A python script to find 'black' rate of Indian Rupee in the P2P Crypto market.

Like every other currency, Indian Rupee to has a 'black market' exchange rate. This rate varies quite a bit by exchange to exchange. Usually its 10-12% above the midmarket rate.

Why is this the case? There are multiple reasons.

-

Capital Controls: The Indian Government has implemented capital controls to prevent large-scale capital outflows that could destabilize the exchange rate. Under the Liberalised Remittance Scheme (LRS), Indian individuals are limited to transferring a maximum of USD 250,000 abroad each year. Peer-to-peer (P2P) cryptocurrency exchanges operate in a legal gray area since individuals who purchase cryptocurrencies can potentially sell them abroad for foreign currency without using official channels. This creates opportunities for money laundering, and there have been instances where Indian bank accounts have been frozen due to transactions involving illicit funds. Consequently, P2P sellers must exercise due diligence before accepting any fiat currency transactions.

-

Liquidity: The Indian Rupee is a less traded currency in the foreign exchange market, which also affects liquidity in the crypto market. Since foreign crypto exchanges cannot accept or trade in Rupees, the options are limited to P2P transactions or domestic crypto exchanges, thereby constraining liquidity. This means that buying or selling crypto in India can be more challenging.

-

Banking Restrictions: The Reserve Bank of India (RBI) has issued advisories to commercial banks in the past, recommending against providing services to cryptocurrency businesses as a measure to prevent money laundering and capital flight. This has led to many domestic crypto exchanges frequently shifting their banking partnerships, often resorting to smaller private sector banks that are willing to work with them. Furthermore, since it's not easy for foreign individuals to open Rupee accounts in India, foreign crypto exchanges are effectively barred from conducting cryptocurrency business in India, except through P2P platforms. This restriction also complicates the exploitation of arbitrage opportunities, as selling cryptocurrency requires finding another Indian individual who is willing to transact in Rupees and capable of making Rupee-based bank transfers.

-

Taxation: There is a Tax Deducted at Source (TDS) on crypto purchases in India. Although TDS can be claimed back when filing tax returns, it represents an additional barrier to engaging with cryptocurrencies. This contributes to the increased cost of cryptocurrencies within the Indian market. Furthermore, cryptocurrencies are sometimes used by individuals to evade taxes, which can inflate the premium on these assets because it enhances their value beyond their inherent worth. I would strongly advise against such practices for several reasons: firstly, tax authorities; secondly, cryptocurrencies are susceptible to hacking and theft; and thirdly, even stablecoins cannot be entirely relied upon to be backed 1:1 with US Dollars.

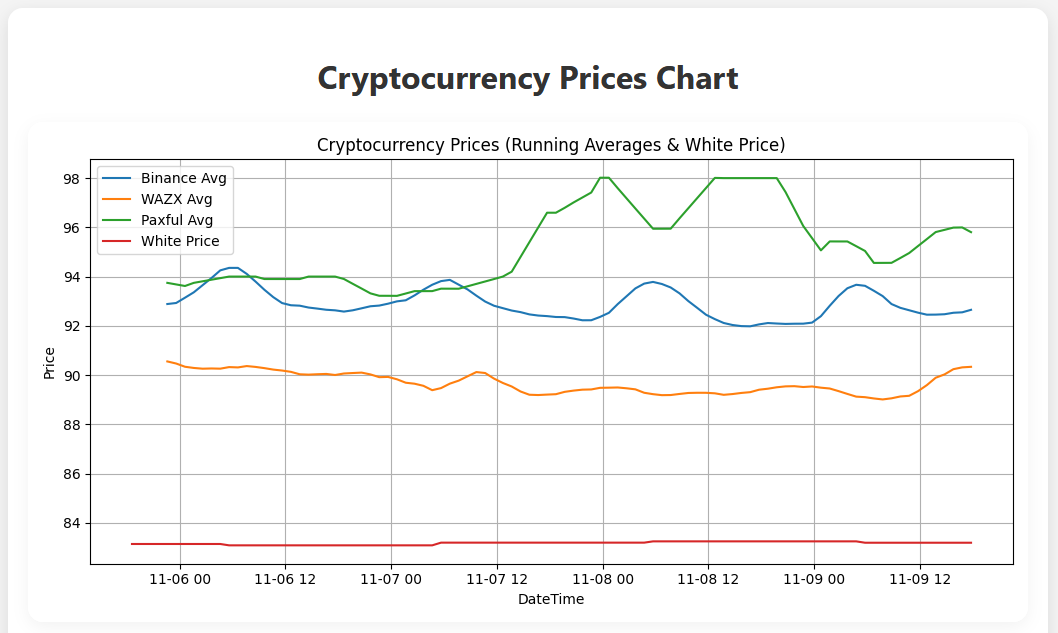

I want to measure, what rates USD Tether goes on in different P2P Markets, I have taken three exchanges. WazirX P2P Exchange, Paxful P2P Exchange and Binance P2P Exchange to monitor black market prices of the Indian rupee. Why? Because it gives a rough idea of how the Indian market is functioning. If the Black Market rupee rate spikes suddenly for some reason, it can be a symptom of reduced trust in the Indian Rupee.

Argentina has capital controls that are even stricter than ours due to economic instability. The Argentine Peso (ARS) is constantly devaluing, and the country is struggling with high inflation, resulting in a much greater demand for foreign currencies. This situation has given rise to a 'blue' rate for the ARS. For instance, the current 'official' exchange rate for ARS-USD is approximately 350, while the blue market rate for the same currency pairing is around 840. That's more than double (140%) the official rate, which really makes our 10-12% premium look good in perspective.