An assistant for backtesting trading strategies and checking (showing) external signals in Tradingview implemented as a Chrome browser extension.

Add to Chrome from webstore

Video how to install extension

Attention!

Active use of the extension can cause detection by the TradingView as using a bot for backtesting and lead to the ban of the user's account.

Although the extension is not a bot (i.e. it does not work independently of the user in the cloud), it does not use the TradingView API and does not interfere with data transmission, but only automates user behavior through the UI. Its use and all risks remain with the users.

Disclaimer

The developer of the extension does not response for any possible consequences of its use.

2.0 => 2.1

- fixed TV UI changed in performance report table that freeze extension

1.16 => 2.0(1.17):

- deep backtesting - thanks @Murena7 for implementation draft version

- fixed for chrome memory error (increased possible cycles for backtesting and speed for settiings of parameters)

- delay for backtesting results (for deep backtesting x2)

- delay between backtests for reduce TV API load

- saving in CSV values with more than 2 digits after point

- fixes for numbers input in nonumbers fields - thanks @TomKaltz for pull request with changes

- backtesting for timeframes - thanks jarno for suppport this changes in version

- automatic getting a list of parameters and their types (numeric, lists and checkboxes are supported)

- generation of the testing range according to the rule: the beginning value is 2 times less than the current one, the end is 2 times more than the current one.

- saving the generated parameters of testing a trading strategy for their correction as a template in a file in CSV format

- Loading adjusted parameter ranges from a CSV file

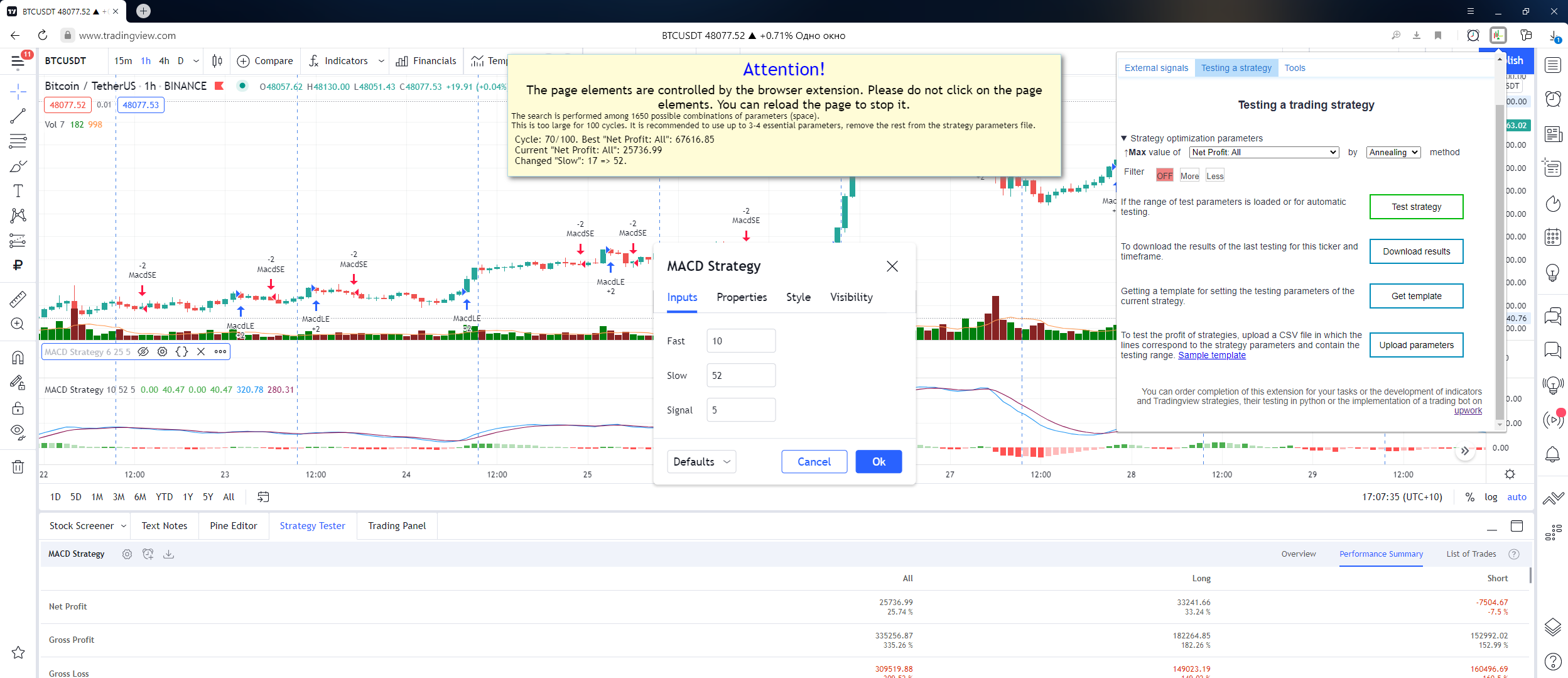

- Configuring the optimisation model:

- Choosing the type of optimisation: searching for the maximum or minimum values

- Selecting an optimised value from the entire list of strategy results in Tradingview (Net Profit, Ratio Avg Win / Avg Loss, Sharpe Ratio, Sortino Ratio, etc.)

- Choosing a search strategy in the parameter space(random, sequential, annealing method)

- Filtering of unsuitable results. For example, the number of tradings is less than necessary

- Setting the number of cycles to search for parameters.

- Performing automatic selection of parameters with storing all the results in the browser storage and the ability to save them as CSV files after testing, including in case of an error or page reloading

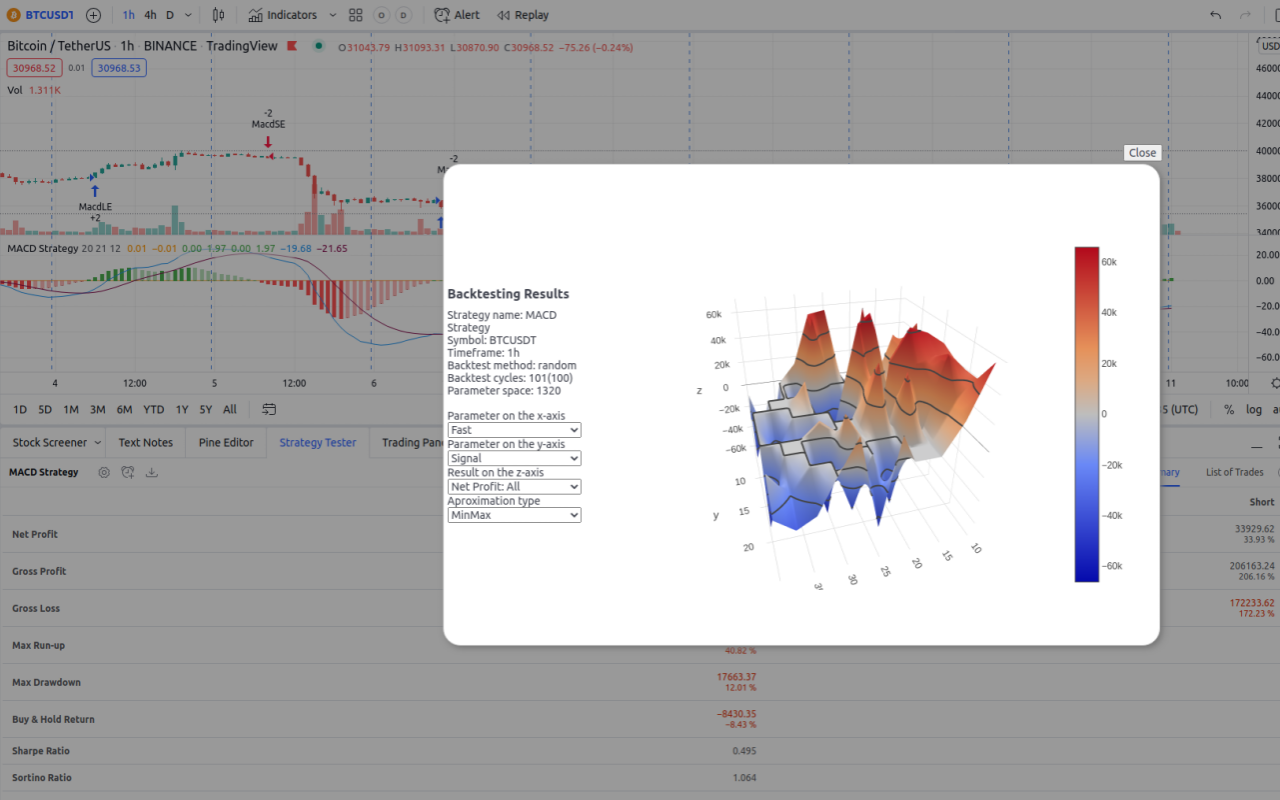

- Showing backtesting results on 3d chartto analyze the effect of various parameters on the result.

The sequential improvements optimization method is implement adjusting the best value already found. It does not perform a complete search of the entire parameter space. The logic of it work is as follows. The current best state (parameters for max results) is taken. The first parameter is taken and all its values in the range are checked sequentially. If the best result is found, then further verification is carried out from this state. Then the next parameter is taken and all its values in the range are checked and etc.

The brute force optimization method implement backtesting all values in strategy space of parameters.

The annealing method is an optimization method in which the search for the maximum possible result is carried out in fewer steps https://en.wikipedia.org/wiki/Simulated_annealing The method works this way: first, the best state and its parameters are determined. One parameter is randomly determined, then its value from range of possible values is randomly selected. The status in this value is checked. If it is better, then it is remembered and further parameter changes are made from it. As the number of tests increases, the spread of parameter values decreases around those already found. That is, if at the beginning of testing the values are randomly selected from the entire range of possible parameter values, then as optimization is carried out, this spread decreases ("cools down") near current values. So in first phase of test - this method is search the most possible state around all space on the finish stage this method trying to improve found best state. So that the system does not get stuck in one parameter area, as it happens with the sequential method, not one random parameter changes periodically, but all at once.

The random improvements method is the simplest. One parameter is randomly determined and then a value is randomly selected for it from the entire range of possible values. If the condition is better, then it is remembered. And then the parameters from this state are randomly changed.

The random method - always selects random values for all parameters at once (default)

Loading external buy or sell signals by timestamps from a CSV file*

To display the signals, you need to create a pine script named 'iondvSignals' from the script bellow add it to the chart:

//©akumidv

//@version=4

study("iondv Signals", shorttitle="iondvSignals", overlay=true)

strTSBuy = input("", "TSBuy")

strTSBuy = input("", "TSSell")

tickerName = input("", "Ticker")

var arrTSBuy = str.split(buy_series_time, ",")

var arrTSSell = str.split(sell_series_time, ",")

plotchar(tickerName == syminfo.ticker and array.includes(arrTSBuy, tostring(time)) ? low : na, location = location.belowbar, color=color.green, char='▲')

plotchar(tickerName == syminfo.ticker and array.includes(arrTSSell, tostring(time)) ? low : na, location = location.abovebar, color=color.red, char='▼')

After that, upload the signals from the file created accordingly the template

timestamp,ticker,timeframe,signal

1625718600000,BTCUSDT,1m,BUY

2021-07-27T01:00:00Z,BABA,1H,SELL

The signals are stored in the browser, to activate them, open the properties of the created indicator named 'iondvSignals'.

Install from Chrome webstroe

Or manually add the latest version to chrome based browser from this repository by following the instruction below.

Click on the browser's address bar, insert chrome://extensions and follow this link. Click on the "Developer mode" switch.

The "Load unpacked" button should appear. Click on it, and in the window that opens, select the folder with the saved repository files (you can download them as a zip archive via the link https://github.com/akumidv/tradingview-assistant-chrome-extension/archive/refs/heads/main.zip).

The manifest.json file is located in the root folder of the extension.

Unpack the new version to the same directory as the previous version (it is better to delete the files of the previous version).

Go to the extensions tab by following the link chrome://extensions. Click the restart button for the extension.

Please add issues in this repository by following link.

Very helpfull will be if you can attach full screenshot with tradingview page and errors. And also with open command tab in browser developer mode (please press F12 to open developer mode and click on console tab)

** The field separator for CSV files is a comma.

If your strategy requires a large amount of testing, it is recommended to order its conversion into python and perform

backtesting and hyperoptimization of parameters using resources, such as Google Collab or your computer. In addition, it significantly speeds up the search for parameters (in 5-10 times per cycle) and history deep. Examples in Jupyter Notebooks in repository trade-strategies-backtesting-optimization. You can run examples in Google Collab, it's free. You would just upload files with extension *.ipynb to your Google Drive and open these files.

Where transfering from TradingViews scripts usually developer should solve some promblems:

- Trading view indicators – some of them have different formulas to calculate results, for example supertrend, ta.RMA and more others. They need additional implementation and in results they calculated more slowly than if python script would use

ta-lib. - Implementation of the data parsing. If the data for the crypt is mostly free, but the data of low timeframes is usually paid (for example, eodhistoricaldata). Developer need to implement an interface to them and some process to store and reuse local(cloud) stored data.

- Difference in data for stock or forex exchanges from Tradingview. Also, for some cryptocurrency exchanges.

- Adopt framework of backtesting (backtesting, backtrader, vectorbot, etc.) to work with strategy

- Wrap this code for frameworks of parameter gyperspace optimization (simple example you can see in trade-strategies-backtesting-optimization) and increase speed of backtesting with some methods.

From my experience it demands 2-3 minutes developer time for each row of tradingview script. For example if you have 200 line strategy it would demand ~6 hours to conversion. For some complicated strategies it can deman much more.

To reduce developing time you can use some my repositories:

- tradingview-ta-lib - Tradingview

talib implementation in python (only for tradingview indecators that have different caclulatoin results withta-liborpython-ta- early developing stage. - catcher-bot - Bot for screening all symbols on excahnges/exchanges and cath trade signals - early developing stage.

akumidv [at] yahoo.com (Do not send errors to email please, use github issues for them)

https://linkedin.com/in/akuminov

Regarding contacts via social networks - they are banned in Russia, so I do not answer quickly. Email is preferred way, but usually I do not have the ability to answer quickly (2-3 days delay).

Cryptocurrency transfer information

- USDT, TRX (TRC20) network TFqv5hB3cdVHxkxhL8qjpfRMbeqMcuwzFP

- USDT, Matic (Poligon) network: 0xe837f97420abba87bee280b6edf319b07289b513

- USDT, ETH (ERC20) network: 0xe837f97420abba87bee280b6edf319b07289b513

- USDT, BSC (BEP20) network: 0xe837f97420abba87bee280b6edf319b07289b513

- USDT, Sol (Solana) network: CuwuesyM1tyrjyJr9avDrrRqcB4rTbciao5mXYP8HkKo

Binance Pay ID for USDT, USDC, BUSD or other crypto: 240890941 (akumidv)