This vault contains all the smart contracts for Opyn's Convexity Protocol. Convexity allows options sellers to earn premiums on their collateral and options buyers to protect themselves against technical, financial and systemic risks that the underlying token faces.

Convexity is a protocol that uses protective put options as insurance. At a high level, the insurance buyer pays the insurance provider some premium ahead of time to get access to oTokens. An example of an oToken is the ocDai token which might protect the holder of the token from Jan 1 2020 to Jan 1 2021 against any disasters that Compound's cDai faces. In the case of a disaster, the holder of the oToken can turn in their oToken and their cDai and in exchange take the collateral locked in the Convexity Protocol by insurance providers. If there is no disaster, it is strictly worse for the holder of cDai to give up their cDai in exchange for collateral locked on the Convexity protocol, thus the insurance providers earn a premium on their collateral

Before diving into the codebase, please read:

- Run

git cloneto clone this repo. - Run

cd OptionsProtocol. - Run

npm installto install all dependencies.

- Open a terminal window and run

ganache-clito first have ganache running - In a new terminal window, run

npm testto execute the test suite.

- Set up a local file in ./OptionsProtocol called secret.js. In this file, insert the mnemonic to the address that is deploying the contracts.

- Run

npm run-script test:rinkebyto deploy the contracts to the Rinkeby network. This script runs the file ./test/sell-and-buy.test.ts. It creates new ocDai and ocUSDC markets, adds liquidity to these markets and creates and sells the oTokens minted on Uniswap.

The main functionality offered by the convexity protocol is as below:

- Create oTokens

- Keep the oToken vaults sufficiently collateralized

- Liquidate the undercollateralized vaults

- Exercise the oTokens during the expiry window

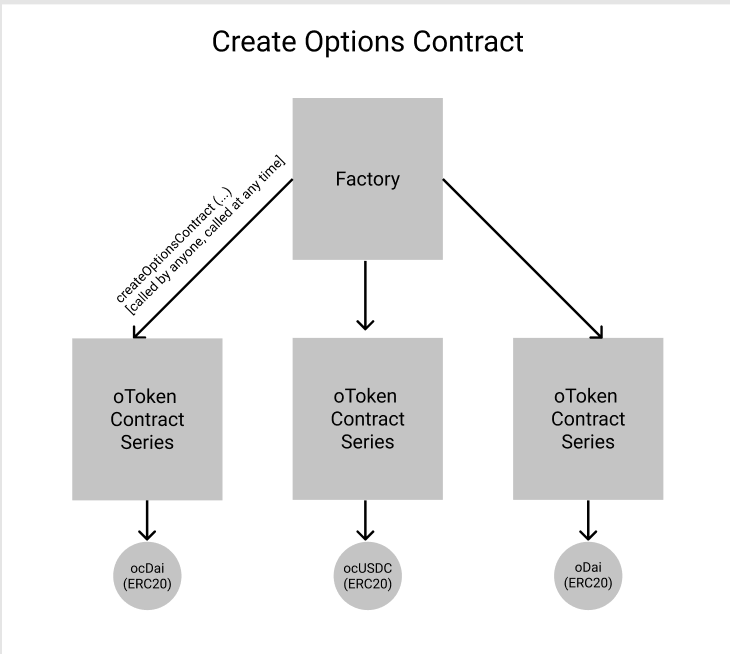

The Options Factory contract instantiates and keeps track of all the Options Contracts that exist. Within each options contract, the ERC20 oTokens are fungible.

The Options Contract has all the functionality mentioned above built into it. Each Options contract takes in the parameters of underlying, strikePrice, expiry, collateral and windowSize. Anyone can create an Options Contract.

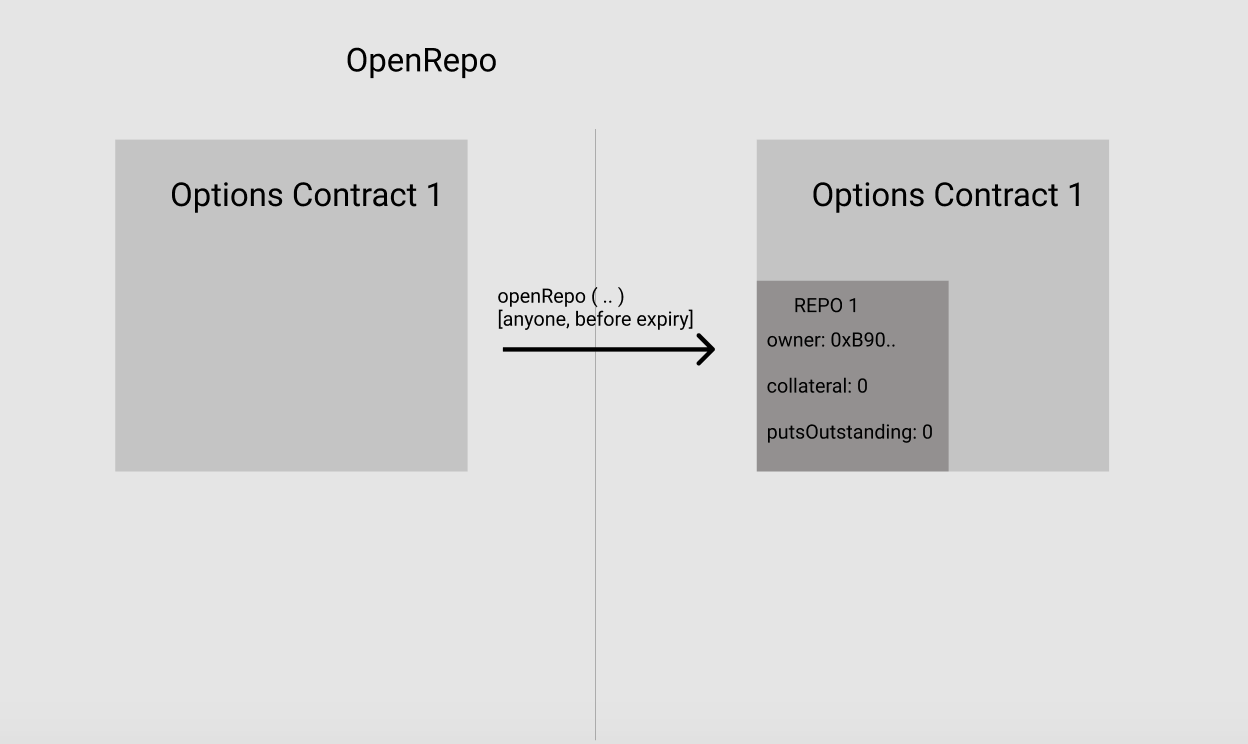

oTokens are created by first calling openVault () which instantiates a new vault and sets the owner of that vault to be the msg.sender.

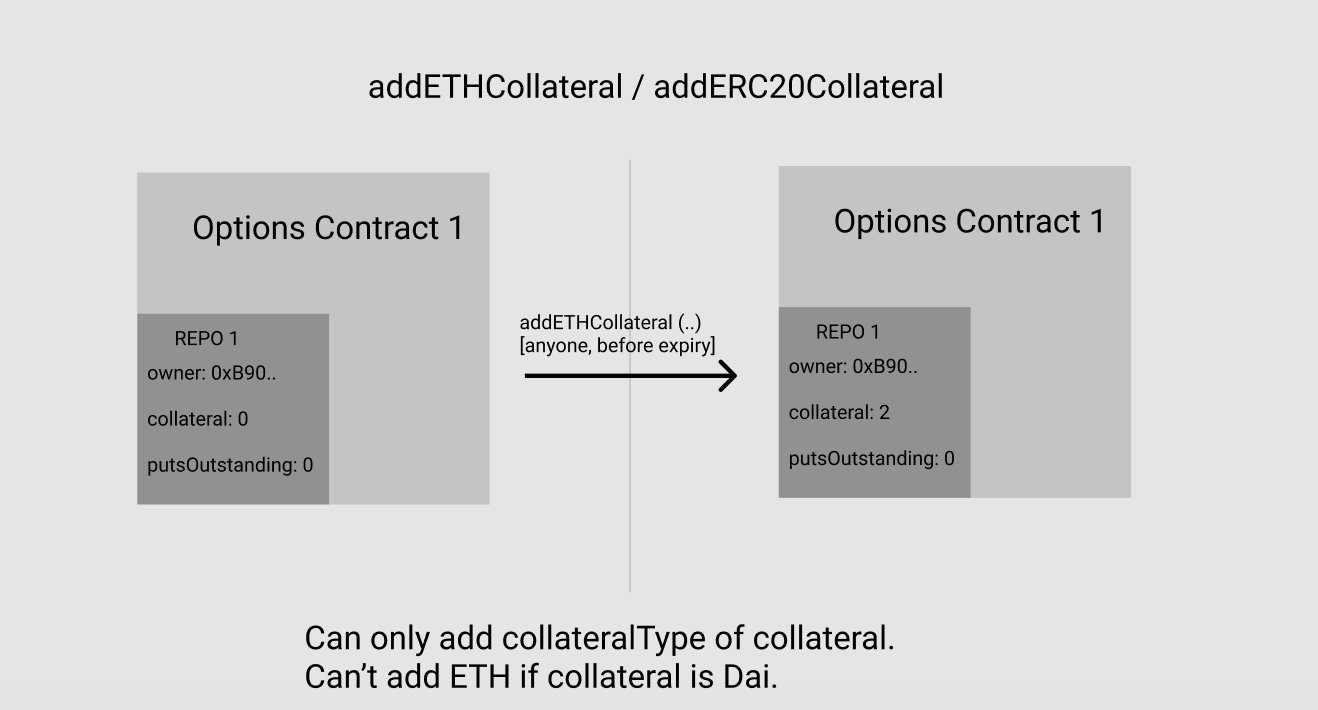

Once a vault is opened, anyone can add collateral to the vault by calling addETHCollateral (vaultIndex) or addERC20Collateral (vaultIndex) depending on what the collateral of that contract is.

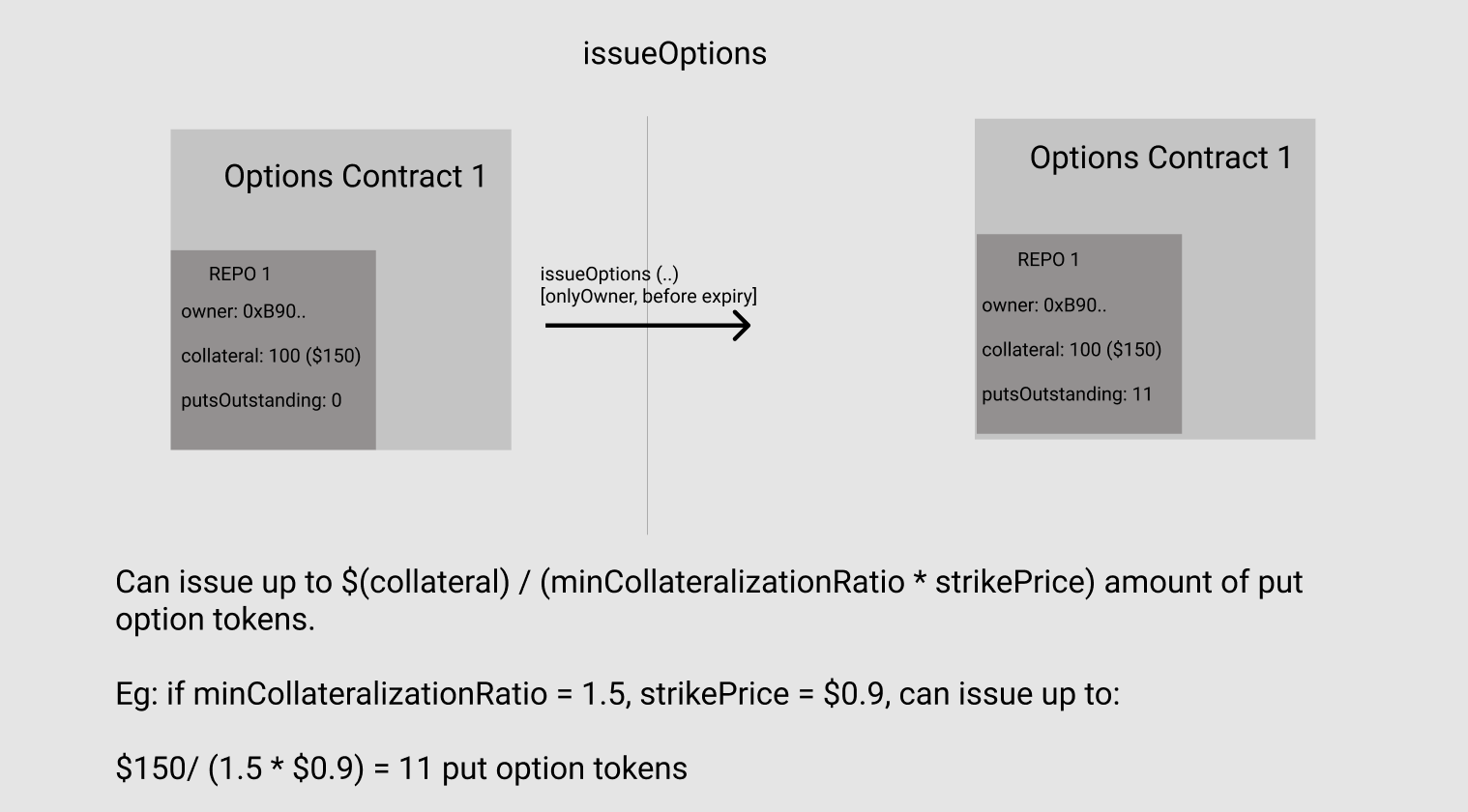

The owner can then mint oTokens by calling issueOTokens (vaultIndex, numTokens).

vault owners can ensure their vaults are sufficiently collateralized in 2 ways.

The first way is adding more collateral by calling addETHCollateral (vaultIndex) or addERC20Collateral (vaultIndex). See the section on addCollateral above.

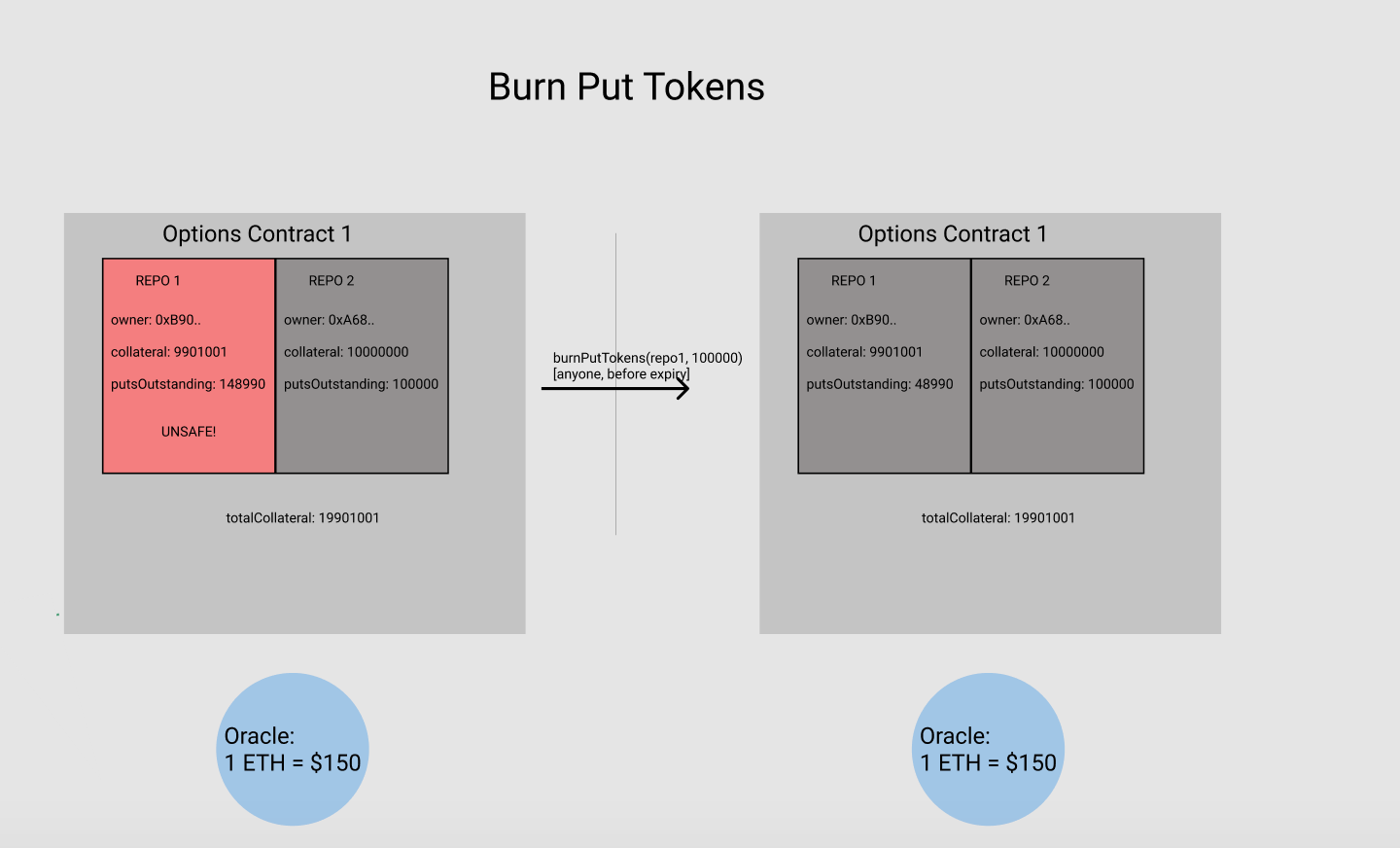

vault owners can also burn oTokens to increase the collateralization ratio by buying back oTokens from the market and then calling burnOTokens (vaultIndex, amtToBurn).

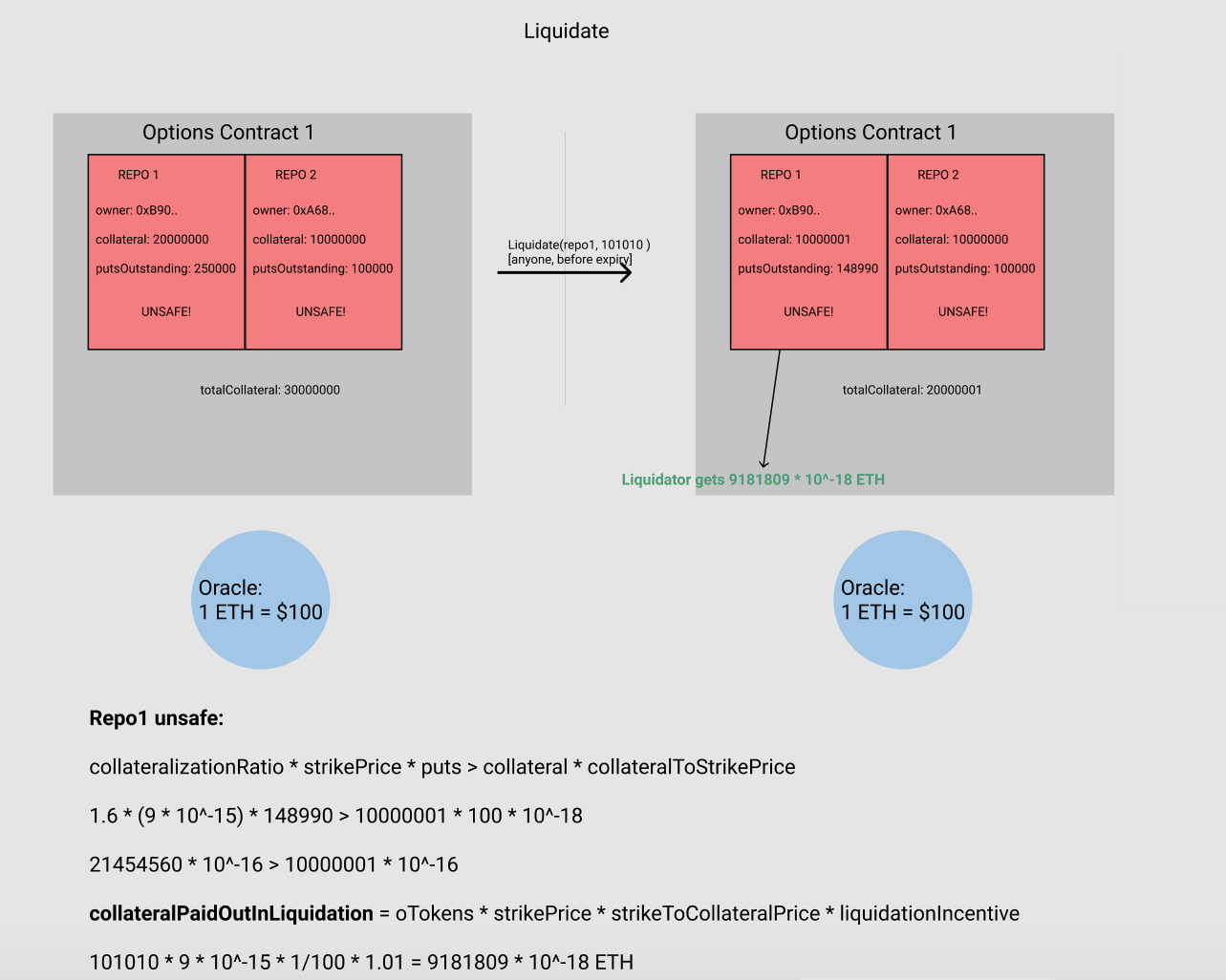

Liquidation happens by calling liquidate(vaultIndex, _oTokens). All vaults need collateralizationRatio * strikePrice * oTokensIssued <= collateral * collateralToStrikePrice to be safe.

If that condition fails, a liquidator can come with _oTokens. The liquidator gets _oTokens * strikePrice * (incentive + fee) amount of collateral out. They can liquidate a max of liquidationFactor * vault.collateral in one function call i.e. partial liquidations.

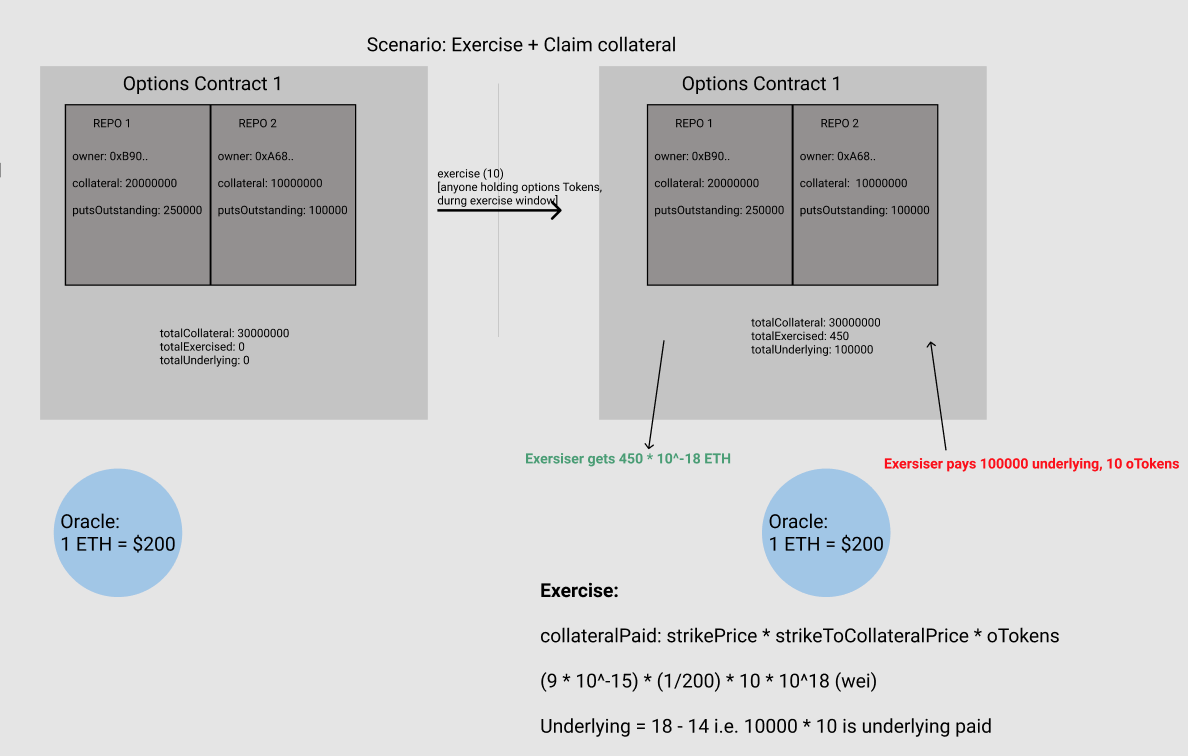

Any oToken holder can call exercise (oTokens, vaultsToExerciseFrom[]) during the exercise window and in return get out strike price amount of collateral. Note that since they are receiving the payment in the collateral asset, they should exchange it immediately for the strike asset to protect themselves against volatility. If the oToken holder wants to exercise before the exercise window, they can sell their oTokens on any exchange like Uniswap etc.

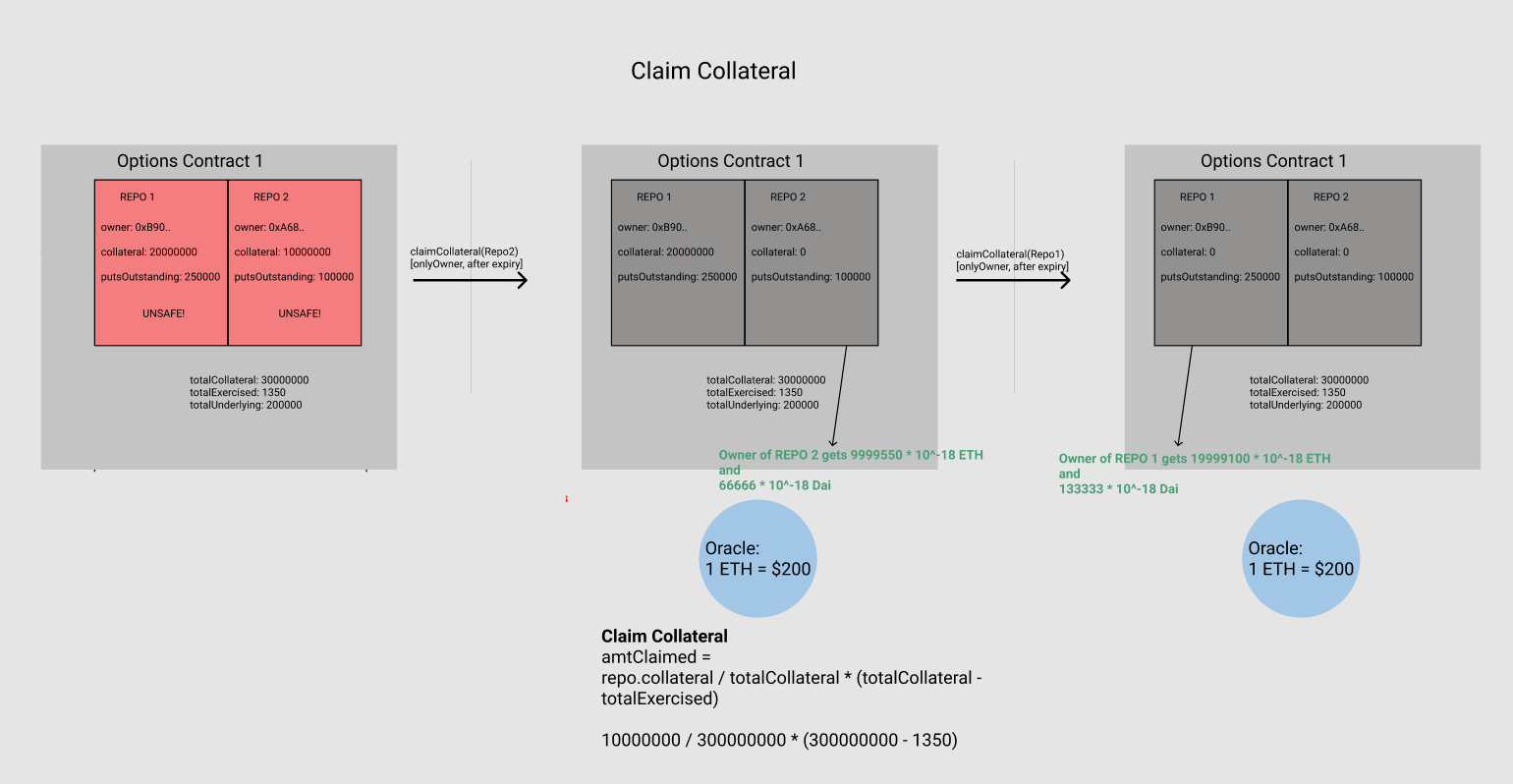

After the contract expires, the insurance providers can collect their collateral back. The amount they receive depends on how many times their vault was exercised from. The oTokens expire so don't have to be burned as they no longer have any value. Vaults can't be unsafe after expiry because they no longer have a promised insurance amount.

The vault owner can withdraw their share of underlying at any time, if their vault was exercised, by calling the removeUnderlying() function.