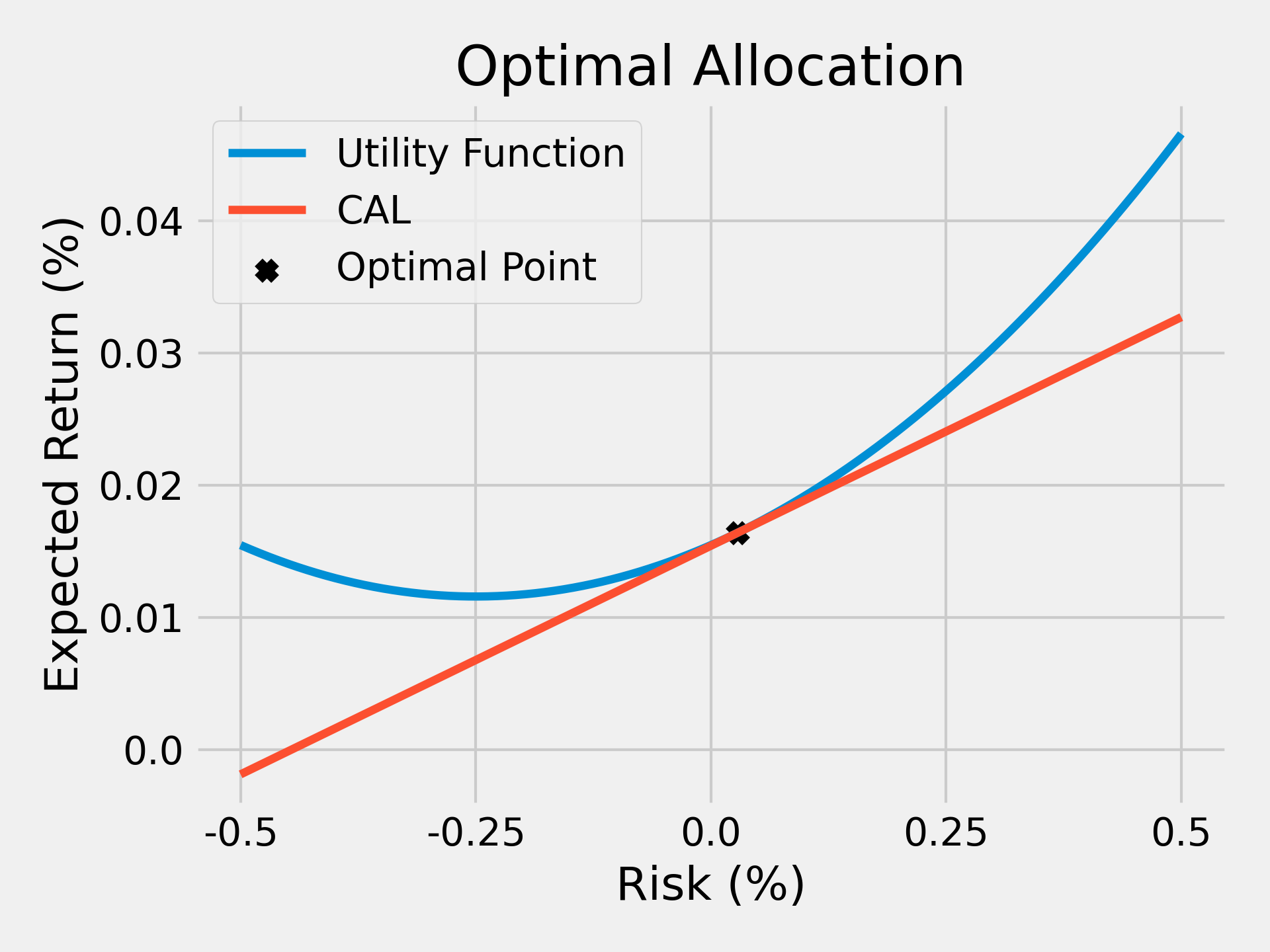

Asset Allocation

Model

$$

\begin{split}

\max_{\mu,\sigma} ~ & ~ U = \mu-\frac12 A\sigma^2 \\

\text{s.t.} ~ & ~ \mu=r_F + \frac{\sigma}{\sigma_P} (\mu_P-r_F) \\

\end{split}

$$

Subscript clarification:

- F is for "risk-free"

- P is for "portfolio"

Usage

Result

Data

There is only one sample csv file 2011-01-31.csv in ./data/. Collect other data by your self.