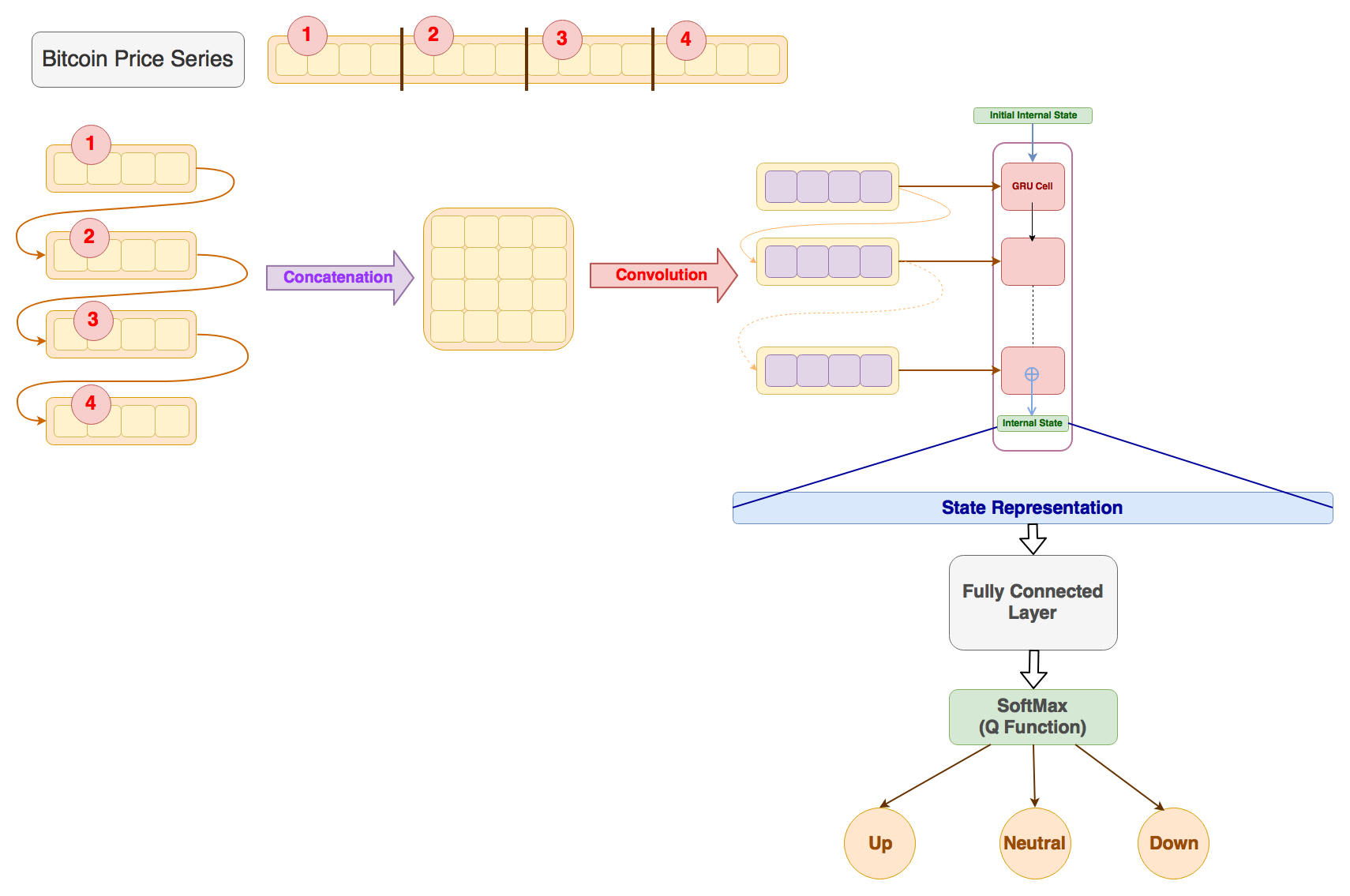

Deep Reinforcement Learning based Trading Agent for Bitcoin using DeepSense Network for Q function approximation.

For complete details of the dataset, preprocessing, network architecture and implementation, refer to the Wiki of this repository.

- Python 2.7

- Tensorflow

- TA-Lib (for processing Bitcoin Price Series)

- Pandas (for pre-processing Bitcoin Price Series)

- tqdm (for displaying progress of training)

To setup a ubuntu virtual machine with all the dependencies to run the code, refer to assets/vm.

Please give a ⭐ to this repository to support the project 😄.

- Add Docker support for a fast and easy start with the project

- Extract highest and lowest prices and the volume of Bitcoin traded within a given time interval in the

Preprocessor - Use closing, highest, lowest prices and the volume traded as input channels to the model (remove features calculated just using closing prices)

- Normalize the price tensors using the price of the previous time step

- For the complete state representation, input the remaining number of trades to the model

- Use separate diff price blocks to calculate the unrealized PnL

- Use exponentially decayed weighted unrealized PnL as a reward function to incorporate current state of investment and stabilize the learning of the agent

is inspired by Deep Q-Trading where they solve a simplified trading problem for a single asset.

For each trading unit, only one of the three actions: neutral(1), long(2) and short(3) are allowed and a reward is obtained depending upon the current position of agent. Deep Q-Learning agent is trained to maximize the total accumulated rewards.

Current Deep Q-Trading model is modified by using the Deep Sense architecture for Q function approximation.

Per minute Bitcoin series is obtained by modifying the procedure mentioned in this repository. Transactions in the Coinbase exchange are sampled to generate the Bitcoin price series.

Refer to assets/dataset to download the dataset.

Basic Preprocessing

Completely ignore missing values and remove them from the dataset and accumulate blocks of continuous values using the timestamps of the prices.

All the accumulated blocks with number of timestamps lesser than the combined history length of the state and horizon of the agent are then filtered out since they cannot be used for training of the agent.

In the current implementation, past 3 hours (180 minutes) of per minute Bitcoin prices are used to generate the representation of the current state of the agent.

With the existing dataset (at the time of writing), following are the logs generated while preprocessing the dataset:

INFO:root:Number of blocks of continuous prices found are 58863

INFO:root:Number of usable blocks obtained from the dataset are 887

INFO:root:Number of distinct episodes for the current configuration are 558471

Advanced Preprocessing

Process missing values and concatenate smaller blocks to increase the sizes of continuous price blocks.

Standard technique in literature to fill the missing values in a way that does not much affect the performance of the model is using exponential filling with no decay.

(To be implemented)

Tensorflow "1.1.0" version is used for the implementation of the Deep Sense network.

Implementation is adapted from this Github repository with a few simplifications in the network architecture to incorporate learning over a single time series of the Bitcoin data.

Implementation and preprocessing is inspired from this Medium post. The actual implementation of the Deep Q Network is adapted from DQN-tensorflow.