http://www.amazon.com/gp/product/0470181990/tag=quantfinancea-20

The original version incorporated network data acquisition from Yahoo!Finance

from pandas_datareader. Yahoo! changed their API and broke pandas_datareader.

The changes allow you to specify your own data so you're not tied into equity

data from Yahoo! finance. If you're still using equity data, just download

a CSV from finance.yahoo.com and use the data.yahoo_data_helper method

to form the data properly.

- Garman Klass

- Hodges Tompkins

- Parkinson

- Rogers Satchell

- Yang Zhang

- Standard Deviation

Also includes

- Skew

- Kurtosis

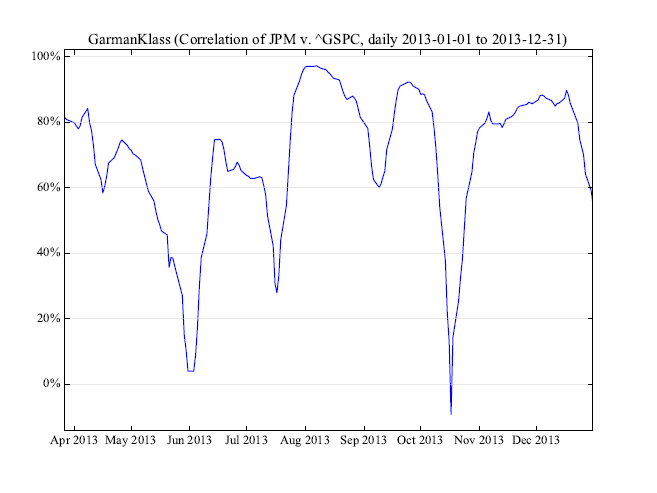

- Correlation

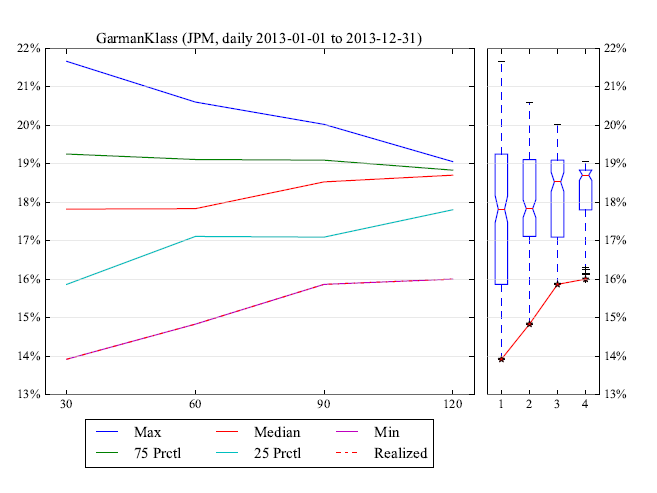

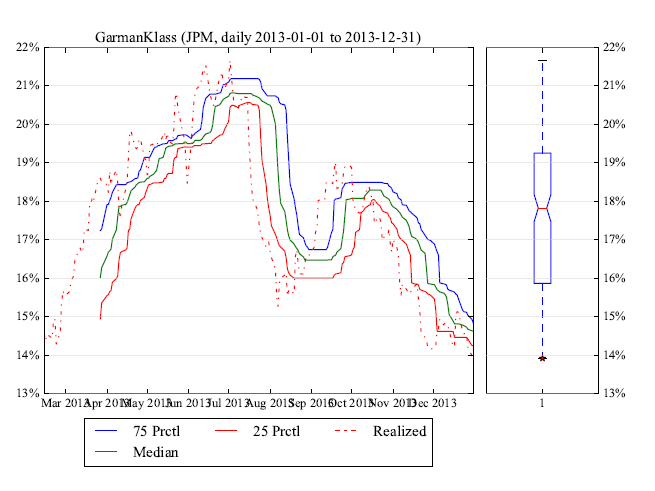

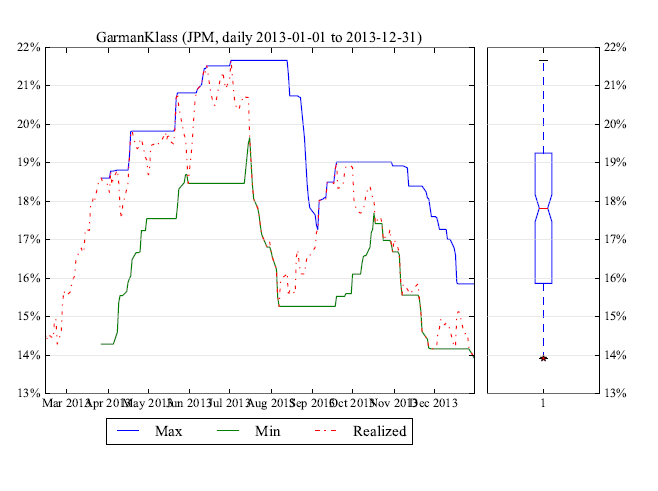

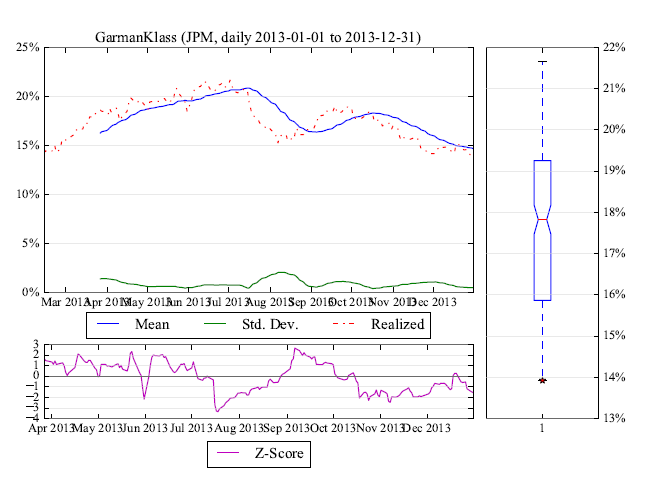

For each of the estimators, plot:

- Probability cones

- Rolling quantiles

- Rolling extremes

- Rolling descriptive statistics

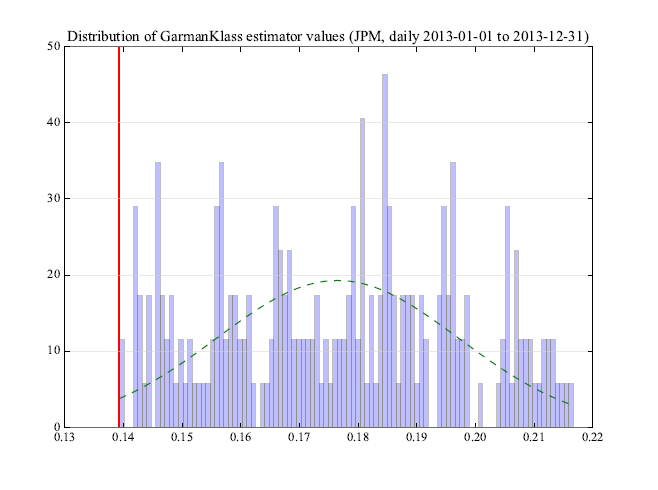

- Histogram

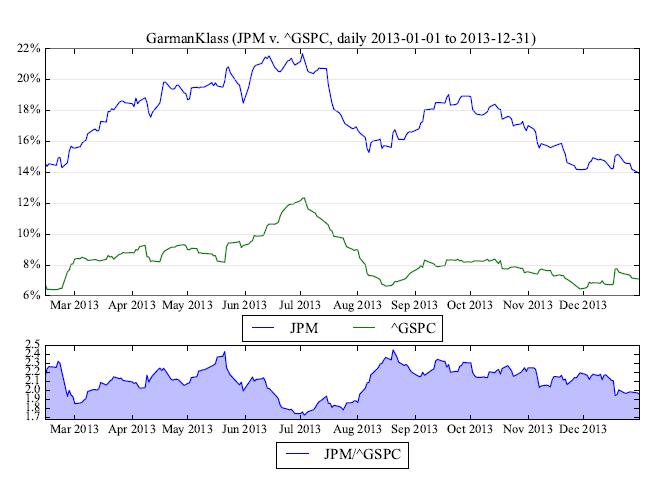

- Comparison against arbirary comparable

- Correlation against arbirary comparable

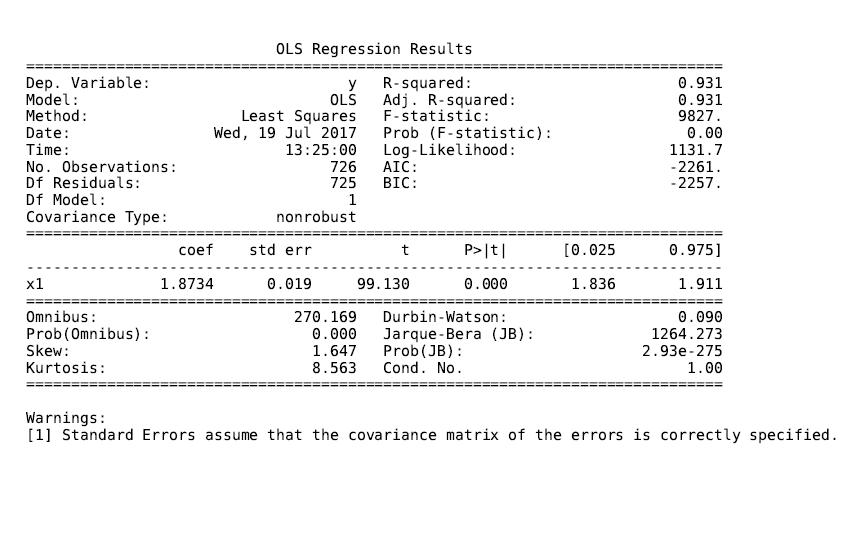

- Regression against arbirary comparable

Create a term sheet with all the metrics printed to a PDF.

Example usage:

from volatility import volest

import yfinance as yf

# data

symbol = 'JPM'

bench = 'SPY'

estimator = 'GarmanKlass'

# estimator windows

window = 30

windows = [30, 60, 90, 120]

quantiles = [0.25, 0.75]

bins = 100

normed = True

# use the yahoo helper to correctly format data from finance.yahoo.com

jpm_price_data = yf.Ticker(symbol).history(period="5y")

jpm_price_data.symbol = symbol

spx_price_data = yf.Ticker(bench).history(period="5y")

spx_price_data.symbol = bench

# initialize class

vol = volest.VolatilityEstimator(

price_data=jpm_price_data,

estimator=estimator,

bench_data=spx_price_data

)

# call plt.show() on any of the below...

_, plt = vol.cones(windows=windows, quantiles=quantiles)

_, plt = vol.rolling_quantiles(window=window, quantiles=quantiles)

_, plt = vol.rolling_extremes(window=window)

_, plt = vol.rolling_descriptives(window=window)

_, plt = vol.histogram(window=window, bins=bins, normed=normed)

_, plt = vol.benchmark_compare(window=window)

_, plt = vol.benchmark_correlation(window=window)

# ... or create a pdf term sheet with all metrics in term-sheets/

vol.term_sheet(

window,

windows,

quantiles,

bins,

normed

)Hit me on twitter with comments, questions, issues @jasonstrimpel