The CAPM Financial Analysis project is a Python-based implementation of the Capital Asset Pricing Model (CAPM). This model is widely used in finance to estimate the expected return on an investment by taking into account the risk-free rate, the market risk premium, and the asset's beta. The project provides functionalities to calculate the expected returns for a given set of securities based on the CAPM formula.

The application uses libraries such as Pandas, NumPy, Streamlit and Plotly, to gather stock data from Yahoo Finance and perform calculations to determine expected returns.

To run the CAPM Financial Analysis application, install the required Python dependencies. You can use pip to install them:

pip install -r requirements.txtRun the application using the following command. This will start a local development server and open the CAPM Financial Analysis application in your browser.

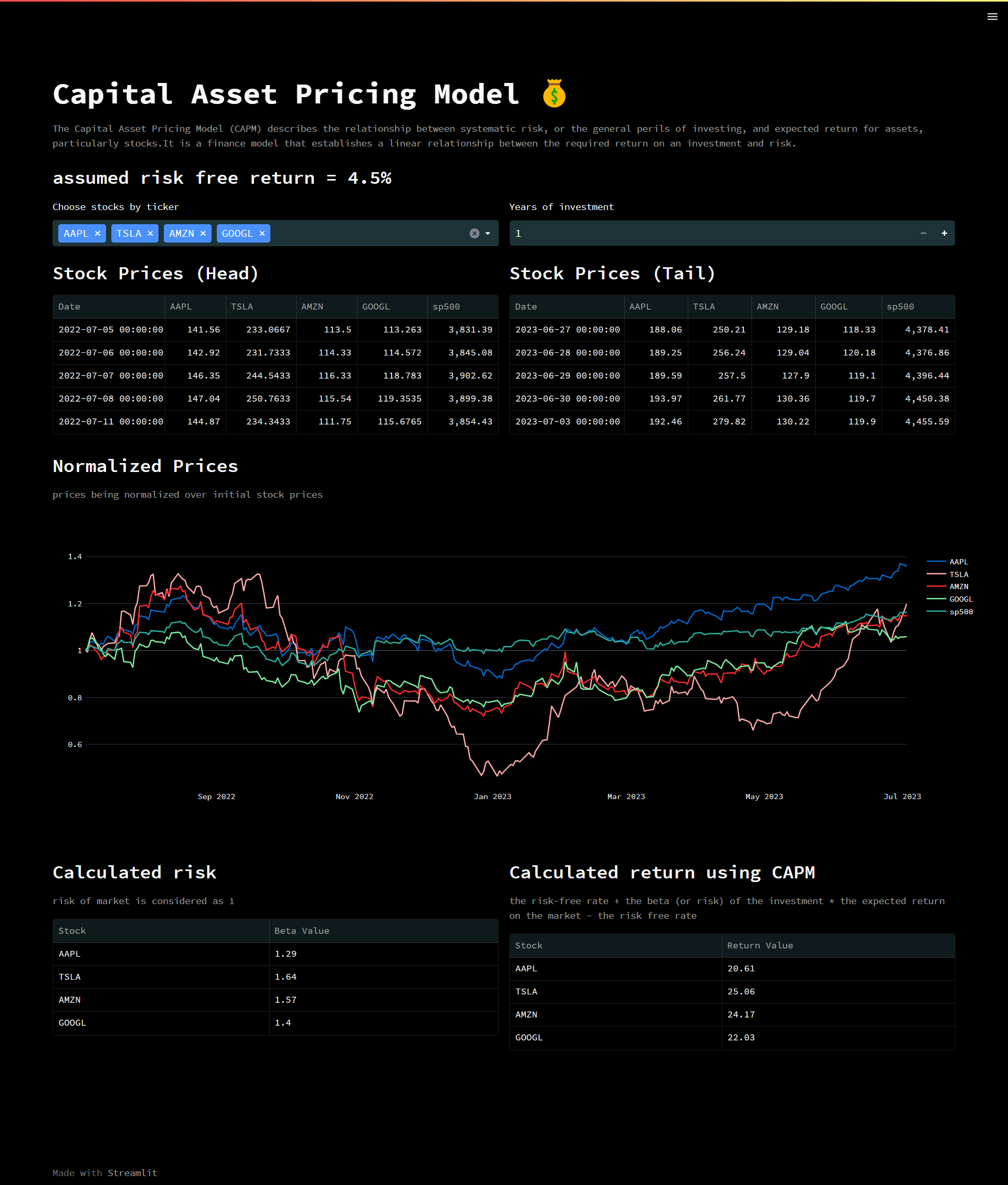

streamlit run Return_CAPM.pyThe CAPM Financial Analysis application allows you to select a list of stocks and specify the number of years for investment. It then calculates the expected returns for each stock based on the CAPM formula and displays the results. Follow these steps:

- Choose stocks by ticker:

- Use the multi-select input to choose one or more stocks by their tickers.

- Available stock tickers are provided in the dropdown menu.

- Specify the number of years of investment:

- Use the number input to enter the number of years you plan to invest.

- View the results:

- The application retrieves historical stock price data for the selected stocks and the S&P 500 index.

- It normalizes the stock prices based on the initial prices and displays the normalized prices in an interactive plot.

- It calculates the beta values and alpha values for each stock based on the daily returns.

- The calculated beta values and alpha values are displayed in a table.

- The application calculates the expected returns using the CAPM formula and displays them in a table.

- Interpret the results:

- The normalized prices plot helps visualize the performance of selected stocks relative to the initial prices.

- The calculated beta values indicate the riskiness of each stock relative to the market (S&P 500).

- The expected returns table shows the estimated returns for each stock based on the CAPM formula.

- The application assumes a risk-free return of 4.25%.

- The S&P 500 index is used as a benchmark for the market return.

- The application retrieves historical stock price data using the Yahoo Finance API (via the

yfinancelibrary) and the S&P 500 data from the FRED database (via thepandas_datareaderlibrary). - The

CAPM_charts,price_normalize, andreturnsmodules contain helper functions used by the main application.

The CAPM Financial Analysis application provides an interactive interface for calculating expected returns based on CAPM. By selecting stocks and specifying the investment period, users can estimate the returns and analyze the riskiness of their investment choices.

Pull requests are welcome. For major changes, please open an issue first to discuss what you would like to change.