Often, basic regression techniques are not sufficient to grasp the more complex, time-dependent patterns that are common when dealing with time series data. Using time series analysis techniques, the purpose is to get more insight into your data on one hand and to make predictions on the other hand. First, we'll introduce the types of trends that exist in time series models and have a look at them.

You will be able to:

- Explain what stationarity means and why it is important in time series analysis

- Use rolling statistics as a check for stationarity

- Describe the Dickey-Fuller test and its purpose

A time series is said to be stationary if its statistical properties such as mean, variance, etc. remain constant over time.

Why is it important? Because most time series models work on the assumption that the time series are stationary. For general time series datasets, if it shows a particular behavior over time, there is a very high probability that it will follow a similar behavior in the future. Also, the theories related to stationary series are more mature and easier to implement as compared to non-stationary series.

Although stationarity is defined using very strict criteria, for practical purposes we can assume the series to be stationary if it has following constant statistical properties over time:

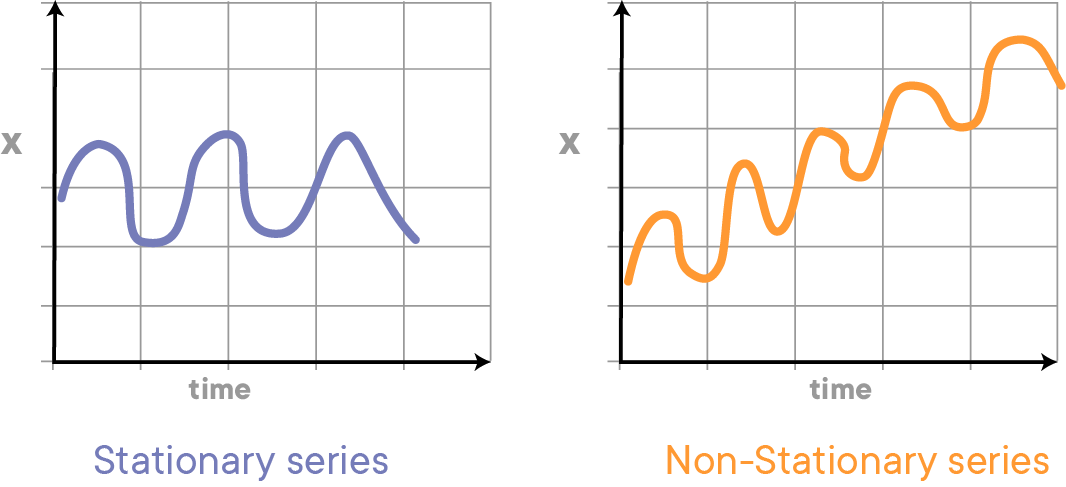

The mean of the series should not be a function of time rather should be a constant. The image below has the left-hand graph satisfying the condition whereas the graph in red has a time-dependent mean.

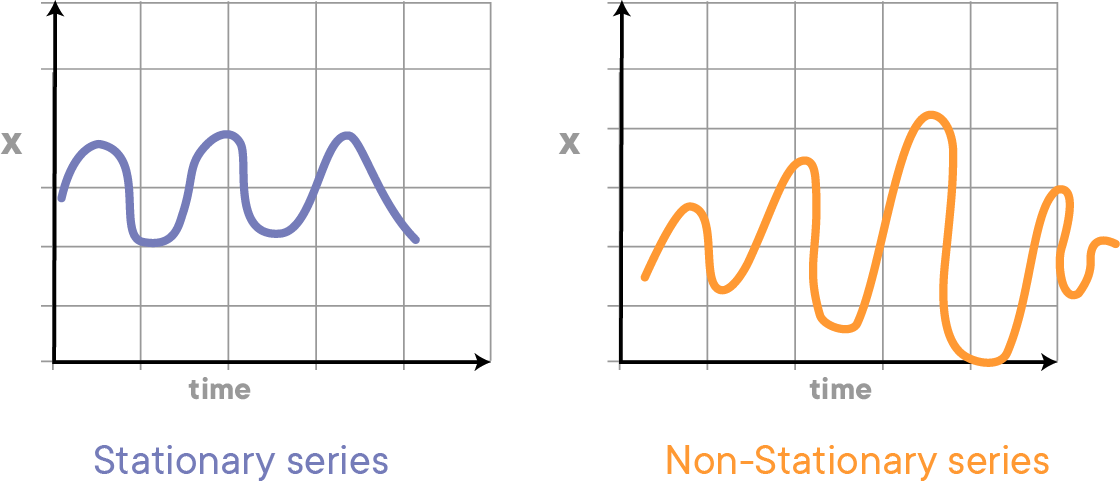

The variance of the series should not be a function of time. This property is known as homoscedasticity. The following graph depicts what is and what is not a stationary series. (Notice the varying spread of distribution in the right-hand graph)

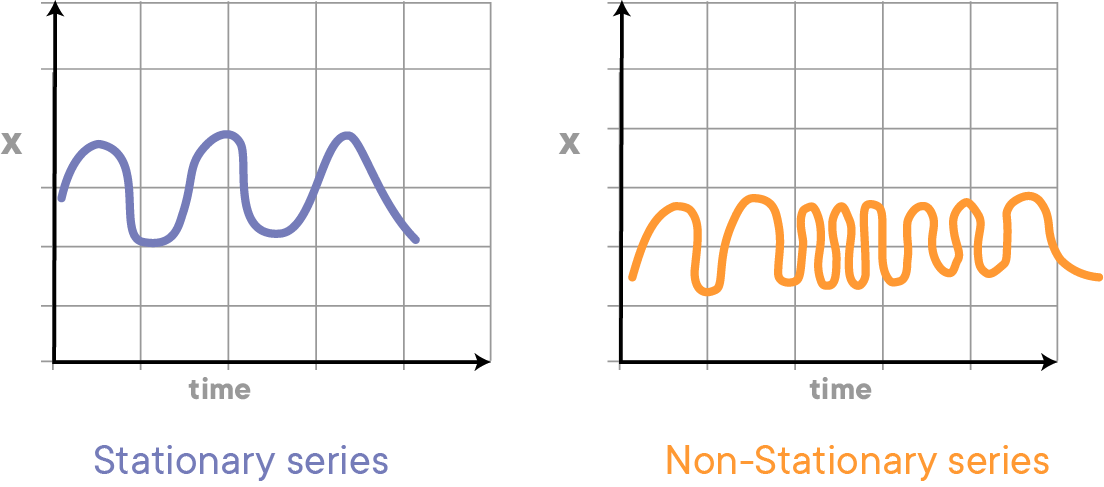

The covariance of the $i$th term and the $(i + m)$th term should not be a function of time. In the following graph, you will notice the spread becomes closer as the time increases. Hence, the covariance is not constant with time for the ‘red series’ below.

When time series models are not stationary, we say there is a trend. Let's have a look at a few examples of trends that can be observed in time series models.

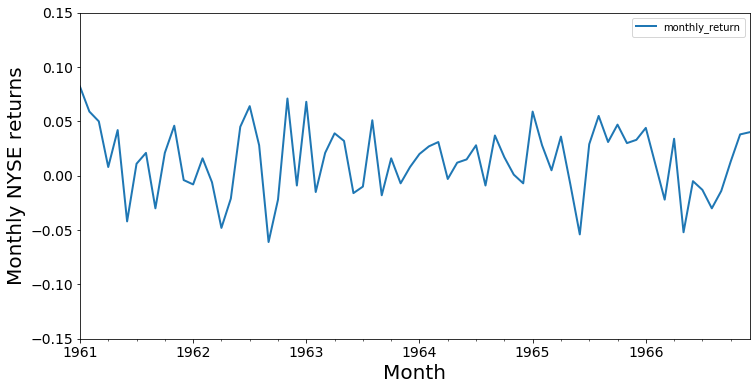

Let's consider the monthly returns for the NYSE from January 1961 through December 1966 again. You'll notice that the monthly return goes up and down, but there is no clear direction, and over time, the index oscillates around 0. We say that this particular time series has no trend.

import numpy as np

import pandas as pd

%matplotlib inline

import matplotlib.pyplot as plt

data = pd.read_csv('NYSE_monthly.csv')

data['Month'] = pd.to_datetime(data['Month'])

data.set_index('Month', inplace=True)

data.plot(figsize=(12,6), linewidth=2, fontsize=14)

plt.xlabel('Month', fontsize=20)

plt.ylabel('Monthly NYSE returns', fontsize=20)

plt.ylim((-0.15, 0.15));data.head().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| monthly_return | |

|---|---|

| Month | |

| 1961-01-01 | 0.082 |

| 1961-02-01 | 0.059 |

| 1961-03-01 | 0.050 |

| 1961-04-01 | 0.008 |

| 1961-05-01 | 0.042 |

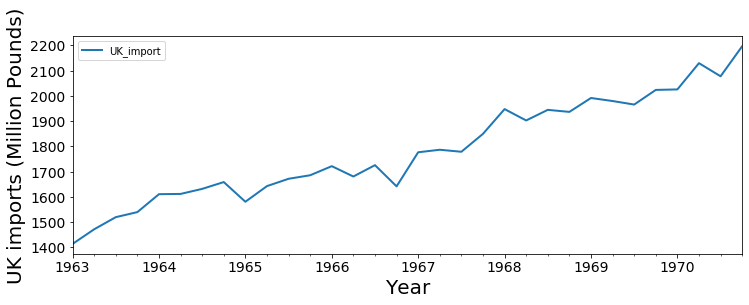

In many cases, there will be some sort of trend, however. A common trend type is a linear trend, where the observation grows bigger over time, or declines. Below is the plot of quarterly U.K. imports of goods and services over time.

data = pd.read_csv('uk_imports.csv')

data['Quarter'] = pd.to_datetime(data['Quarter'])

data.set_index('Quarter', inplace=True)

data.plot(figsize=(12,4), linewidth=2, fontsize=14)

plt.ylabel('UK imports (Million Pounds)', fontsize=20)

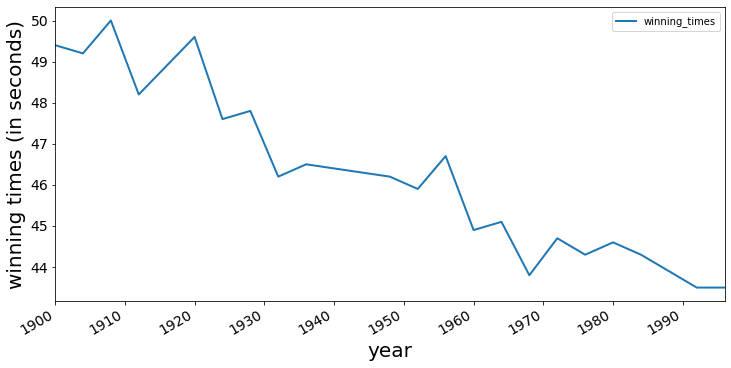

plt.xlabel('Year', fontsize=20);Below is a record of the winning times for the men's 400 m final at the Olympics. Note how the winning time has gone down over the years from 1896 to 1996.

data = pd.read_csv('winning_400m.csv')

data['year'] = pd.to_datetime(data['year'].astype(str))

data.set_index('year', inplace=True)data.plot(figsize=(12,6), linewidth=2, fontsize=14)

plt.xlabel('year', fontsize=20)

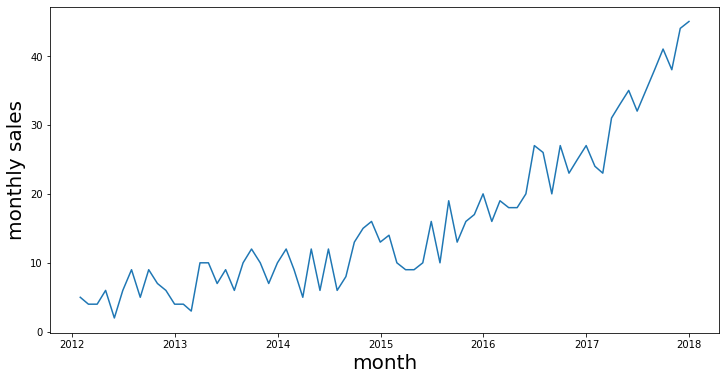

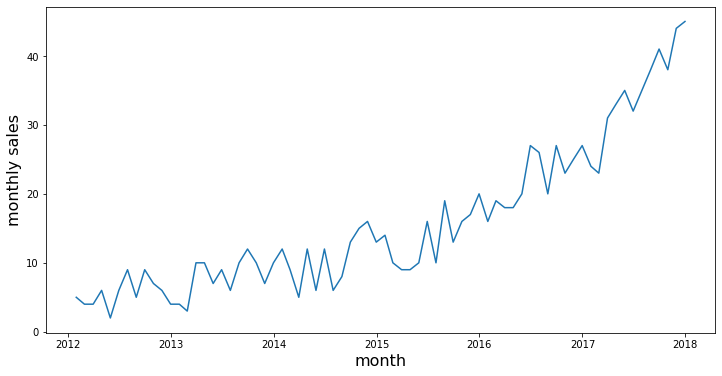

plt.ylabel("winning times (in seconds)", fontsize=20);Another type of trend that can be observed is an exponential trend. A typical example could be a company's sales. Initially, when small companies start to grow, there sales could be slower; but when their product catches people's attention, the sales can start to grow exponentially. A simulated example can be found below.

# generated data

years = pd.date_range('2012-01', periods=72, freq='M')

index = pd.DatetimeIndex(years)

np.random.seed(3456)

sales = np.random.randint(-4, high=4, size=72)

bigger = np.array([0,0,0,0,0,0,0,0,0,1,1,1,1,1,1,1,1,1,1,1,3,3,3,3,

3,3,3,3,3,3,3,3,7,7,7,7,7,7,7,7,7,7,7,

11,11,11,11,11,11,11,11,11,11,18,18,18,

18,18,18,18,18,18,26,26,26,26,26,36,36,36,36,36])

data = pd.Series(sales+bigger+6, index=index)

ts = data

fig = plt.figure(figsize=(12,6))

plt.plot(data)

plt.xlabel('month', fontsize=20)

plt.ylabel('monthly sales', fontsize=20)

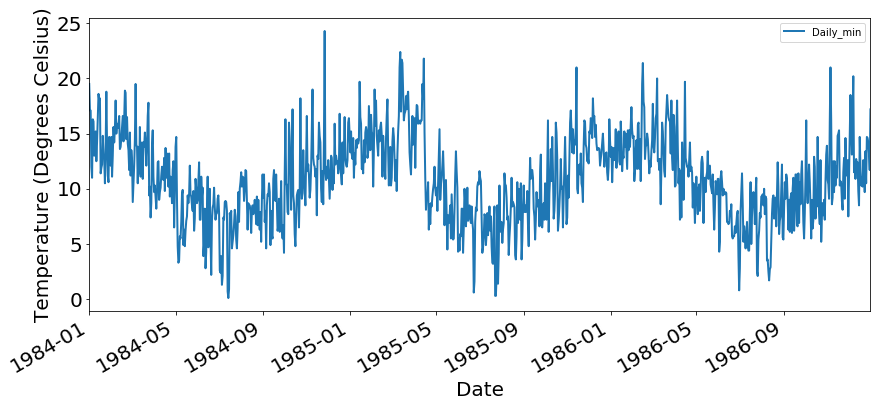

plt.show()Trends can also go both up and down. In many applications, what will happen is that trends are periodic. Think about temperature trends: while temperature will go up in summer, it will go down again in winter, and we can expect to see a cyclical pattern. The Australian minimum temperature dataset shows the result below.

data = pd.read_csv('min_temp.csv')

data['Date'] = pd.to_datetime(data['Date'], format='%d/%m/%y')

data.set_index('Date', inplace=True)

data.head().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| Daily_min | |

|---|---|

| Date | |

| 1981-01-01 | 20.7 |

| 1981-01-02 | 17.9 |

| 1981-01-03 | 18.8 |

| 1981-01-04 | 14.6 |

| 1981-01-05 | 15.8 |

data_slice= data['1984':'1986']

data_slice.plot(figsize=(14,6), linewidth=2, fontsize=20)

plt.xlabel('Date', fontsize=20)

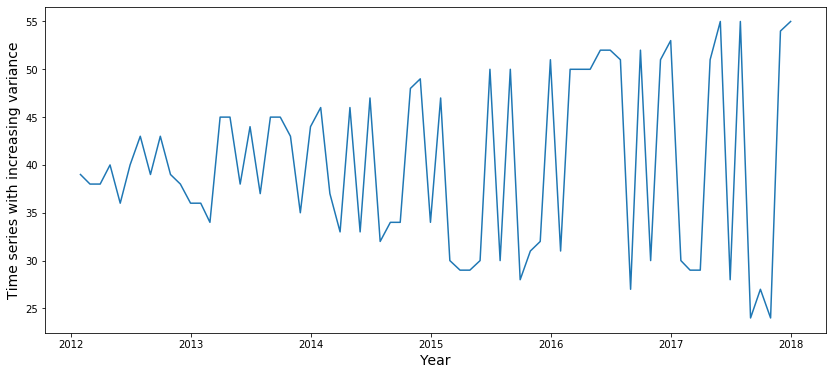

plt.ylabel('Temperature (Degrees Celsius)', fontsize=20);In the previous trend types, the variability remained constant over time. But in some cases, this might not be the case, and variability can change over time. A simulated example is shown in the plot below.

# Generated data

years = pd.date_range('2012-01', periods=72, freq='M')

index = pd.DatetimeIndex(years)

np.random.seed(3456)

sales= np.random.randint(-4, high=4, size=72)

add = np.where(sales>0, 1, -1)

bigger = np.array([0,0,0,0,0,0,0,0,0,1,1,1,1,2,2,2,2,2,2,2,2,2,3,3,

3,3,3,3,4,4,5,5,6,6,6,6,6,7,7,7,7,7,7,8,8,8,8,8,8,8,

9,9,9,9,9,9,9,9,10,10,10,10,10,10,12,12,12,12,12,12,12,12])

data = pd.Series((sales+add*bigger)+40, index=index)

fig = plt.figure(figsize=(14,6))

plt.plot(data)

plt.ylabel('Time series with increasing variance', fontsize=14)

plt.xlabel('Year', fontsize=14)

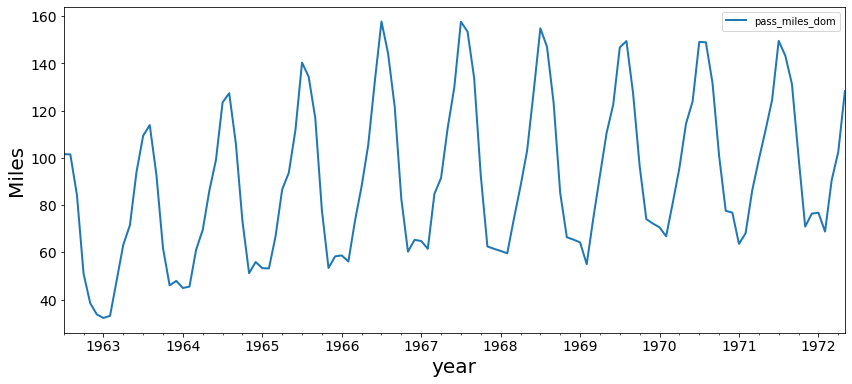

plt.show()This plane passenger data between July '62 and May '72 shows that a time series can have a periodic (seasonal) trend in conjunction with an upward trend over time.

air = pd.read_csv('airpassengers.csv')

air['Month'] = pd.to_datetime(air['Month'])

air.set_index('Month', inplace=True)

air.head().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| pass_miles_dom | |

|---|---|

| Month | |

| 1962-07-01 | 101.6 |

| 1962-08-01 | 101.5 |

| 1962-09-01 | 84.3 |

| 1962-10-01 | 51.0 |

| 1962-11-01 | 38.5 |

air.plot(figsize=(14,6), linewidth=2, fontsize=14)

plt.xlabel('year', fontsize=20)

plt.ylabel('Miles', fontsize=20);Let's look at our generated monthly sales data again with an exponential trend. From simply plotting the data, it is already pretty clear that there is a certain trend.

# generated data

years = pd.date_range('2012-01', periods=72, freq='M')

index = pd.DatetimeIndex(years)

np.random.seed(3456)

sales= np.random.randint(-4, high=4, size=72)

bigger = np.array([0,0,0,0,0,0,0,0,0,1,1,1,1,1,1,1,1,1,1,1,3,3,3,3,

3,3,3,3,3,3,3,3,7,7,7,7,7,7,7,7,7,7,7,

11,11,11,11,11,11,11,11,11,11,18,18,18,

18,18,18,18,18,18,26,26,26,26,26,36,36,36,36,36])

data = pd.Series(sales+bigger+6, index=index)

ts = data

fig = plt.figure(figsize=(12,6))

plt.plot(data)

plt.xlabel('month', fontsize=16)

plt.ylabel('monthly sales', fontsize=16)

plt.show()In what follows, we'll discuss two formal ways to assess trends:

- Rolling statistics

- The Dickey-Fuller Test

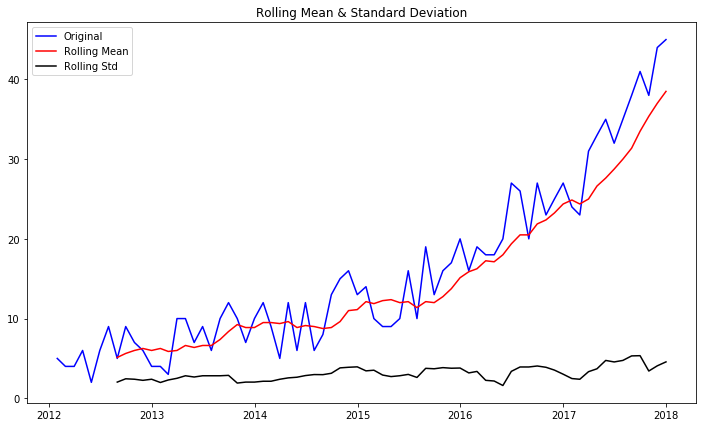

We can plot the moving average or moving variance and see if it varies with time. By moving average/variance we mean at any point in time

Pandas has a built-in method called rolling(), which can be called along with .mean() and .std() to calculate these rolling statistics. Let's take a window size of 8 for this example.

roll_mean = ts.rolling(window=8, center=False).mean()

roll_std = ts.rolling(window=8, center=False).std()fig = plt.figure(figsize=(12,7))

plt.plot(ts, color='blue', label='Original')

plt.plot(roll_mean, color='red', label='Rolling Mean')

plt.plot(roll_std, color='black', label = 'Rolling Std')

plt.legend(loc='best')

plt.title('Rolling Mean & Standard Deviation')

plt.show(block=False)The red and black lines represent the rolling mean and rolling standard deviations. You can see that the mean is not constant over time, so we can reconfirm our conclusion that the time series is not stationary based on rolling mean and rolling standard error.

The Dickey-Fuller test is a statistical test for testing stationarity. The null-hypothesis for the test is that the time series is not stationary. So if the test statistic is less than the critical value, we reject the null

hypothesis and say that the series is stationary. The Dickey-Fuller test is available in tsa.stattools sub-module of the statsmodels library. More details on this can be viewed here.

from statsmodels.tsa.stattools import adfuller

dftest = adfuller(ts)

# Extract and display test results in a user friendly manner

dfoutput = pd.Series(dftest[0:4], index=['Test Statistic', 'p-value', '#Lags Used', 'Number of Observations Used'])

for key,value in dftest[4].items():

dfoutput['Critical Value (%s)'%key] = value

print(dftest)(3.761375741674094, 1.0, 8, 63, {'1%': -3.5386953618719676, '5%': -2.9086446751210775, '10%': -2.591896782564878}, 314.84474355172597)

A nice print-out of the Dickey-Fuller test can be found below. The p-value is 1 here, so the time series is not stationary!

print ('Results of Dickey-Fuller test: \n')

print(dfoutput)Results of Dickey-Fuller test:

Test Statistic 3.761376

p-value 1.000000

#Lags Used 8.000000

Number of Observations Used 63.000000

Critical Value (1%) -3.538695

Critical Value (5%) -2.908645

Critical Value (10%) -2.591897

dtype: float64

A great overview of how to test for time series stationarity can be found here.

In this lab, you learned how to check for the stationarity of a time series in Python. You used rolling statistics, with rolling mean and rolling standard deviation to check for trends and seasonal elements in a time series, and how to use Dickey-Fuller test to run a statistical test on a time series and check for its stationarity with a significance level.