A command-line tool to find the optimal portfolio composition employing Markowitz Efficient Frontier Theory

- Python version 3.6 or greater is required.

- Install the requirements using

$ pip3 install -r requirements.txt❯ python3 efficientFrontier.py --help

usage: efficientFrontier.py [-h] [--stocks [STOCKS [STOCKS ...]]] [--num NUM] [--rfr RFR] [--years YEARS]

optional arguments:

-h, --help show this help message and exit

--stocks [STOCKS [STOCKS ...]]

The stocks to include in portfolio

--num NUM The number of portfolios to be simulated

--rfr RFR The risk free rate of return

--years YEARS The number of years

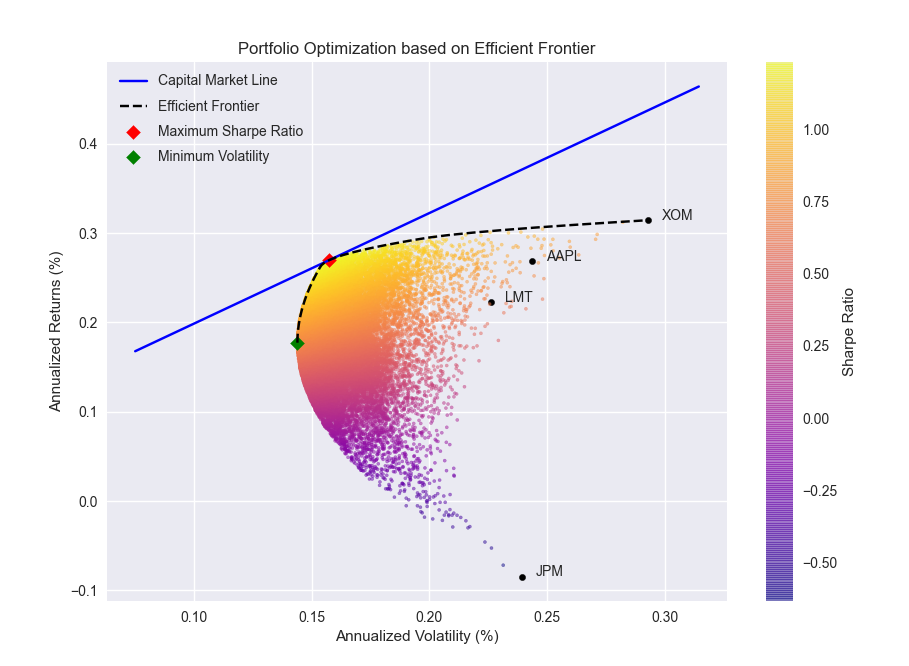

❯ python3 efficientFrontier.py --stocks AAPL JPM XOM LMT

Stocks: ['AAPL', 'JPM', 'XOM', 'LMT']

Risk Free Rate: 0.075

--------------------------------------------------------------------------------

Maximum Sharpe Ratio Portfolio Allocation

Annualised Return: 0.27

Annualised Volatility: 0.16

Symbols AAPL JPM XOM LMT

Allocation 39.88 0.0 31.14 28.99

--------------------------------------------------------------------------------

Minimum Volatility Portfolio Allocation

Annualised Return: 0.18

Annualised Volatility: 0.14

Symbols AAPL JPM XOM LMT

Allocation 27.17 22.86 13.34 36.64

Individual Stock Returns and Volatility

AAPL : Annualized Return = 26.86 , Annualized Volatility = 24.38

JPM : Annualized Return = -8.43 , Annualized Volatility = 23.94

XOM : Annualized Return = 31.45 , Annualized Volatility = 29.31

LMT : Annualized Return = 22.29 , Annualized Volatility = 22.62

--------------------------------------------------------------------------------