Navigating Asymmetry: Insights from Aggregate and Choice Models on the Influence of Regular Prices and Discounts on Retailer Performances

Tanetpong (Ned) Choungprayoon, Rickard Sandberg

In this study, we challenge the traditional approach of quantitative research which primarily models the effect of the final retail price, by highlighting the significant differences between regular prices and discounts and their impact on brand sales. Our investigation employs empirical testing for brand sales model specifications, leveraging both the aggregate sales response model and the individual choice model to estimate the price and discount elasticities of brand sales, along with their potential asymmetries in gains and losses. Using the scanner data from 2014 to 2016 which comes from a membership database of a grocery retailer in The Nordics and focusing on a category that comprises more than 70% of frequently purchased SKUs across three store formats and includes 11 brands, we conduct an in-depth case analysis of 'Brand B,' a major brand sold in all formats. This study reveals the crucial need for employing appropriate models to accurately estimate the effect of price promotions on brand sales. Our findings suggest that discounts are particularly effective in the supermarket format, with customers showing a higher responsiveness to increases rather than decreases in final prices in the hypermarket format. The estimated choice model indicates different effects of price and promotion for 'Brand B' across formats, with hypermarkets having the highest price and discount elasticities, and convenience stores showing the least sensitivity to price and discount changes. This research offers valuable insights for brand managers in designing effective pricing and discount strategies tailored to specific store formats.

The purpose of this repository is to publish the empirical research project conducted as part of my doctoral dissertation and to make the analysis part (with R) accessible, potentially inspiring further study. The slides related to this study are also available in this repository. The empirical data is obtained from the retailer and stored via AWS and retrieve using (Postgre) SQL. This project is supported by Torsten Söderbergs Stiftelse.

slide_deck contains the most updated slides

data contains df.csv which is simulated data, similar to our data structure (i.e. scanner data), used for the walkthrough and Simulate_Data.R illustrating how data is simulated

analysis contains R code used for operationalizing and transforming scanner data for aggregate model development (data_operationalization_aggregate.R) and choice model development (data_operationalization_choice.R) and R code used for analysis in this study including

-

R code for Empirical Testing for Brand Sales Model Specification (aggregate_model_estimation.R)

-

R code for (linear and nonlinear) Aggregate Sales-Response Models (aggregate_model_estimation.R) and

-

R code for Utility Choice Model (choice_model_estimation.R)

gen contains transformed aggregate data (df_bybrand_aggregate.csv) and transform customer choice data (df_choice.csv) and empirical testing results (empiricaltest_result.csv)

img contains equation and visualization used in the walkthrough

For this project, we mainly use data.table for data simulation, data aggregation, ggplot2 for visualization, car for testing effectiveness between regular price and discounts (if two coefficients are statistically equivalent), lm for testing evidence of nonlinearity by likelihood ratio and mlogit for estimating utility choice model with random parameters. Honestly, most of the work involves data transformation and operationalization (i.e., transforming customer scanner data aggregate data and customer chocie data).

Load required package

library(data.table)

library(data.table)

library(car)

library(lmtest)

library(mlogit)Setting: We simulated scanner data from 150 customers shopping across formats (hypermarket, supermarket and conveniece store) imposing positive relationship between discounts and quantity sold and negative relationship between regular price and quantity sold. For simplicity, we walkthrough showing example of one category (category z). In category z, there are 5 brands available including "Brand A", "Brand B", "Brand C", "Brand D" and "Brand E".

Import data

df <- fread("../data/df.csv")

#Assuming we are interested in category z

df <- df[category == "z",]| Variable | Description |

|---|---|

| cust | Customer id |

| week_nr | Week number |

| spend | Total money spent |

| brand | Brand purchased |

| format | Store format |

| category | Category z |

| regprice | Regular prices (list price) |

| discount | Discounts offered |

| quantity | Quantity purchased |

| holiday | = 1 if week_nr is holiday, otherwise 0 |

As we are interested in both aggregate aspect (brand sales) and choice-level aspect we need to (1) transform by aggregating and operationalizing relevant variables into brand-level (2) calculate relevant variables by individual (e.g. price mister A paid last time he bought is not the same with price mister B paid last time he bought).

Calculate (market-weighted average) brand variables

df[, finalspending := regprice - discount]

df[, regpriceperunit := regprice/quantity]

df[, finalpriceperunit := finalspending /quantity]

df[, discountperunit := discount/quantity]

# Calculate weekly sales by brand

weeklysalesbybrand <- df[, .(totalsales = sum(quantity), LL = .N), by = .(week_nr,holiday, brand, format)]

#LL can be calculated by uniqueN(product_id) to count distinct product id

# Merge df_complete with weeklysalesbybrand and calculate weights

df_weightcalc <- merge(df, weeklysalesbybrand, by = c("week_nr","holiday", "brand", "format"))

df_weightcalc[, wp := quantity/totalsales]

# Calculate weighted averages

df_weightcalc[, avgregpriceperunit := regpriceperunit * wp]

df_weightcalc[, avgfinalprice := finalpriceperunit * wp]

df_weightcalc[, avgdiscount := discountperunit * wp]

# Aggregate by week_nr, brand, and format

df_bybrand <- df_weightcalc[, .(totalvolume = sum(quantity),

totalvalue = sum(finalspending),

LL = mean(LL),

avgregprice = sum(avgregpriceperunit),

avgfinalprice = sum(avgfinalprice),

avgdiscount = sum(avgdiscount)), by = .(week_nr,holiday, brand, format)]

rm(weeklysalesbybrand,df_weightcalc)

df_bybrand[, depth := avgdiscount/avgregprice]

df_bybrand[, nondepth := 1 - depth]Calculate (1) log-transformed (market-weighted average) competitor brand variables (2) log-transformed lag variable (3) Gaussian-copula correction term (4) first difference of log-transformed variables for aggregate model estimation and (5) (Final price, Regular price, Discounts) Gain and loss with respect to what offered the week before

# Filter the data for brand "D" and then group by week_nr

brand_focal_week_data <- df[brand == brand_we_interested, .(formatvisit = uniqueN(format)), by = .(week_nr)]

weeks_with_allvisits <- brand_focal_week_data[formatvisit >= 3, week_nr]

df_store <- df[week_nr %in% weeks_with_allvisits]

rm(brand_focal_week_data)

df_store[, brand_focal := ifelse(brand == brand_we_interested, "Focal", "Nonfocal")]

#Generate (market-weighted average) brand_focal variables

df_store[, finalspending := regprice - discount]

df_store[, regpriceperunit := regprice/quantity]

df_store[, finalpriceperunit := finalspending /quantity]

df_store[, avgdiscountperunit := discount/quantity]

# Calculate weekly sales by brand_focal

weeklysalesbybrand <- df_store[, .(totalsales = sum(quantity), LL = .N), by = .(week_nr,holiday, brand_focal, format)]

#LL can be calculated by uniqueN(product_id) to count distinct product id

# Merge df_complete with weeklysalesbybrand and calculate weights

df_weightcalc <- merge(df_store, weeklysalesbybrand, by = c("week_nr","holiday", "brand_focal", "format"))

df_weightcalc[, wp := quantity/totalsales]

# Calculate weighted averages

df_weightcalc[, avgregpriceperunit := regpriceperunit * wp]

df_weightcalc[, avgfinalprice := finalpriceperunit * wp]

df_weightcalc[, avgavgdiscount := avgdiscountperunit * wp]

# Aggregate by week_nr, brand, and format

df_bybrand_focal <- df_weightcalc[, .(totalvolume = sum(quantity),

totalvalue = sum(finalspending),

LL = mean(LL),

regprice = sum(avgregpriceperunit),

finalprice = sum(avgfinalprice),

discount = sum(avgavgdiscount)), by = .(week_nr,holiday, brand_focal, format)]

rm(weeklysalesbybrand,df_weightcalc)

#FOR SIMPLICITY WE SPLIT BETWEEN FOCAL BRAND AND NON-FOCAL BRAND, in the end we want detail of focal brand and non focal in the same row

weeklysalesbybrand_Focal <- df_bybrand_focal[df_bybrand_focal$brand_focal == "Focal",]

weeklysalesbybrand_Nonfocal <- df_bybrand_focal[df_bybrand_focal$brand_focal!= "Focal",]

# Rename columns to distinguish between Focal and Nonfocal

setnames(weeklysalesbybrand_Nonfocal, old = c("finalprice", "regprice", "discount"),

new = c("finalprice_Nonfocal", "regprice_Nonfocal", "discount_Nonfocal"))

setnames(weeklysalesbybrand_Focal, old = c("finalprice", "regprice", "discount"),

new = c("finalprice_Focal", "regprice_Focal", "discount_Focal"))

# Merge Focal and Nonfocal data

df_storeinfo <- merge(weeklysalesbybrand_Focal, weeklysalesbybrand_Nonfocal, by = c("week_nr", "format"))

df_storeinfo <- df_storeinfo[,c("week_nr","finalprice_Nonfocal","regprice_Nonfocal","discount_Nonfocal","finalprice_Focal","regprice_Focal","discount_Focal","format")]

# Create a function to streamline the creation of format-specific columns

create_format_specific_cols <- function(data, format_name) {

cols <- c("finalprice", "regprice","discount")

setnames(data, old = paste0(cols, "_Focal"), new = paste0(format_name, cols, "_Focal"))

setnames(data, old = paste0(cols, "_Nonfocal"), new = paste0(format_name, cols, "_Nonfocal"))

# Remove 'format' column

data <- data[, !("format"), with = FALSE]

return(data)

}

# Apply the function to each format and combine the results

storedf_hyper <- create_format_specific_cols(df_storeinfo[format == "hypermarket"], "hyper")

storedf_super <- create_format_specific_cols(df_storeinfo[format == "supermarket"], "super")

storedf_conve <- create_format_specific_cols(df_storeinfo[format == "convenience"], "conve")

# Combine all format data

# Assuming store_df, storedf_hyper, storedf_super, storedf_conve are your data frames

list_of_df_formats <- list(df_storeinfo, storedf_hyper, storedf_super, storedf_conve)

# Merge all data frames in the list based on 'vecka'

relevant_storedf <- Reduce(function(x, y) merge(x, y, by = c("week_nr"), all = TRUE), list_of_df_formats)

#we can check the avgregprice should be the same with format_avgregprice

# Find columns that match the patterns 'regprice_' or 'avgdiscount_'

finalprice_cols <- grep("finalprice_", names(relevant_storedf), value = TRUE)

regprice_cols <- grep("regprice_", names(relevant_storedf), value = TRUE)

discount_cols <- grep("discount_", names(relevant_storedf), value = TRUE)

# Combine these with the other column names

relevant_columns <- c("week_nr","format",finalprice_cols, regprice_cols,discount_cols)

# Subset the data.table with the relevant columns

relevant_storedf <- relevant_storedf[, ..relevant_columns]

# Optionally, remove unnecessary variables from environment

rm(list = c("df_bybrand_focal","weeklysalesbybrand_Nonfocal", "weeklysalesbybrand_Focal", "df_storeinfo",

"storedf_hyper", "storedf_super", "storedf_conve","list_of_df_formats"))

Calculating customer choice data is tricky, as we have scanner data, hence we will infer weekly brand attribute for each store format from the data. For simplicity, we only study brand "D", hence we consider brand D as our focal brand making other 4 brands become competitive brand (or non-focal brand).

For customer choice data, customer-data price gain is different from aggregate-brand price gain. Customer price gain is when mister A pay less that what he paid prior time, regardless of store format he visited, while aggregate-brand price gain is when the brand offers less price at a particular format compared to the week before.

Please note that there are a few assumption need to be made regarding how customers remember price and brand (e.g., customers only remember price last time they visit or last 2, 3,.. times)

Calculate weekly brand attribute at store-format level data

# Filter the data for brand "D" and then group by week_nr

brand_focal_week_data <- df[brand == brand_we_interested, .(formatvisit = uniqueN(format)), by = .(week_nr)]

weeks_with_allvisits <- brand_focal_week_data[formatvisit >= 3, week_nr]

df_store <- df[week_nr %in% weeks_with_allvisits]

rm(brand_focal_week_data)

df_store[, brand_focal := ifelse(brand == brand_we_interested, "Focal", "Nonfocal")]

#Generate (market-weighted average) brand_focal variables

df_store[, finalspending := regprice - discount]

df_store[, regpriceperunit := regprice/quantity]

df_store[, finalpriceperunit := finalspending /quantity]

df_store[, avgdiscountperunit := discount/quantity]

# Calculate weekly sales by brand_focal

weeklysalesbybrand <- df_store[, .(totalsales = sum(quantity), LL = .N), by = .(week_nr,holiday, brand_focal, format)]

#LL can be calculated by uniqueN(product_id) to count distinct product id

# Merge df_complete with weeklysalesbybrand and calculate weights

df_weightcalc <- merge(df_store, weeklysalesbybrand, by = c("week_nr","holiday", "brand_focal", "format"))

df_weightcalc[, wp := quantity/totalsales]

# Calculate weighted averages

df_weightcalc[, avgregpriceperunit := regpriceperunit * wp]

df_weightcalc[, avgfinalprice := finalpriceperunit * wp]

df_weightcalc[, avgavgdiscount := avgdiscountperunit * wp]

# Aggregate by week_nr, brand, and format

df_bybrand_focal <- df_weightcalc[, .(totalvolume = sum(quantity),

totalvalue = sum(finalspending),

LL = mean(LL),

regprice = sum(avgregpriceperunit),

finalprice = sum(avgfinalprice),

discount = sum(avgavgdiscount)), by = .(week_nr,holiday, brand_focal, format)]

rm(weeklysalesbybrand,df_weightcalc)

#FOR SIMPLICITY WE SPLIT BETWEEN FOCAL BRAND AND NON-FOCAL BRAND, in the end we want detail of focal brand and non focal in the same row

weeklysalesbybrand_Focal <- df_bybrand_focal[df_bybrand_focal$brand_focal == "Focal",]

weeklysalesbybrand_Nonfocal <- df_bybrand_focal[df_bybrand_focal$brand_focal!= "Focal",]

# Rename columns to distinguish between Focal and Nonfocal

setnames(weeklysalesbybrand_Nonfocal, old = c("finalprice", "regprice", "discount"),

new = c("finalprice_Nonfocal", "regprice_Nonfocal", "discount_Nonfocal"))

setnames(weeklysalesbybrand_Focal, old = c("finalprice", "regprice", "discount"),

new = c("finalprice_Focal", "regprice_Focal", "discount_Focal"))

# Merge Focal and Nonfocal data

df_storeinfo <- merge(weeklysalesbybrand_Focal, weeklysalesbybrand_Nonfocal, by = c("week_nr", "format"))

df_storeinfo <- df_storeinfo[,c("week_nr","finalprice_Nonfocal","regprice_Nonfocal","discount_Nonfocal","finalprice_Focal","regprice_Focal","discount_Focal","format")]

# Create a function to streamline the creation of format-specific columns

create_format_specific_cols <- function(data, format_name) {

cols <- c("finalprice", "regprice","discount")

setnames(data, old = paste0(cols, "_Focal"), new = paste0(format_name, cols, "_Focal"))

setnames(data, old = paste0(cols, "_Nonfocal"), new = paste0(format_name, cols, "_Nonfocal"))

# Remove 'format' column

data <- data[, !("format"), with = FALSE]

return(data)

}

# Apply the function to each format and combine the results

storedf_hyper <- create_format_specific_cols(df_storeinfo[format == "hypermarket"], "hyper")

storedf_super <- create_format_specific_cols(df_storeinfo[format == "supermarket"], "super")

storedf_conve <- create_format_specific_cols(df_storeinfo[format == "convenience"], "conve")

# Combine all format data

# Assuming store_df, storedf_hyper, storedf_super, storedf_conve are your data frames

list_of_df_formats <- list(df_storeinfo, storedf_hyper, storedf_super, storedf_conve)

# Merge all data frames in the list based on 'vecka'

relevant_storedf <- Reduce(function(x, y) merge(x, y, by = c("week_nr"), all = TRUE), list_of_df_formats)

#we can check the avgregprice should be the same with format_avgregprice

# Find columns that match the patterns 'regprice_' or 'avgdiscount_'

finalprice_cols <- grep("finalprice_", names(relevant_storedf), value = TRUE)

regprice_cols <- grep("regprice_", names(relevant_storedf), value = TRUE)

discount_cols <- grep("discount_", names(relevant_storedf), value = TRUE)

# Combine these with the other column names

relevant_columns <- c("week_nr","format",finalprice_cols, regprice_cols,discount_cols)

# Subset the data.table with the relevant columns

relevant_storedf <- relevant_storedf[, ..relevant_columns]

# Optionally, remove unnecessary variables from environment

rm(list = c("df_bybrand_focal","weeklysalesbybrand_Nonfocal", "weeklysalesbybrand_Focal", "df_storeinfo",

"storedf_hyper", "storedf_super", "storedf_conve","list_of_df_formats"))

Calculate customer level data

df_hh <- df_store #We selected the dataset that we have complete store formats information

df_choice <- merge(df_hh,relevant_storedf, by=c("week_nr","format")) #we need to maintain the format so we can conlude the price that customer encounter at the format the bought

remove(list=c("df_hh", "df_store","relevant_storedf","df"))

genattribute_focalbrand <- function(df,brand_we_interested,lambda_IRP,lambda_loyalty) {

# Remove duplicates

df <- unique(df, by = c("week_nr", "cust"))

# Define choices

df[, choice_Focal := ifelse(brand == brand_we_interested, 1, 0)]

df[, choice_Nonfocal := ifelse(brand != brand_we_interested, 1, 0)]

# Define lag function

lag_1 <- function(x) shift(x, 1, type = "lag")

# Order the dataframe for lagged operations

df <- df[order(cust, week_nr)]

# Function to calculate IRP

calc_irp <- function(col, lambda_IRP) {

col1 <- lag_1(col)

col2 <- lag_1(col1)

irp1 <- lambda_IRP * col2 + (1 - lambda_IRP) * col1

irp <- lambda_IRP * irp1 + (1 - lambda_IRP) * col1

return(list(irp1 = irp1, irp = irp))

}

# Calculate IRP for price and avgdiscount for both Focal and Nonfocal

df[, c("IR_finalprice1_Focal", "IR_finalprice_Focal") := calc_irp(regprice_Focal, lambda_IRP)]

df[, c("IR_regprice1_Focal", "IR_regprice_Focal") := calc_irp(regprice_Focal, lambda_IRP)]

df[, c("IR_discount1_Focal", "IR_discount_Focal") := calc_irp(discount_Focal, lambda_IRP)]

df[, c("IR_finalprice1_Nonfocal", "IR_finalprice_Nonfocal") := calc_irp(regprice_Nonfocal, lambda_IRP)]

df[, c("IR_regprice1_Nonfocal", "IR_regprice_Nonfocal") := calc_irp(regprice_Nonfocal, lambda_IRP)]

df[, c("IR_discount1_Nonfocal", "IR_discount_Nonfocal") := calc_irp(discount_Nonfocal, lambda_IRP)]

# Calculate gain/loss variables

gain_loss <- function(gap, format = NULL) {

if (!is.null(format)) {

gap <- gap * (df$format == format)

}

gain <- pmax(gap, 0)

loss <- pmax(-gap, 0)

return(list(gain = gain, loss = loss))

}

df[, c("finalpricegap_Focal","regpricegap_Focal", "discountgap_Focal","finalpricegap_Nonfocal" ,"regpricegap_Nonfocal", "discountgap_Nonfocal") :=

.((finalprice_Focal - IR_finalprice_Focal),

(regprice_Focal - IR_regprice_Focal),

(discount_Focal - IR_discount_Focal),

(finalprice_Nonfocal - IR_finalprice_Nonfocal),

(regprice_Nonfocal - IR_regprice_Nonfocal),

(discount_Nonfocal - IR_discount_Nonfocal))]

# Apply gain/loss function to each format and type

formats <- c("hyper", "super", "conve")

for (focal in c("Focal", "Nonfocal")) {

for (format in formats) {

df[, c(paste0(format, "finalpricegain_", focal), paste0(format, "finalpriceloss_", focal)) :=

gain_loss(get(paste0("regpricegap_", focal)), format)]

df[, c(paste0(format, "regpricegain_", focal), paste0(format, "regpriceloss_", focal)) :=

gain_loss(get(paste0("regpricegap_", focal)), format)]

df[, c(paste0(format, "discountgain_", focal), paste0(format, "discountloss_", focal)) :=

gain_loss(get(paste0("discountgap_", focal)), format)]

}

}

# Calculate loyalty variable

lambda_loyalty = lambda_loyalty

# Calculate lagged loyalty variables

df[, loyal1_Focal := lag_1(choice_Focal)]

df[, loyal1_Nonfocal := lag_1(choice_Nonfocal)]

# Calculate loyalty variables

df[, loyal_Focal := lambda_loyalty * loyal1_Focal + (1 - lambda_loyalty) * choice_Focal]

df[, loyal_Nonfocal := lambda_loyalty * loyal1_Nonfocal + (1 - lambda_loyalty) * choice_Nonfocal]

df[, loyal := fifelse(choice_Nonfocal == 0, loyal_Nonfocal, loyal_Focal)]

# Calculate format share

df[, `:=` (supermarket_shop = as.integer(format == "supermarket"),

hypermarket_shop = as.integer(format == "hypermarket"),

convenience_shop = as.integer(format == "convenience"),

shoppingtime = 1)]

df[, `:=` (TotalShoppingtime = cumsum(shift(shoppingtime, fill = 1)),

supermarkettime = cumsum(shift(supermarket_shop, fill = 0)),

hypermarkettime = cumsum(shift(hypermarket_shop, fill = 0)),

conveniencetime = cumsum(shift(convenience_shop, fill = 0))

), by = cust]

df[, `:=` (sup_share = supermarkettime / TotalShoppingtime,

hyper_share = hypermarkettime / TotalShoppingtime,

conve_share = conveniencetime / TotalShoppingtime)]

# Remove first week used for constructing IRP and Loyalty and duplicates

df <- na.omit(df)

df <- unique(df, by = c("week_nr", "cust"))

return(df)

}

df_choicemade <- genattribute_focalbrand(df_choice,brand_we_interested = "D",lambda_IRP = 0.90,lambda_loyalty= 0.89)

Widen data (for seperate choice) with attributes fitting with mlogit package

choice_rearrange <- function(df_choicemade){

df_choice_rearranged <-df_choicemade[,c("week_nr","cust","brand_focal",

"hyperfinalprice_Focal","hyperfinalprice_Nonfocal","hyperregprice_Focal","hyperregprice_Nonfocal","hyperdiscount_Focal","hyperdiscount_Nonfocal",

"superfinalprice_Focal","superfinalprice_Nonfocal","superregprice_Focal","superregprice_Nonfocal","superdiscount_Focal","superdiscount_Nonfocal",

"convefinalprice_Focal","convefinalprice_Nonfocal","converegprice_Focal","converegprice_Nonfocal","convediscount_Focal","convediscount_Nonfocal",

"hyperfinalpricegain_Focal","hyperfinalpricegain_Nonfocal","hyperfinalpriceloss_Focal","hyperfinalpriceloss_Nonfocal",

"hyperregpricegain_Focal","hyperregpricegain_Nonfocal","hyperregpriceloss_Focal","hyperregpriceloss_Nonfocal",

"hyperdiscountgain_Focal","hyperdiscountgain_Nonfocal","hyperdiscountloss_Focal","hyperdiscountloss_Nonfocal",

"superfinalpricegain_Focal","superfinalpricegain_Nonfocal","superfinalpriceloss_Focal","superfinalpriceloss_Nonfocal",

"superregpricegain_Focal","superregpricegain_Nonfocal","superregpriceloss_Focal","superregpriceloss_Nonfocal",

"superdiscountgain_Focal","superdiscountgain_Nonfocal","superdiscountloss_Focal","superdiscountloss_Nonfocal",

"convefinalpricegain_Focal","convefinalpricegain_Nonfocal","convefinalpriceloss_Focal","convefinalpriceloss_Nonfocal",

"converegpricegain_Focal","converegpricegain_Nonfocal","converegpriceloss_Focal","converegpriceloss_Nonfocal",

"convediscountgain_Focal","convediscountgain_Nonfocal","convediscountloss_Focal","convediscountloss_Nonfocal")]

df_choice_tranformed <- dfidx(df_choice_rearranged, choice = "brand_focal", varying = 4:57, sep = "_")

df_choice_tranformed$choice <- as.numeric(df_choice_tranformed$brand_focal)

df_choicevariant_0 <- data.frame(df_choice_tranformed[,c("week_nr","cust","choice",

"hyperfinalprice","hyperregprice","hyperdiscount","hyperfinalpricegain","hyperfinalpriceloss","hyperregpricegain","hyperregpriceloss","hyperdiscountgain","hyperdiscountloss",

"superfinalprice","superregprice","superdiscount","superfinalpricegain","superfinalpriceloss","superregpricegain","superregpriceloss","superdiscountgain","superdiscountloss",

"convefinalprice","converegprice","convediscount","convefinalpricegain","convefinalpriceloss","converegpricegain","converegpriceloss","convediscountgain","convediscountloss")])

extract_index <- data.frame(df_choicevariant_0[,31])

setnames(extract_index, new = c("chid","brand_alt"))

df_choicevariant<- cbind(df_choicevariant_0,extract_index)

df_choiceinvariant <- data.frame(df_choicemade[,c("week_nr","cust","brand_focal",

"loyal_Focal","loyal_Nonfocal","sup_share","hyper_share","conve_share")])

df <- merge(df_choicevariant,df_choiceinvariant, by=c("week_nr","cust"))

df$Nonfocal_intercept = ifelse(df$brand_alt == "Nonfocal", 1, 0)

df$Focal_intercept = ifelse(df$brand_alt == "Focal", 1, 0)

df$loyal_nonfocal = ifelse(df$brand_alt == "Nonfocal", df$loyal_Nonfocal, df$loyal_Focal)

return(df)

}

df_choice <- choice_rearrange(df_choicemade)

#generate output

write.csv(df_choice,'../gen/df_choice.csv', row.names = TRUE)Plot relationship between brand B quantity sold and final price, regular prices and discounts

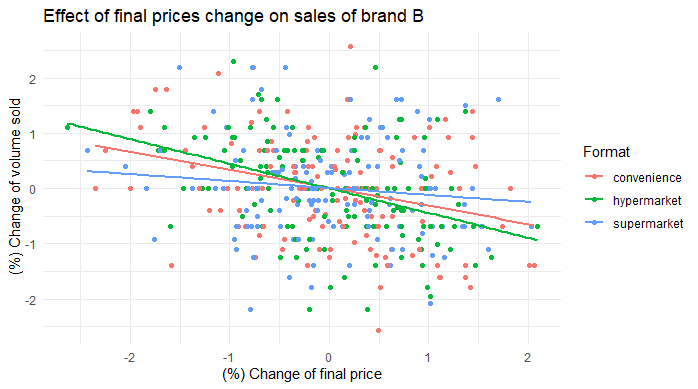

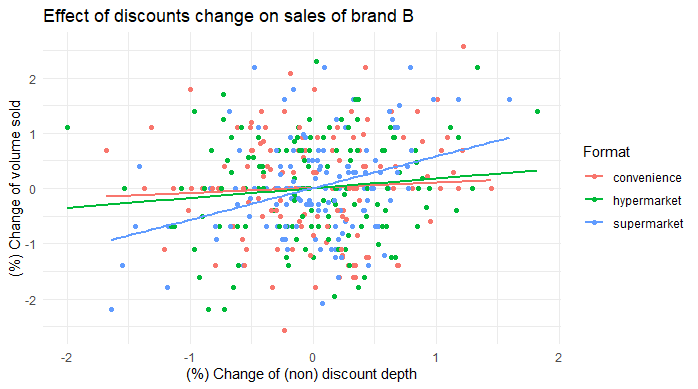

ggplot(df_bybrand_formats[brand == "B",], aes(x = dlognondepth, y = dlogtotalvolume, color = format)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE) +

theme_minimal() +

labs(title ="Effect of discounts change on sales of brand B", x = "(%) Change of (non) discount depth", y = "(%) Change of volume sold", color = "Format")

ggplot(df_bybrand_formats[brand == "B",], aes(x = dlogavgfinalprice, y = dlogtotalvolume, color = format)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE) +

theme_minimal() +

labs(title ="Effect of final prices change on sales of brand B", x = "(%) Change of final price", y = " (%) Change of volume sold", color = "Format")

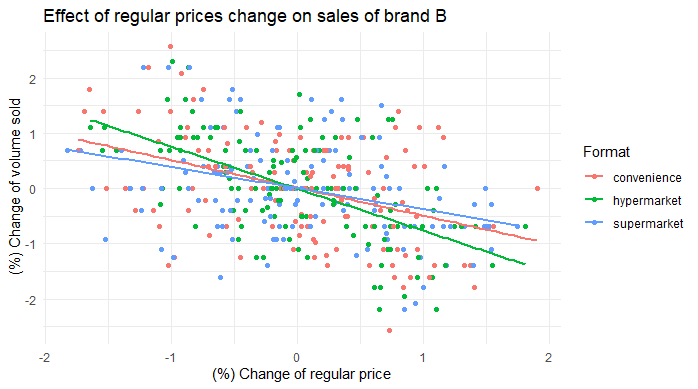

ggplot(df_bybrand_formats[brand == "B",], aes(x = dlogavgregprice, y = dlogtotalvolume, color = format)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE) +

theme_minimal() +

labs(title ="Effect of regular prices change on sales of brand B", x = "(%) Change of regular price", y = " (%) Change of volume sold", color = "Format")

- Varying effect of final price, regular price and discounts across formats

- Mathematical decomposition of final price into regular price (list price) and discounts is shown in the appendix of the slides

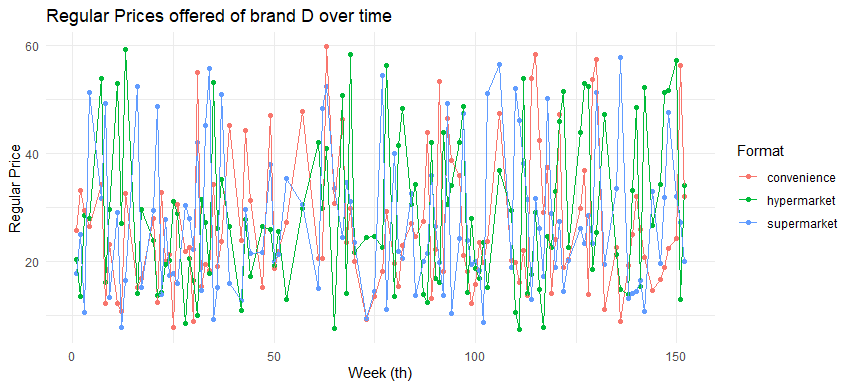

Plot brand attribute over time

#Plot store offering

ggplot(relevant_storedf, aes(x = week_nr, y = regprice_Focal, color = format)) +

geom_point() +

geom_line() +

theme_minimal() +

labs(title ="Regular Prices offered of brand E over time", x = "Week (th)", y = "Regular Price", color = "Format")

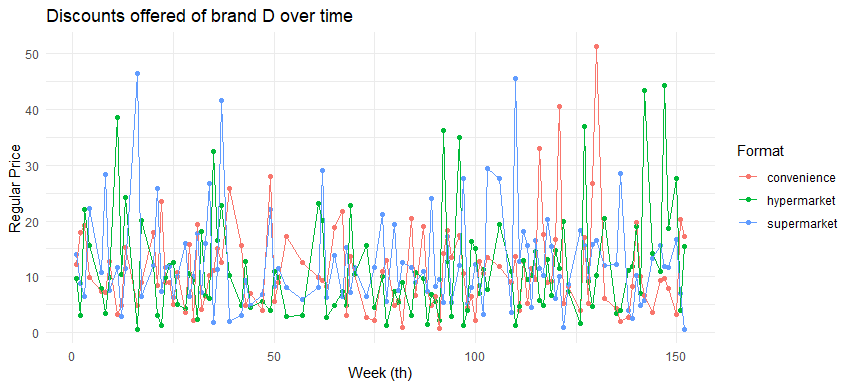

ggplot(relevant_storedf, aes(x = week_nr, y = discount_Focal, color = format)) +

geom_point() +

geom_line() +

theme_minimal() +

labs(title ="Discounts offered of brand E over time", x = "Week (th)", y = "Regular Price", color = "Format")

- Varying regular price and discounts offered across formats, hence, customers who visit different store format at the different time would have different price information

Compare (selected) customers price gap

df_choicemade[, cust := as.factor(cust)]

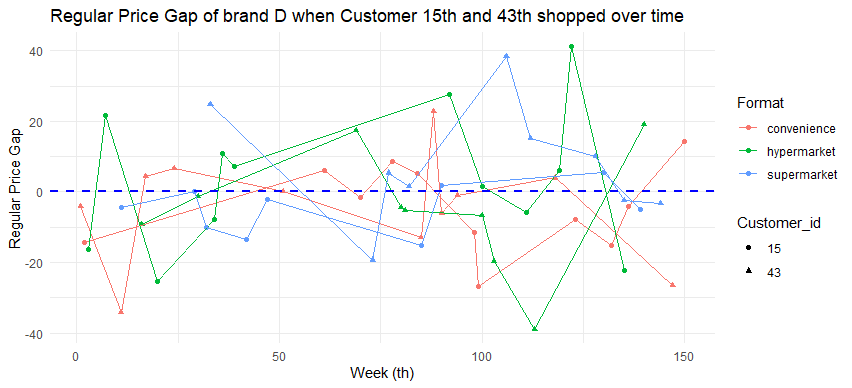

ggplot(df_choicemade[df_choicemade$cust %in% c("15","43"),],

aes(x = week_nr, y = regpricegap_Focal, color = format, shape = cust)) +

geom_point() +

geom_line() +

geom_hline(yintercept = 0, linetype = "dashed", color = "blue", size = 1) + # Add this line for the horizontal line

theme_minimal() +

labs(title = "Regular Price Gap of brand E when Customer 15th and 43th shopped over time",

x = "Week (th)",

y = "Regular Price Gap",

color = "Format",

shape = "Customer_id")

- Most of the time, customer 15 encountered cheaper prices of brand D (price gap is negative meaning that what he pays at the time is less than what he paid prior) compared to customer 43

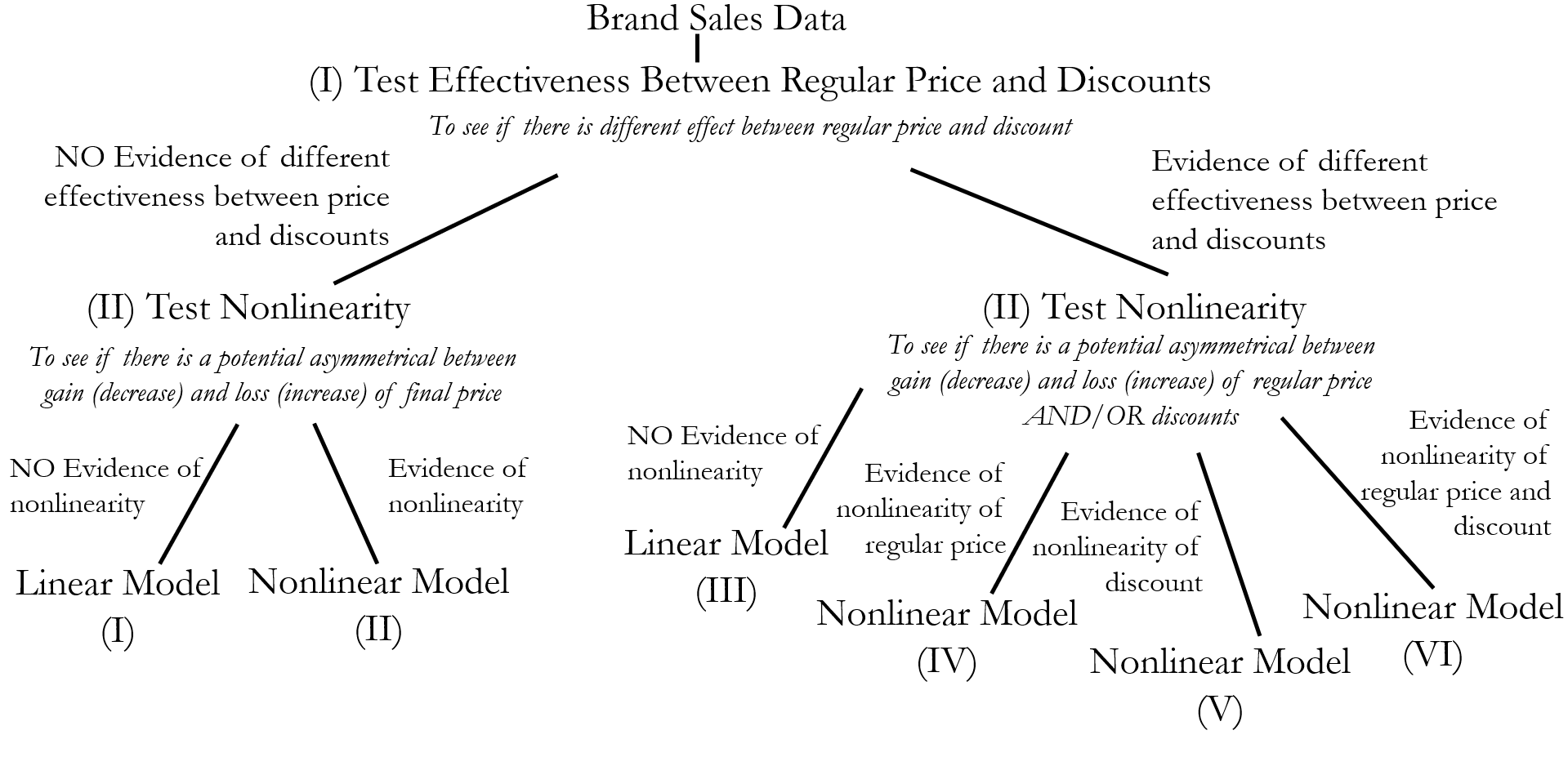

We are proposed research question and how to test as follows:

-

How does the decomposition of promotional prices into regular prices and discounts affect sales’ curves and the price elasticities?

- Test effectiveness between regular price and discounts to see if there is different effect between these two variables

-

Are there asymmetric elasticities of gains and losses between regular prices and discounts?

- Test for nonlinearity to see if there is a potential asymmetrical between gain and loss of final price, regular price and discounts

-

What are the potential price encoding mechanisms when customers made purchases across store formats?

- Employ the appropriate utility choice model to see how price-relevant information potentially affects brand choice

Detail of model specification is available in the appendix of the slides

Develop algorithm to test model for each brand in each store format and test

#Create function for testing discount and reg price effectiveness across formats

test_discount_coef <- function(aggregate_df) {

distinctbrands <- unique(aggregate_df$brand)

distinctformats <- unique(aggregate_df$format)

df_discount_coef_test <- data.table() # Create an empty data.table

for (format_val in distinctformats) {

for (brand_val in distinctbrands) {

subset_df <- aggregate_df[brand == brand_val & format == format_val]

if (nrow(subset_df) > 0) { # Check if there are data for this brand and format

lm_discount <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice +

log(totalvolume1) + log(avgregprice1) + log(nondepth1) +

cop_logavgregprice + cop_lognondepth + holiday,

data = subset_df)

# Test coefficient between price before discount

coeftest <- linearHypothesis(lm_discount, "dlogavgregprice - dlognondepth = 0")

# Store test results in the data.table

df_discount_coef_test <- rbind(df_discount_coef_test, list(

format = format_val,

brand = brand_val,

Coef_Regprice = coef(summary(lm_discount))[["dlogavgregprice", "Estimate"]],

Sd_Regprice = coef(summary(lm_discount))[["dlogavgregprice", "Std. Error"]],

Coef_NonDiscount = coef(summary(lm_discount))[["dlognondepth", "Estimate"]],

Sd_NonDiscount = coef(summary(lm_discount))[["dlognondepth", "Std. Error"]],

p_coef_test = round(coeftest$`Pr(>F)`[2], 4),

R2_of_model = round(summary(lm_discount)$r.squared, 4)

), fill = TRUE)

}

}

}

# Add the decision column based on p-value

df_discount_coef_test[, pricedecision := fifelse(`p_coef_test` < 0.05, 'discount', 'finalprice')]

return(df_discount_coef_test)

}

#Create function for evidence of nonlinear term

test_nonlinearity_both <- function(aggregate_df, discount_coef_result, critical_p){

# Merge on both brand and format

df_merge_result <- merge(aggregate_df, discount_coef_result, by = c("brand", "format"))

# Split data based on price decision for each brand-format combination

df_finalprice <- df_merge_result[df_merge_result$pricedecision == 'finalprice', ]

distinctbrandformat_finalprice <- unique(df_finalprice[, .(brand, format)])

df_discount <- df_merge_result[df_merge_result$pricedecision == 'discount', ]

distinctbrandformat_discount <- unique(df_discount[, .(brand, format)])

# Initialize data frames for results

df_finalprice_lr <- data.frame(matrix(NA, ncol = 5 , nrow = nrow(distinctbrandformat_finalprice)))

df_discount_lr <- data.frame(matrix(NA, ncol = 5 , nrow = nrow(distinctbrandformat_discount)))

# Process final price data

for (i in 1:nrow(distinctbrandformat_finalprice)) {

brand_val <- distinctbrandformat_finalprice$brand[i]

format_val <- distinctbrandformat_finalprice$format[i]

lm_finalprice <- lm(dlogtotalvolume ~ dlogavgfinalprice + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice1) + cop_logavgfinalprice + holiday,

data = df_finalprice[brand == brand_val & format == format_val])

lm_finalprice_price2 <- lm(dlogtotalvolume ~ dlogavgfinalprice + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice1) + cop_logavgfinalprice + holiday + I(dlogavgfinalprice^2),

data = df_finalprice[brand == brand_val & format == format_val])

test_price <- lrtest(lm_finalprice, lm_finalprice_price2)

df_finalprice_lr[i,] <- c(brand_val, format_val, round(test_price$`Pr(>Chisq)`[2],3), "NA", "NA")

}

# Process discount data

for (i in 1:nrow(distinctbrandformat_discount)) {

brand_val <- distinctbrandformat_discount$brand[i]

format_val <- distinctbrandformat_discount$format[i]

lm_discount <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,

data = df_discount[brand == brand_val & format == format_val])

lm_discount_price2 <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday + I(dlogavgregprice^2),

data = df_discount[brand == brand_val & format == format_val])

lm_discount_discount2 <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday + I(dlognondepth^2),

data = df_discount[brand == brand_val & format == format_val])

lm_discount_pricediscount2 <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday + I(dlogavgregprice^2) + I(dlognondepth^2),

data = df_discount[brand == brand_val & format == format_val])

test_price <- lrtest(lm_discount, lm_discount_price2)

test_discount <- lrtest(lm_discount, lm_discount_discount2)

test_price_discount <- lrtest(lm_discount, lm_discount_pricediscount2)

df_discount_lr[i,] <- c(brand_val, format_val, round(test_price$`Pr(>Chisq)`[2],3), round(test_discount$`Pr(>Chisq)`[2],3), round(test_price_discount$`Pr(>Chisq)`[2],3))

}

# Combine results and return

df_nonlinearity_test <- data.table(rbind(df_discount_lr, df_finalprice_lr))

colnames(df_nonlinearity_test) <- c('brand', 'format', 'p-value-price^2', 'p-value-discount^2', 'p-value-priceanddiscount^2')

# Give the decision in this nonlinearity step

# Initialize default decision

df_nonlinearity_test[, Decision := NA_character_]

# Apply conditions based on the decision tree

df_nonlinearity_test[`p-value-price^2` < critical_p & `p-value-discount^2` < critical_p & `p-value-priceanddiscount^2` < critical_p, Decision := "RegDisNonlinear (mod 6)"]

df_nonlinearity_test[`p-value-price^2` >= critical_p & `p-value-discount^2` < critical_p, Decision := "DisNonlinear (mod 5)"]

df_nonlinearity_test[`p-value-price^2` < critical_p & `p-value-discount^2` >= critical_p, Decision := "RegPriceNonlinear (mod 4)"]

df_nonlinearity_test[`p-value-price^2` >= critical_p & `p-value-discount^2` >= critical_p & `p-value-priceanddiscount^2` < critical_p, Decision := "RegDisLinear (mod 3)"]

df_nonlinearity_test[`p-value-price^2` < critical_p & `p-value-discount^2` == "NA" & `p-value-priceanddiscount^2` == "NA", Decision := "NonlinearFinal (mod 2)"]

df_nonlinearity_test[`p-value-price^2` >= critical_p & `p-value-discount^2` == "NA" & `p-value-priceanddiscount^2` == "NA", Decision := "FinalLinear (mod 1)"]

return(df_nonlinearity_test)

}

#Import Data

df <- fread("../gen/df_bybrand_aggregate.csv")

#Test

df_results <- test_discount_coef(df)

df_nonlinearresults <- test_nonlinearity_both(df, df_results, critical_p = 0.05) #Conservative value

#Export results

write.csv(df_nonlinearresults,'../gen/empiricaltest_result.csv')

| Brand | Format | Test between Reg Price and Discount | Test Nonlinearity | Model Conclusion |

|---|---|---|---|---|

| D | Hypermarket | Significant Difference | No evidence of nonlinearity | Model 3 |

| D | Convenience | Insignificant Difference | Evidence of nonlinearity in Final Price | Model 2 |

| D | Supermarket | Insignificant Difference | No evidence of nonlinearity | Model 1 |

| E | Hypermarket | Significant Difference | Evidence of nonlinearity in Regular Price | Model 4 |

| E | Convenience | Significant Difference | Evidence of nonlinearity in Regular Price | Model 4 |

| E | Supermarket | Significant Difference | Evidence of nonlinearity in Regular Price | Model 4 |

- We will zoom in brand D by estimating the aggregate model with respect to different formats and estimating utility choice model where there is asymmetry of final price (gain VS loss) in convenience store

Develop fuction to estimate different proposed model

####################################################

################## MODEL (I) #######################

####################################################

aggregate_model1<-function(df){

m_1 <- lm(dlogtotalvolume ~ dlogavgfinalprice + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice1) + cop_logavgfinalprice + holiday,data=df)

return(m_1)

}

####################################################

################## MODEL (II) ######################

####################################################

aggregate_model2<-function(df){

m_1 <- lm(dlogtotalvolume ~ dlogavgfinalprice + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice1) + cop_logavgfinalprice + holiday,data=df)

return(m_1)

}

aggregate_model2 <- function(df,alpha_l_price,gamma){

gamma = gamma #Speed of transition

LS_nonlinear <- function(parvec){

F_P_L <- 1/(1+exp(-gamma*(df$dlogavgfinalprice)))

ut <- df$dlogtotalvolume - (parvec[1] + (parvec[2]+ parvec[3]*F_P_L)*df$dlogavgfinalprice

+ parvec[4]*df$dlogavgcompfinalprice

+ parvec[5]*((log(df$totalvolume1))+parvec[6]*log(df$avgfinalprice1))

+ parvec[7]*df$cop_logavgfinalprice + parvec[8]*df$holiday)

logL <- sum (-0.5* log(parvec[9]) - 0.5*ut^2/parvec[9] )

return(-logL)

}

lm_linear <- lm(dlogtotalvolume ~ dlogavgfinalprice + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice) + cop_logavgfinalprice + holiday,data=df)

c_lm <- summary(lm_linear)$coefficients[1,1]

alpha_0_lm <- summary(lm_linear)$coefficients[2,1]

beta_compprice <- summary(lm_linear)$coefficients[3,1]

phi_1_lm <- summary(lm_linear)$coefficients[4,1]

phi_2_lm <- (summary(lm_linear)$coefficients[5,1])/(summary(lm_linear)$coefficients[4,1])

beta_coplogfinalprice <- summary(lm_linear)$coefficients[6,1]

beta_holiday <- summary(lm_linear)$coefficients[7,1]

#print(paste("Linearmodel_price_coef:",summary(lm_linear)$coefficients[2,1],Linearmodel_price_se:",summary(lm_linear)$coefficients[2,2],...)

parvec_1 <- c_lm

parvec_2 <- alpha_0_lm

parvec_3 <- alpha_l_price

parvec_4 <- beta_compprice

parvec_5 <- phi_1_lm

parvec_6 <- phi_2_lm

parvec_7 <- beta_coplogfinalprice

parvec_8 <- beta_holiday

parvec_9 <- summary(lm_linear)$sigma

Start_v_LS <- c(parvec_1,parvec_2,parvec_3,parvec_4,parvec_5,parvec_6,parvec_7,parvec_8,parvec_9)

est_nonlinear = optim(Start_v_LS,

fn = LS_nonlinear, # function to maximize

method = "BFGS",

control = list(fnscale = 1), # minimize the function

hessian = T # calculate Hessian matrix because we will need for confidence intervals

)

par_LS.est<-est_nonlinear$par

OI<-solve(est_nonlinear$hessian)

par_LS.se<-sqrt(diag(OI))

Start_v_LS

par_LS.est

par_LS_name <- c("constant", "price_elas","price_elas_loss",

"compprice","correction_vol","correction_finalprice","copula_logfinalprice","holiday","sigma")

par_LS <- data.table(cbind(par_LS_name,par_LS.est,par_LS.se))

return(par_LS)

}

aggregate_model2_sim <-function(df){

m_2_sim <- lm(dlogtotalvolume ~ dlogavgfinalprice_gain + dlogavgfinalprice_loss + dlogavgcompfinalprice + log(totalvolume1) + log(avgfinalprice1) + cop_logavgfinalprice + holiday,data=df)

return(m_2_sim)

}

#####################################################

################## MODEL (III) ######################

#####################################################

aggregate_model3 <-function(df){

m_3 <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

return(m_3)

}

####################################################

################## MODEL (IV) ######################

####################################################

aggregate_model4 <- function(df,alpha_l_regprice,gamma){

gamma = gamma #Speed of transition

LS_nonlinear <- function(parvec){

F_P_L <- 1/(1+exp(-gamma*(df$dlogavgregprice)))

ut <- df$dlogtotalvolume - (parvec[1] + (parvec[2]+ parvec[3]*F_P_L)*df$dlogavgregprice

+ parvec[4]*df$dlognondepth

+ parvec[5]*df$dlogavgcompfinalprice

+ parvec[6]*((log(df$totalvolume1))+parvec[7]*log(df$avgregprice1)+parvec[8]*log(df$nondepth1))

+ parvec[9]*df$cop_logavgregprice + parvec[10]*df$cop_lognondepth + parvec[11]*df$holiday)

logL <- sum (-0.5* log(parvec[12]) - 0.5*ut^2/parvec[12] )

return(-logL)

}

lm_linear <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

c_lm <- summary(lm_linear)$coefficients[1,1]

alpha_0_p_lm <- summary(lm_linear)$coefficients[2,1]

beta_nondepth <- summary(lm_linear)$coefficients[3,1]

beta_compprice <- summary(lm_linear)$coefficients[4,1]

phi_1_lm <- summary(lm_linear)$coefficients[5,1]

phi_2_lm <- (summary(lm_linear)$coefficients[6,1])/(summary(lm_linear)$coefficients[5,1])

phi_3_lm <- (summary(lm_linear)$coefficients[7,1])/(summary(lm_linear)$coefficients[5,1])

beta_coplogregprice <- summary(lm_linear)$coefficients[8,1]

beta_coplognondepth <- summary(lm_linear)$coefficients[9,1]

beta_holiday <- summary(lm_linear)$coefficients[10,1]

parvec_1 <- c_lm

parvec_2 <- alpha_0_p_lm

parvec_3 <- alpha_l_regprice

parvec_4 <- beta_nondepth

parvec_5 <- beta_compprice

parvec_6 <- phi_1_lm

parvec_7 <- phi_2_lm

parvec_8 <- phi_3_lm

parvec_9 <- beta_coplogregprice

parvec_10 <- beta_coplognondepth

parvec_11 <- beta_holiday

parvec_12 <- summary(lm_linear)$sigma

Start_v_LS <- c(parvec_1,parvec_2,parvec_3,parvec_4,parvec_5,parvec_6,parvec_7,parvec_8,parvec_9,parvec_10,parvec_11,parvec_12)

est_nonlinear = optim(Start_v_LS,

fn = LS_nonlinear, # function to maximize

method = "BFGS",

control = list(fnscale = 1), # minimize the function

hessian = T # calculate Hessian matrix because we will need for confidence intervals

)

par_LS.est<-est_nonlinear$par

OI<-solve(est_nonlinear$hessian)

par_LS.se<-sqrt(diag(OI))

Start_v_LS

par_LS.est

par_LS_name <- c("constant", "regprice_elas","regprice_elas_loss","nondepth_elas","compprice",

"correction_vol","correction_regprice","correction_nondepth","copula_logregprice","copula_lognondepth",

"holiday","sigma")

par_LS <- data.table(cbind(par_LS_name,par_LS.est,par_LS.se))

return(par_LS)

}

aggregate_model4_sim <-function(df){

m_4_sim <- lm(dlogtotalvolume ~ dlogavgregprice_gain + dlogavgregprice_loss + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

return(m_4_sim)

}

###################################################

################## MODEL (V) ######################

###################################################

aggregate_model5 <- function(df,alpha_l_nondepth,gamma){

gamma = gamma #Speed of transition

LS_nonlinear <- function(parvec){

F_D_L <- 1/(1+exp(-gamma*(df$dlognondepth)))

ut <- df$dlogtotalvolume - (parvec[1] + parvec[2]*df$dlogavgregprice

+ (parvec[3]+ parvec[4]*F_D_L)*df$dlognondepth

+ parvec[5]*df$dlogavgcompfinalprice

+ parvec[6]*((log(df$totalvolume1))+parvec[7]*log(df$avgregprice1)+parvec[8]*log(df$nondepth1))

+ parvec[9]*df$cop_logavgregprice + parvec[10]*df$cop_lognondepth + parvec[11]*df$holiday)

logL <- sum (-0.5* log(parvec[12]) - 0.5*ut^2/parvec[12] )

return(-logL)

}

lm_linear <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

c_lm <- summary(lm_linear)$coefficients[1,1]

beta_regprice <- summary(lm_linear)$coefficients[2,1]

alpha_0_d_lm <- summary(lm_linear)$coefficients[3,1]

beta_compprice <- summary(lm_linear)$coefficients[4,1]

phi_1_lm <- summary(lm_linear)$coefficients[5,1]

phi_2_lm <- (summary(lm_linear)$coefficients[6,1])/(summary(lm_linear)$coefficients[5,1])

phi_3_lm <- (summary(lm_linear)$coefficients[7,1])/(summary(lm_linear)$coefficients[5,1])

beta_coplogregprice <- summary(lm_linear)$coefficients[8,1]

beta_coplognondepth <- summary(lm_linear)$coefficients[9,1]

beta_holiday <- summary(lm_linear)$coefficients[10,1]

parvec_1 <- c_lm

parvec_2 <- beta_regprice

parvec_3 <- alpha_0_d_lm

parvec_4 <- alpha_l_nondepth

parvec_5 <- beta_compprice

parvec_6 <- phi_1_lm

parvec_7 <- phi_2_lm

parvec_8 <- phi_3_lm

parvec_9 <- beta_coplogregprice

parvec_10 <- beta_coplognondepth

parvec_11 <- beta_holiday

parvec_12 <- summary(lm_linear)$sigma

Start_v_LS <- c(parvec_1,parvec_2,parvec_3,parvec_4,parvec_5,parvec_6,parvec_7,parvec_8,parvec_9,parvec_10,parvec_11,parvec_12)

est_nonlinear = optim(Start_v_LS,

fn = LS_nonlinear, # function to maximize

method = "BFGS",

control = list(fnscale = 1), # minimize the function

hessian = T # calculate Hessian matrix because we will need for confidence intervals

)

par_LS.est<-est_nonlinear$par

OI<-solve(est_nonlinear$hessian)

par_LS.se<-sqrt(diag(OI))

Start_v_LS

par_LS.est

par_LS_name <- c("constant", "regprice_elas","nondepth_elas","nondepth_elas_loss","compprice",

"correction_vol","correction_regprice","correction_nondepth","copula_logregprice","copula_lognondepth",

"holiday","sigma")

par_LS <- data.table(cbind(par_LS_name,par_LS.est,par_LS.se))

return(par_LS)

}

aggregate_model5_sim <-function(df){

m_5_sim <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth_gain + dlognondepth_loss + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

return(m_5_sim)

}

####################################################

################## MODEL (VI) ######################

####################################################

aggregate_model6 <- function(df,alpha_l_regprice,alpha_l_nondepth,gamma){

gamma = gamma #Speed of transition

LS_nonlinear <- function(parvec){

F_P_L <- 1/(1+exp(-gamma*(df$dlogavgregprice)))

F_D_L <- 1/(1+exp(-gamma*(df$dlognondepth)))

ut <- df$dlogtotalvolume - (parvec[1] + (parvec[2]+ parvec[3]*F_P_L)*df$dlogavgregprice

+ (parvec[4]+ parvec[5]*F_D_L)*df$dlognondepth

+ parvec[6]*df$dlogavgcompfinalprice

+ parvec[7]*((log(df$totalvolume1))+parvec[8]*log(df$avgregprice1)+parvec[9]*log(df$nondepth1))

+ parvec[10]*df$cop_logavgregprice + parvec[11]*df$cop_lognondepth + parvec[12]*df$holiday)

logL <- sum (-0.5*log(parvec[13]) - 0.5*ut^2/parvec[13] )

return(-logL)

}

lm_linear <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

c_lm <- summary(lm_linear)$coefficients[1,1]

alpha_0_p_lm <- summary(lm_linear)$coefficients[2,1]

alpha_0_d_lm <- summary(lm_linear)$coefficients[3,1]

beta_compprice <- summary(lm_linear)$coefficients[4,1]

phi_1_lm <- summary(lm_linear)$coefficients[5,1]

phi_2_lm <- (summary(lm_linear)$coefficients[6,1])/(summary(lm_linear)$coefficients[5,1])

phi_3_lm <- (summary(lm_linear)$coefficients[7,1])/(summary(lm_linear)$coefficients[5,1])

beta_coplogregprice <- summary(lm_linear)$coefficients[8,1]

beta_coplognondepth <- summary(lm_linear)$coefficients[9,1]

beta_holiday <- summary(lm_linear)$coefficients[10,1]

parvec_1 <- c_lm

parvec_2 <- alpha_0_p_lm

parvec_3 <- alpha_l_regprice

parvec_4 <- alpha_0_d_lm

parvec_5 <- alpha_l_nondepth

parvec_6 <- beta_compprice

parvec_7 <- phi_1_lm

parvec_8 <- phi_2_lm

parvec_9 <- phi_3_lm

parvec_10 <- beta_coplogregprice

parvec_11 <- beta_coplognondepth

parvec_12 <- beta_holiday

parvec_13 <- summary(lm_linear)$sigma

Start_v_LS <- c(parvec_1,parvec_2,parvec_3,parvec_4,parvec_5,parvec_6,parvec_7,parvec_8,parvec_9,parvec_10,parvec_11,parvec_12,parvec_13)

est_nonlinear = optim(Start_v_LS,

fn = LS_nonlinear, # function to maximize

method = "BFGS",

control = list(fnscale = 1), # minimize the function

hessian = T # calculate Hessian matrix because we will need for confidence intervals

)

par_LS.est<-est_nonlinear$par

OI<-solve(est_nonlinear$hessian)

par_LS.se<-sqrt(diag(OI))

Start_v_LS

par_LS.est

par_LS_name <- c("constant","regprice_elas", "regprice_elas_loss","nondepth_elas","nondepth_elas_loss","compprice",

"correction_vol","correction_regprice","correction_nondepth","copula_logregprice","copula_lognondepth",

"holiday","sigma")

par_LS <- data.table(cbind(par_LS_name,par_LS.est,par_LS.se))

return(par_LS)

}

aggregate_model6_sim <-function(df){

m_6_sim <- lm(dlogtotalvolume ~ dlogavgregprice_gain + dlogavgregprice_loss + dlognondepth_gain + dlognondepth_loss + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

return(m_6_sim)

}

######################################################################

################## MODEL EXAMPLE WITH THRESHOLD ######################

######################################################################

showcase_threshold_mod5 <- function(df,alpha_g_regprice,alpha_l_regprice,threshold_l,threshold_g,gamma){

gamma = gamma #Speed of transition

LS_nonlinear <- function(parvec){

F_P_G <- 1/(1+exp(gamma*(df$dlogavgregprice - parvec[4])))

F_P_L <- 1/(1+exp(-gamma*(df$dlogavgregprice - parvec[6])))

ut <- df$dlogtotalvolume - (parvec[1] + (parvec[2] + parvec[3]*F_P_G + parvec[5]*F_P_L)*df$dlogavgregprice

+ parvec[7]*df$dlognondepth

+ parvec[8]*df$dlogavgcompfinalprice

+ parvec[9]*((log(df$totalvolume1))+parvec[10]*log(df$avgregprice1)+parvec[11]*log(df$nondepth1))

+ parvec[12]*df$cop_logavgregprice + parvec[13]*df$cop_lognondepth + parvec[14]*df$holiday)

logL <- sum (-0.5* log(parvec[15]) - 0.5*ut^2/parvec[15])

return(-logL)

}

lm_linear <- lm(dlogtotalvolume ~ dlogavgregprice + dlognondepth + dlogavgcompfinalprice + log(totalvolume1) + log(avgregprice1) + log(nondepth1) + cop_logavgregprice + cop_lognondepth + holiday,data=df)

c_lm <- summary(lm_linear)$coefficients[1,1]

alpha_0_p_lm <- summary(lm_linear)$coefficients[2,1]

beta_nondepth <- summary(lm_linear)$coefficients[3,1]

beta_compprice <- summary(lm_linear)$coefficients[4,1]

phi_1_lm <- summary(lm_linear)$coefficients[5,1]

phi_2_lm <- (summary(lm_linear)$coefficients[6,1])/(summary(lm_linear)$coefficients[5,1])

phi_3_lm <- (summary(lm_linear)$coefficients[7,1])/(summary(lm_linear)$coefficients[5,1])

beta_coplogregprice <- summary(lm_linear)$coefficients[8,1]

beta_coplognondepth <- summary(lm_linear)$coefficients[9,1]

beta_holiday <- summary(lm_linear)$coefficients[10,1]

parvec_1 <- c_lm

parvec_2 <- alpha_0_p_lm

parvec_3 <- alpha_g_regprice

parvec_4 <- threshold_g

parvec_5 <- alpha_l_regprice

parvec_6 <- threshold_g

parvec_7 <- beta_nondepth

parvec_8 <- beta_compprice

parvec_9 <- phi_1_lm

parvec_10 <- phi_2_lm

parvec_11 <- phi_3_lm

parvec_12 <- beta_coplogregprice

parvec_13 <- beta_coplognondepth

parvec_14 <- beta_holiday

parvec_15 <- summary(lm_linear)$sigma

Start_v_LS <- c(parvec_1,parvec_2,parvec_3,parvec_4,parvec_5,parvec_6,parvec_7,parvec_8,parvec_9,parvec_10,parvec_11,parvec_12,parvec_13,parvec_14,parvec_15)

est_nonlinear = optim(Start_v_LS,

fn = LS_nonlinear, # function to maximize

method = "BFGS",

control = list(fnscale = 1), # minimize the function

hessian = T # calculate Hessian matrix because we will need for confidence intervals

)

par_LS.est<-est_nonlinear$par

OI<-solve(est_nonlinear$hessian)

par_LS.se<-sqrt(diag(OI))

Start_v_LS

par_LS.est

par_LS_name <- c("constant", "regprice_elas","regprice_elas_gain","thresholdregprice_gain","regprice_elas_loss","thresholdregprice_loss",

"nondepth_elas","compprice","correction_vol","correction_regprice","correction_nondepth",

"copula_logregprice","copula_lognondepth","holiday","sigma")

par_LS <- data.table(cbind(par_LS_name,par_LS.est,par_LS.se))

return(par_LS)

}

Estimate effect of price-related variables of brand D across formats

df <- fread("../gen/df_bybrand_aggregate.csv")

##For simplicity, we will use simplified version for nonlinear model

##########################################

########## Hypermarket Brand D ###########

##########################################

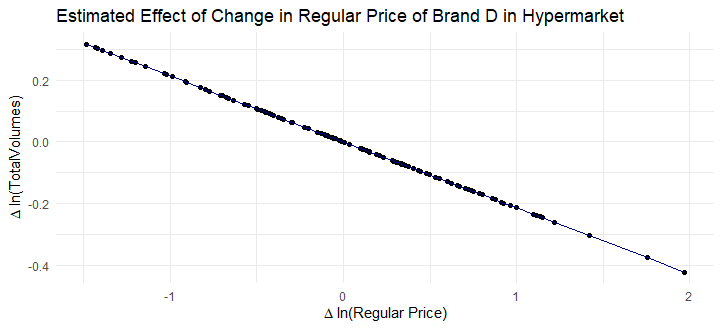

Est_D_hypermarket = aggregate_model3(df[brand == "D" & format == "hypermarket",])

#Plot for Brand D Hypermarket

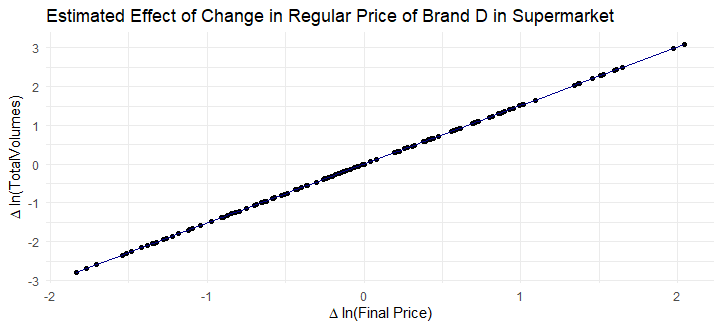

dt_Est_D_hypermarket <- data.table(x = df[brand == "D" & format == "hypermarket",]$dlogavgregprice)

fit_Est_D_hypermarket <- coef(Est_D_hypermarket)["dlogavgregprice"]*dt_Est_D_hypermarket$x

dt_Est_D_hypermarket[,fit := fit_Est_D_hypermarket]

ggplot(dt_Est_D_hypermarket,aes(x = x, y = fit)) +

geom_point() + # Pastel color for points

geom_line(color = "darkblue") + # Pastel color for line

theme_minimal() +

labs(title = "Estimated Effect of Change in Regular Price of Brand D in Hypermarket", x = expression(Delta * " ln(Regular Price)"), y = expression(Delta * " ln(TotalVolumes)"))

##########################################

########## Convenience Brand D ###########

##########################################

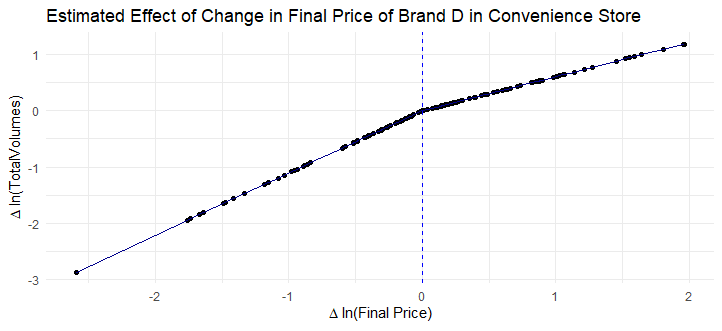

Est_D_convenience = aggregate_model2_sim(df[brand == "D" & format == "convenience",]) #Positive coefficient but its just simulated data

#Plot for Brand D Convenience

dt_Est_D_convenience <- data.table(x_gain = df[brand == "D" & format == "convenience",]$dlogavgfinalprice_gain,x_loss = df[brand == "D" & format == "convenience",]$dlogavgfinalprice_loss, x = df[brand == "D" & format == "convenience",]$dlogavgfinalprice)

fit_Est_D_convenience <- coef(Est_D_convenience)["dlogavgfinalprice_gain"]*dt_Est_D_convenience$x_gain + coef(Est_D_convenience)["dlogavgfinalprice_loss"]*dt_Est_D_convenience$x_loss

dt_Est_D_convenience[,fit := fit_Est_D_convenience]

ggplot(dt_Est_D_convenience,aes(x = x, y = fit)) +

geom_point() + # Pastel color for points

geom_line(color = "darkblue") +

geom_vline(xintercept = 0, linetype = "dashed", color = "blue") + # Pastel color for line

theme_minimal() +

labs(title = "Estimated Effect of Change in Final Price of Brand D in Convenience Store", x = expression(Delta * " ln(Final Price)"), y = expression(Delta * " ln(TotalVolumes)"))

##########################################

########## Supermarket Brand D ###########

##########################################

Est_D_supermarket = aggregate_model1(df[brand == "D" & format == "supermarket",])

#Plot for Brand D Hypermarket

dt_Est_D_supermarket <- data.table(x = df[brand == "D" & format == "supermarket",]$dlogavgfinalprice)

fit_Est_D_supermarket <- coef(Est_D_supermarket)["dlogavgfinalprice"]*dt_Est_D_supermarket$x

dt_Est_D_supermarket[,fit := fit_Est_D_supermarket]

ggplot(dt_Est_D_supermarket,aes(x = x, y = fit)) +

geom_point() + # Pastel color for points

geom_line(color = "darkblue") + # Pastel color for line

theme_minimal() +

labs(title = "Estimated Effect of Change in Regular Price of Brand D in Supermarket", x = expression(Delta * " ln(Final Price)"), y = expression(Delta * " ln(TotalVolumes)"))

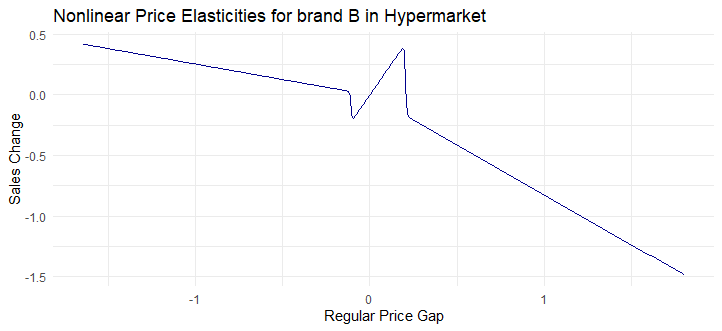

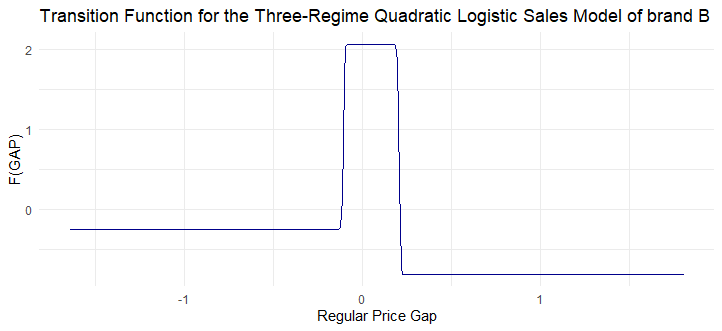

However, with enough data points, one can try to explore the extended version of model (detail is available in the appendix of the slides) adopted from Pauwels et al., 2007 including threshold indicating the point the elasticity change (for example, when price increase too much, we stop buying). Please bear in mind that the nonlinear estimation requires a lot of input regarding initial value of thresholds and change in gain and loss in elasticities.

I tried to impose extended model without. As our data is purely simulated without an attempt to reflects real world, the results do not look very realistic.

Estimate nonlinear model with threshold

Est_modelwiththreshold <- showcase_threshold_mod5(df[brand == "B" & format == "hypermarket",],alpha_g_regprice = 2,alpha_l_regprice = 1,threshold_l = -10,threshold_g = 0,gamma = 300)

# Plot

dt_Est_modelwiththreshold <- data.table(x = seq(min(df[brand == "B" & format == "hypermarket",]$dlogavgregprice), max(df[brand == "B" & format == "hypermarket",]$dlogavgregprice), by = 0.01))

# Extracting values

regprice_elas <- as.numeric(Est_modelwiththreshold[par_LS_name == "regprice_elas", par_LS.est][1])

regprice_elas_gain <- as.numeric(Est_modelwiththreshold[par_LS_name == "regprice_elas_gain", par_LS.est][1])

regprice_elas_loss <- as.numeric(Est_modelwiththreshold[par_LS_name == "regprice_elas_loss", par_LS.est][1])

thresholdregprice_gain <- as.numeric(Est_modelwiththreshold[par_LS_name == "thresholdregprice_gain", par_LS.est][1])

thresholdregprice_loss <- as.numeric(Est_modelwiththreshold[par_LS_name == "thresholdregprice_loss", par_LS.est][1])

gamma = 300

fit_Est_modelwiththreshold <- (regprice_elas

+ regprice_elas_gain * (1 + exp(gamma * (dt_Est_modelwiththreshold$x - thresholdregprice_gain)))^-1

+ regprice_elas_loss * (1 + exp(-gamma * (dt_Est_modelwiththreshold$x - thresholdregprice_loss)))^-1) * dt_Est_modelwiththreshold$x

fit_transition_Est_modelwiththreshold <- (regprice_elas

+ regprice_elas_gain * (1 + exp(gamma * (dt_Est_modelwiththreshold$x - thresholdregprice_gain)))^-1

+ regprice_elas_loss * (1 + exp(-gamma * (dt_Est_modelwiththreshold$x - thresholdregprice_loss)))^-1)

dt_Est_modelwiththreshold[, `:=`(Nonlinearealasticity = fit_Est_modelwiththreshold,

Transitionfunction = fit_transition_Est_modelwiththreshold)]

ggplot(dt_Est_modelwiththreshold, aes(x = x, y = fit_Est_modelwiththreshold)) +

geom_line(color = "darkblue") +

theme_minimal() +

labs(title = "Nonlinear Price Elasticities for brand B in Hypermarket",

x = "Regular Price Gap",

y = "Sales Change")

ggplot(dt_Est_modelwiththreshold, aes(x = x, y = fit_transition_Est_modelwiththreshold)) +

geom_line(color = "darkblue") +

theme_minimal() +

labs(title = "Transition Function for the Three-Regime Quadratic Logistic Sales Model of brand B",

x = "Regular Price Gap",

y = "F(GAP)")Estimate Utility Choice Model

# LOAD DATA

df_choice <- fread("../gen/df_choice.csv")

df_choice[, bought := as.logical(choice)]

df_choice <- as.data.frame(df_choice) # Convert to dataframe to fit with mlogit

df <- mlogit.data(df_choice, choice = "bought", shape = "long", chid.var = "chid", id = "cust", alt.var = "brand_alt")

# ESTIMATE

#Random parameters are purely assumed for this simulated data

# Choice model where there is asymmetry of final price (gain VS loss) in convenience store

m_utilitychoice <- mlogit(bought ~ hyperregprice + hyperdiscount

+ convefinalpricegain + convefinalpriceloss + convefinalprice

+ superfinalprice + Nonfocal_intercept + loyal_nonfocal |-1, data = df, panel = TRUE, rpar = c(Nonfocal_intercept = "n",loyal_nonfocal = "n"), correlation = FALSE, R = 100, Halton = NA)

summary(m_utilitychoice)| Dependent variable: Bought | |

|---|---|

| RegPrice - Hypermarket | 0.003 (0.004) |

| Discount - Hypermarket | -0.004 (0.006) |

| Final Price Gain - Convenience | -0.018*** (0.005) |

| Final Price Loss - Convenience | -0.008* (0.005) |

| Final Price - Convenience | 0.003 (0.004) |

| Final Price - Supermarket | 0.005 (0.004) |

| Nonfocal_intercept | 0.969*** (0.058) |

| Loyal_nonfocal | 0.382*** (0.058) |

| sd.Nonfocal_intercept | 0.008 (0.416) |

| sd.loyal_nonfocal | 0.027 (0.460) |

| ---------------------- | ----------------------- |

| Observations | 3,241 |

| Log Likelihood | -1,697.858 |

| ---------------------- | ----------------------- |

| Note: | *p<0.1; **p<0.05; ***p<0.01 |

- Based on our simulated data, customers generally prefer nonfocal brand and they tend to be responsive for final price change in convenience store