Table of Contents

- Introduction

- Should You Read This?

- About This Guide

- Basic Equity Concepts

- Equity Compensation Details

- Tax Basics

- Taxes on Stock and Options

- Taxes on RSUs

- Stages of a Startup

- Evaluating Equity Compensation

- Negotiations and Offers

- Common Scenarios

- Documents and Agreements

- Compensation Gotchas

- Tax Gotchas

- Further Reading

- Disclaimer

- License

If you’ve ever worked or considered working in a startup or fast-growing tech company, you probably have experienced or tried to learn about stock options, RSUs, and other elements of equity compensation.

It’s a confusing topic that’s often not discussed clearly, but this is unfortunate, as it hurts people’s ability to make good decisions. Many people learn the basic ideas through experience or reading, but equity compensation is a complicated and difficult area usually only thoroughly understood by professionals. Sadly, costly and avoidable mistakes are routine, and this hurts both companies and employees.

This guide aims to improve that situation. It does not presume you have a law degree or MBA. The material is dense, but we have tried to present it in a way that both lawyers and non-lawyers can understand.

Think of the guide as a small book, not a blog. We suggest you star and refer to it in the future. An hour or two reading the material here and the linked resources could ultimately be among the most financially valuable ways you could spend that time.

This document and the discussion around it are not legal or tax advice. Talk to a professional if you need advice about your particular situation. See the full disclaimer below.

If you’re thinking of working for a company that is offering you equity, it’s critical to understand both the basic ideas and some very technical details of what form of compensation it is, and how it affects your taxes. Equity compensation and taxation might seem like different topics, but they are so intertwined it’s hard to explain one without the other. Moreover, an understanding of the underlying rules is for negotiating fair offers — on both sides.

Of course, this guide can’t replace professional advice. But following the advice of a company lawyer, your lawyer, or your tax advisor can be easier if you understand these topics better. Unfortunately, there’s just no way you can “just trust,” sign lots of papers, and expect it’ll work out. Ask almost anyone who’s worked at startups and they’ll have stories of how they or their friends or colleagues made costly mistakes because they did not understand the details.

- This guide applies to companies in the United States.

- It is geared toward employees, advisors, and independent contractors who want to know how stock and stock options in startups work, either before or after they begin working with a startup.

- It may also be useful for founders or hiring managers, who need to talk about equity compensation with employees or potential hires, or anyone curious to learn about these topics.

- The aim is to be as helpful for the absolute beginner as it is for those with more experience.

- We keep this brief, so you can skim and return to it easily.

- Sections are organized into individual points, so it’s easier to read, refer back to, contribute to, and correct.

- We link liberally, so we can define terms, include curated articles that have a lot more detail, and give credit where it is due.

This is an open guide. It’s open to contributions, so unlike a blog, it is living, and can be improved. While a lot of information on this topic is just a Google search away, it is scattered about. Many blogs and articles focus only on a narrow topic, are getting older, or are on sites supported by ads or other products. It should be possible to assemble this information sensibly, for free. This document was started by Joshua Levy and Joe Wallin. It’s a preliminary version, and no doubt has some errors and shortcomings, but we want to see it evolve.

Please join us in making this guide better. We are publishing this on GitHub, like an open source project. This way, we pool information, while also discussing and reviewing to ensure high quality. We gladly credit all contributors.

Please use issues to discuss topics, ask questions, identify issues, or suggest improvements. Don’t be shy about creating issues — they are the only way to discuss things here. Also take a look at the page on contributing.

This section covers the fundamental concepts and terminology around stock, stock options, and equity compensation.

- Your compensation is everything you get for working for a company.

- When you negotiate compensation with a company, the elements to think about are cash (salary and bonus), benefits (health insurance, retirement, other perks), and equity (what we discuss here).

- Equity compensation refers to owning or having rights to buy a portion of the company.

- Equity compensation is commonly used for founders, executives, employees, contractors, advisors, directors, and others.

- The purpose of equity compensation is twofold:

- To attract the best talent; and

- To align incentives between individuals and the interests of the company.

- Equity compensation generally consists of stock or stock options or restricted stock units (RSUs) in the company. We’ll define these concepts next.

- Stock represents ownership of the company, and is measured in shares. Founders, investors, employees, board members, and others like contractors or advisors may all have stock.

- Stock in private companies frequently cannot be sold and may need to be held indefinitely, or at least until the company is sold. In public companies, people can buy and sell stock on exchanges, but in private companies like startups, usually you can’t buy and sell stock easily.

- Public and some private companies can pay dividends to shareholders, but this is not common among technology startups.

- The total number of outstanding shares reflects how many shares are currently held by all shareholders. This number starts at an essentially arbitrary value (such as 10 million) and thereafter will increase as new shares are issued. It may increase or decrease for other reasons, too, such as stock splits and share buy back.

- If you have stock, what ultimately determines its value is percentage ownership of the entire company, not the absolute number of shares. To determine the percentage of the company a certain number of shares represent, divide it by the number of outstanding shares.

- However, there are subtleties to be aware of regarding what this outstanding total refers to:

- Private companies always have what is referred to as “authorized but unissued” shares. For example, a corporation might have 100 million authorized shares, but will only have actually issued 10 million shares. In this example, the corporation would have 90 million authorized but unissued shares. When you are trying to determine what percentage a number of shares represents, you do not make reference to the authorized but unissued shares.

- You actually want to know the total issued, but even this number can be confusing, as it can be computed more than one way. Typically, people refer to the total number of shares “issued and outstanding” or “fully diluted.”

- “Issued and outstanding” refers to the number of shares actually issued by the company to shareholders. Note this will not include shares that others may have an option to purchase.

- “Fully diluted” refers to all of the shares that have been issued, all of the shares that have been set aside in a stock incentive plan, and all of the shares that could be issued if all convertible securities (such as outstanding warrants) were exercised. A key difference is that this total will include all the shares in the employee option pool that are reserved but not yet issued to employees. (The option pool is discussed more below.)

- Generally, it’s best to know the fully diluted number to know the likely percentage a number of shares is worth in the future. The terminology mentioned here isn’t universally applied, either, so it’s worth discussing it to be sure there is no miscommunication.

- It is hard to value private company stock. A stock certificate is a piece of paper that entitles you to something of highly uncertain value, and could well be worthless in the future, or highly valuable, depending on the fate of the company.

- Generally, selling stock in a private company may be difficult, as the company is not listed on exchanges, and in any case, there may be restrictions on the stock imposed by the company. In startups, it is typical to hold the stock until the company is sold or becomes public in an IPO. A sale or IPO is often called an exit. Sales, dissolutions, and bankruptcy are sometimes called liquidations.

- In a few cases, you may be able to sell private company stock to another private party, such as an accredited investor who wants to become an investor in the company, but this is fairly rare. This is often called the secondary market. Sales generally require the agreement and cooperation of the company. For example, typically your shares would be subject to a right of first refusal in favor of the company (meaning, you couldn’t sell your shares to a third party without offering to sell it to the company first). Another possible roadblock is that private buyers may want internal company financials to establish the value of the stock, and this typically requires the cooperation of the company. There have been some efforts such as SharesPost, SecondMarket, and EquityZen to establish a market around such sales, particularly for well-known pre-IPO companies, but it’s still not a routine practice. Quora has more discussion on this topic.

- Stock comes in two main types, common stock and preferred stock. You’ll also hear the term founders’ stock, which is (usually) common stock allocated at a company’s formation. It’s complicated, but in general preferred stock is stock that has rights, preferences, and privileges that common stock does not have. For example, preferred stock usually has a liquidation preference, which specifies how owners of preferred stock will see proceeds of a sale before owners of common stock do.

- Liquidation overhang refers to how much liquidation preference is ahead of the common stock. For example, if the company has received hundreds of millions of dollars in investments from investors, the common stock will not be worth anything on a sale unless the sale price exceeds the liquidation overhang.

- Generally employees and service providers receive common stock or options to purchase common stock in return for their service, and investors receive preferred stock.

- Stock options (more specifically called “employee stock options” when they are given to employees) are contracts that allow you to buy shares, which is called exercising the options. They are not the same as stock, since they’re just the right to buy stock.

- Stock options allow you to buy shares at a fixed price per share, the strike price. The strike price is generally set lower (often much lower) than what people expect will be the future value of the stock, which means you can make money when you sell the stock.

- Options expire. You need to know how long the exercise window will be open.

- Options are only exercisable for a fixed period of time, typically seven to ten years as long as you are working for the company.

- Importantly, they also expire when you quit working for the company (e.g., 90 days after termination of service) — so can effectively be worthless if you cannot exercise them before you leave.

- Recently (in 2015) a few companies (such as Amplitude, Clef, Coinbase, Pinterest, and Quora) are now finding ways to keep the exercise window open for years after leaving a company, and promote this as fairer to employees.

- Stock and stock options may be granted to you, but there are lots of conditions attached. Often these conditions might be the amount of time you’ve worked for a company, or if certain things happen to the company, like the company is sold. This is called vesting.

- Vesting usually occurs according to a vesting schedule, which applies only while you work for the company. For example, it is very common to have stock or options vest over a period of four years, a bit at a time, where none of it is vested at first, and all of it is vested after four years.

- Vesting schedules can also have a cliff, where until you work for a given amount of time, you are 0% vested. For example, if your equity award had a one-year cliff and you only worked for the company for 11 months, you would not get anything, since you not have vested in any part of your award. Similarly, if the company is sold within a year, depending on what your paperwork says, you may also receive nothing on the sale of the company.

- A very common vesting schedule is vesting over 4 years, with a 1 year cliff. This means you get 0% vesting for the first 12 months, 25% vesting at the 12th month, and 1/48th (2.08%) more vesting each month until the 48th month. For example, if you leave just before a year is up, you get nothing, but if you leave after 3 years, you get 75%.

- Vesting might also occur in certain situations. You may have acceleration, where vesting is triggered if a company is sold (single trigger) or if it’s sold and you’re fired (double trigger). This is common for founders and not so common for employees.

- Restricted stock units (RSUs) are a different type of compensation often preferred by large companies or companies that have very high valuations (e.g. Apple or Facebook pre-IPO). RSUs are an agreement by the company to grant shares of stock to the employee according to the vesting schedule. Each unit represents one share of stock that you will be given when the units vest.

Now for the details around using stock and options for compensation.

- Companies can give equity compensation as stock awards, stock options, or RSUs. While the intent of each is similar, they differ in many ways, particularly around taxation. RSUs generally don’t make sense for early stage companies.

- If companies do grant stock, it may be restricted stock. In this context, “restricted” refers to the fact that the stock will be subject to repurchase at the lower of fair market value or cost, which repurchase right lapses over the service-based vesting period.

- Typically, stock awards are limited to executives or very early hires, since once the value of the shares increases, the tax burden of receiving them can be too great for most people. Instead, it’s more common for employees to get stock options.

- At some point early on, generally before the first employees are hired, stock will be allocated to a stock option pool. A typical size for this is 20% of the stock of the company, but it can be 10%, 15%, or other sizes. Once the pool is established, then the company's board of directors grants pieces of it to employees as they join the company. Often, the whole pool is never used. The size of the pool is not just about how generous the company is with employees; it is determined by complex factors between founders and investors.

- Compensatory stock options come in two flavors:

- Incentive stock options (ISOs) (also called statutory stock options)

- Nonstatuatory stock options (NSOs) (also called nonqualifying stock options, or NQOs)

- ISOs are common for employees because they have the possibility of being more favorable from a tax point of view than NSOs. They can only be granted to employees (not independent contractors or directors who are not also employees). But ISOs have a number of limitations and conditions and can also create difficult tax consequences. More on this below.

- Sometimes, to help you lower your tax burden, the company makes it possible to early exercise (or forward exercise) stock options. This means you exercise them even before they vest: you exercise them and you become a stockholder, but the company has the right to repurchase the unvested shares (at the lower of the price you paid or the fair market value of the shares) if you quit working for the company. The company will typically repurchase the unvested shares should you leave the company before the stock you’ve purchased vests.

- Stock options will expire after you leave a company (typically after 90 days). You might early exercise, or exercise at different times during your employment, depending on how much it costs and what the tax implications are. More on this below.

- Companies may impose additional restrictions on stock that is vested. They likely have a right of first refusal if you do wish to sell stock. And it can happen that companies will reserve the right to repurchase vested shares in certain events.

Equity compensation awards can give rise to federal and state income taxes as well as employment taxes and Medicare surtax charges. We’ll first back up and discuss fundamentals of how different kinds of taxes are calculated.

- You must pay federal, state, and in some cases local taxes on income.

- State tax rates and rules vary significantly state to state. Since federal rates are much higher than state rates, you usually think of federal tax planning first.

- In general, federal tax applies to many kinds of income. If you’re an employee at a startup, you need to consider four kinds of federal tax, each of which is computed differently:

- Ordinary income tax — the tax on your wages or salary income, as well as investment income that is “short-term”

- Other employment tax — Social Security and Medicare taxes that are withheld from your paycheck

- Long-term capital gains tax — taxes on investment gains that are “long-term” are taxed at a lower rate than ordinary income

- Alternative Minimum Tax (AMT) — an entirely different kind of tax that has separate rules and only applies in some situations

- Ordinary income tax applies in the situations you’re probably already familiar with, where you pay taxes on salaries or wages. Tax rates are based on filing status, i.e., if you are single, married, or support a family, and on how much you make, i.e. which income bracket you fall under.

- As of 2015, there are income brackets at 10%, 15%, 25%, 28%, 33%, 35%, and 39.6% marginal tax rates. Be sure you understand how these brackets work, and what bracket you’re likely to be in. There is sometimes a misconception that if you move to a higher bracket, you’ll make less money. What actually happens is when you cross certain thresholds, each additional (marginal) dollar money you make is taxed at a higher rate, equal to the bracket you’re in. It looks roughly like this (source).

- Investment gains, such as buying and selling a stock, are similarly taxed at “ordinary” rates, unless they are long-term, which means you held the asset for more than a year.

- You also pay a number of other federal taxes (see a 2015 summary for all states), notably:

- 6.2% for Social Security on your first $118,500

- 1.45% for Medicare

- 0.9% Additional Medicare Tax on income over $200,000 (single) or $250,000 (married filing jointly)

- 3.8% Net Investment Income Tax on investment income if you make over $200,000 (single) or $250,000 (married filing jointly)

- Ordinary federal income tax, Social Security, and Medicare taxes are withheld from your paycheck by your employer and are called employment taxes.

- Long-term capital gains are taxed at a lower rate than ordinary income tax: 0%, 15%, or 20%. This covers cases where you get dividends or sell stock after holding it a year. If you are in the middle brackets (more than about $37K and less than $413K of ordinary income), your long-term capital gains rate is 15% (more details).

- State long-term capital gains rates vary widely. California has the highest, at 13.3%, while other states have none. For this reason, some people even consider moving to another state if they are likely to have a windfall gain, like selling a lot of stock after an IPO.

- Alternative Minimum Tax (AMT) is a complex part of the federal tax code many taxpayers never worry about. Generally, you do not pay unless you have high income (>$250K) or high deductions. It also depends on the state you’re in, since your state taxes can significantly affect your deductions. Confusingly, if you are affected, AMT tax rates are usually at 26% or 28% marginal tax rate, but effectively is 35% for some ranges, meaning it is higher than ordinary income tax for some incomes and lower for others. AMT rules are so complicated you often need professional tax help if they might apply to you. The IRS’s AMT Assistant might also help.

- AMT is relevant here because exercising incentive stock options can trigger AMT. In some cases a lot of AMT, even when you haven’t sold the stock and have no money to pay. More on this below.

- Section 1202 of the Internal Revenue Code provides a special tax break for qualified small business stock held for more than five years. Currently, this tax break if a 100% exclusion from income for up to $10M in gain. There are also special rules that enable you to rollover gain on qualified small business stock you have held for less than five years. Stock received on the exercise of options can qualify for the Section 1202 stock benefit.

Now we’ve covered the basic concepts of equity and taxes, here are some messy details of how they interact.

As already discussed, employees can get restricted stock, stock options, or RSUs. The tax consequences for each of these is dramatically different.

- Generally, restricted stock is taxed at the time it is vested as ordinary income. So you are taxed on the value of the stock at the time it vests, at full tax rate. Of course, if the stock is in a startup with low value, this may not be very much. But if it’s years later than when the stock was first granted, and the company is worth a lot, the tax could be very high, and it won’t be at low long-term capital gains rates.

- However, the IRS offers an alternative, called a Section 83(b) election, that can change your tax liabilities so you pay for the taxes at the time it is granted. You’re telling the IRS you want to pay taxes early, on stock that is not vested yet, instead of paying as it vests. However, you must file this election yourself with the IRS within 30 days of the grant or exercise, or the opportunity is irrevocably lost.

- If you receive an immediately exercisable stock option (meaning, an option that is early exercisable, when it is not vested), you can then make an 83(b) election on your receipt of the shares on exercise, because they are subject to vesting.

- Section 83(b) elections cannot be made on the receipt of a stock option. They can only be made on the receipt of actual shares of stock.

- Section 83(b) elections only apply to stock that is not yet vested. It does not make sense for shares you receive that are fully vested. Thus, if you receive options that are not early exercisable, you cannot exercise the option until it is vested — and an 83(b) election would not apply.

- Founders and early employees almost always want to do an 83(b) election, since the stock value is tiny, so they are opting to pay a small amount of tax up front, and then have the probability of paying much lower long-term capital gains tax rates on their real value more than a year later.

- When stock vests, or you exercise an option, the IRS will consider what the fair market value (FMV) of the stock is when determining the tax you owe.

- Of course, if no one is buying and selling stock, as is the case in most startups, then its value isn’t obvious. For the IRS to evaluate how much stock is worth, it uses what is known as the 409A valuation of the company.

- The startup pays for an appraisal that sets the 409A, typically annually or after events like fundraising. In practice, this number could be low or high. A company wants the 409A to be low, so that employees make more off options, but not low enough the IRS won’t consider it reasonable. Typically, the 409A is much less than what investors pay for preferred stock; for example, it might be only a third of the preferred stock price.

- Startups generally decide to give ISOs or NSOs depending on the legal advice they get. It’s rarely up to you which you get, so you need to know about both. There are pros and cons of each from both the recipient’s and the company’s perspective. ISOs cannot be granted to non-employees (i.e., independent contractors).

- When you get stock options and are considering if and when to exercise them, you need to think about the taxes. In principle, you need to think about taxes (1) at time of grant; (2) at time of exercise; and (3) at time of sale.

- These events trigger ordinary tax (high), long-term capital gains (low), or AMT (possibly high) taxes in different ways for NSOs and ISOs. The taxes will depend on the gain (sometimes called spread) between the strike price and the FMV, known as the bargain element, and the gain on the sale. This isn’t the whole story, but from an employee’s point of view, the key differences are (see here, here, here, and here):

- Restricted stock awards: Assuming vesting, you pay full taxes early with the 83(b) or at vesting:

- At grant:

- If 83(b) election filed, ordinary tax on FMV

- None otherwise

- At vesting:

- None if 83(b) election filed

- Ordinary tax on FMV of vested portion otherwise

- At sale:

- Long-term capital gains tax on gain if held for 1 year past exercise

- Ordinary tax otherwise (including immediate sale)

- At grant:

- NSOs: You pay full taxes at exercise, and the sale is like any investment gain:

- At grant and vesting:

- No tax if granted at FMV

- At exercise:

- Ordinary tax on the bargain element

- Income and employment tax withholding on paycheck

- At sale:

- Long-term capital gains tax on gain if held for 1 year past exercise

- Ordinary tax otherwise (including immediate sale)

- At grant and vesting:

- ISOs: You might pay less tax at exercise, but it’s complicated:

- At grant and vesting:

- No tax if granted at FMV

- At exercise:

- AMT tax event on the bargain element; no ordinary or capital gains tax

- No income or employment tax withholding on paycheck

- At sale:

- Long-term capital gains if held for 1 year past exercise and 2 years past grant date

- Ordinary tax otherwise (including immediate sale)

- At grant and vesting:

- Restricted stock awards: Assuming vesting, you pay full taxes early with the 83(b) or at vesting:

- The AMT trap: If you have received an ISO, if you exercise it may unexpectedly trigger a big AMT bill — even before you actually make any money on a sale! To make matters worse, you probably can’t sell the stock to pay the tax bill. This infamous problem (more details) has trapped many employees and bankrupted people during past dot-com busts. Now more people know about it, but it’s still a significant obstacle to plan around. (Note that if your AMT is for events prior to 2008, you’re off the hook.)

- If you are granted ISOs or NSOs at a low strike price, and the bargain element is zero, and might be cheap to exercise and won't trigger taxes. So assuming the company allows it, it makes sense to early exercise immediately (buying most or all of the shares, even though they’re not vested yet) and simultaneously file an 83(b) election.

- Section 83(b) elections are elections to be taxed on the receipt of property even though you might have to forfeit or give back the property to the company. You can make an election on the receipt of stock, but you cannot make the election on the receipt of an option or an RSU because options and RSUs are not considered property for purposes of Section 83(b).

- ISOs are often preferred by startups as it’s supposed to be better for an employee from a tax perspective. This assumes that (1) AMT won’t be triggered and (2) you’ll get low long-term capital gains rate by holding the stock for the appropriate holding periods. However, often you either run afoul of the AMT trap, or don’t hold the stock long enough with the complicated 1 year + 2 year requirement, or the spread at exercise is zero or small, so the difference wouldn’t matter anyway. NSOs do have a slightly higher tax because of the employment taxes. Overall, it’s not clear the ISO is that much better for employees, so many people argue for NSOs instead.

- Even more confusingly, ISOs can make it harder to meet the long-term capital gains holding period. Many people expect early exercise together with an 83(b) election will help them hold the stock longer, to qualify for long-term capital gains. While this is true for NSOs, there is a murky part of the rules on ISOs that implies that even with an 83(b) election, the capital gain holding period does not begin until the shares actually vest. So, if you want to immediately exercise an option and file an Section 83(b) election, and you might have liquidity soon, it’s better if you can have it be an NSO.

- If you are awarded RSUs, each unit represents one share of stock that you will be given when the units vest.

- When you receive your shares you are taxed on their value at that time. If you are an employee, this means you have to write a check to the company to cover your income and employment tax withholding.

- If you receive an RSU when the stock is of little value, you cannot elect to be taxed on the value of that stock when you receive the RSU — you pay taxes at vesting time, based on the shares’ value at that time.

- There is a combination of big problems for RSUs in private companies:

- You will owe tax when you receive the shares — even though they are illiquid.

- You can't minimize the impact of an increase in value of the underlying shares between the date you receive the RSU and the date it is settled.

- If you are an employee you will have to write a check to the company to satisfy your income and employment tax withholding.

- RSUs are less attractive than options from a tax point of view because you cannot make an 83(b) election with respect to an RSU. In contrast, if you receive a stock option, as long as it is priced at fair market value, you will have no income upon receipt of the options, and your income tax and employment tax consequences will be deferred until you exercise — an event under your control for the most part.

- Taxation summary (compare with above):

- At grant: No tax

- At vesting/delivery: Ordinary tax on current share value

- At sale:

- Long-term capital gains tax on gain if held for 1 year past exercise

- Ordinary tax otherwise (including immediate sale)

This section is a quick refresher on how companies raise funding and grow, as this is critical to understanding the value of a company and what equity in a company is worth.

- The stage of a startup is largely reflected in how much funding it has raised. Very roughly, typical levels are:

- Bootstrapped: No funding — founders are figuring out what to build or starting to build with their own time or resources.

- Series Seed ($250K to $2 million): Figure out the product and market.

- Series A ($2 to 15 million): Scaling product and making the business model work.

- Series B (tens of millions): Scaling business.

- Series C, D, E, etc. (tens to hundreds of millions): Continued scaling of business.

- Most startups don’t get far. Very roughly, if you look at angel investments, more than half of investments fail, one third are small successes (1X to 5X returns), 1/8th are big successes (5X to 30x), and 1/20th are huge success (30X+)

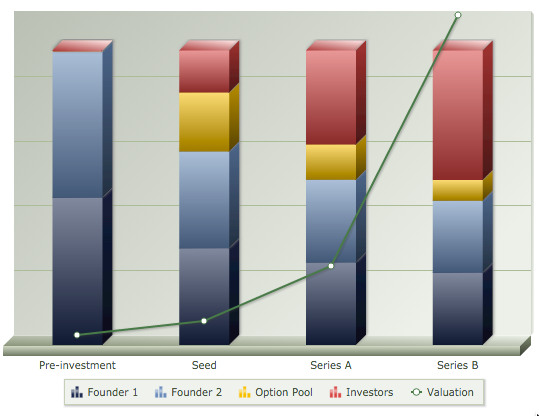

- Each stage reflects the removal of risk and increased dilution. For this reason, the equity team members get is high for early stages (starting with founders) and increasingly lower as a company matures. (See the picture above.)

- It’s critical to understand risk and dilution to know the possible future value of equity. This article from Leo Polovets gives a good overview.

- If you’re talking with a startup, there are lots of questions to ask to establish the state of the company’s business. Startups are legitimately careful about sharing financial information, so you may not get full answers to all of these, but you should at least ask:

- How much money has the company raised? In what rounds, and when?

- What did the last round value the company at?

- Will it likely raise more capital soon?

- How long will your current funding last? (This will likely be given at current burn rate, i.e. no additional hiring.)

- What is the hiring plan? (How many people over what time frame.)

- What is the revenue now, if any? Are there any revenue goals or projections?

- Where do you see this company in 1 year and 5 years? Revenue? Employees? Market position?

It takes quite a bit of know-how to be able discuss, understand, and evaluate equity compensation offers. If you don’t yet have an offer, see the sections below on evaluating a company and negotiation, as well.

- We all know the value of cash. But determining the value of equity is hard, because you have to figure out or make guesses about several things:

- Stock value: The value the company will have in the future, which depends on the value of the business, and the number of shares you own.

- Vesting and liquidity: When you actually will own the shares and when you’ll be able to sell them.

- Tax: Both purchase and sale of stock can require that you pay taxes — sometimes very large amounts. Also, there are several kinds of taxes: Income, capital gains, and AMT.

- Knowing how many shares of stock or stock options is meaningless unless you know the number of outstanding shares. What matters is the percentage of the company the shares represent. Typically it would be in percent or basis points (hundredths of a percent). Some companies don’t volunteer this information unless you specifically ask, but it’s always a fair question, since without it, the offer of shares is almost meaningless.

- You need to understand the type of stock grant or stock option in detail, and what it means for your taxes, to know the likely value.

- In some cases, high taxes may prevent you from exercising, if you can’t sell the stock, so you could effectively be forced to walk away from the stock if you can't afford to exercise.

- If you do get an offer, you need to understand the value of the equity component. You need quite a bit of information to figure this out, and should just ask. If the company trusts you enough to be giving you an offer, and still doesn’t want to answer these questions about your offer, it’s a warning sign. (There are lots of other articles with more details about questions like this.)

- What percentage of the company do the shares represent?

- What set of shares was used to compute that percentage (i.e. is this really the percentage of all shares, or some subset)?

- What did the last round value the company at (i.e. the preferred share price times the total outstanding shares)?

- What is the most recent 409A valuation? When was it done, and will it be done again soon?

- Do you allow early exercise of my options?

- Are all employees on the same vesting schedule?

- Is there any acceleration of my vesting if the company is acquired?

- Do you have a policy regarding follow-on stock grants?

- Does the company have any repurchase right to vested shares?

- Finally, consider the common scenarios for exercising options, discussed below.

If you don’t yet have an offer, it’s important to negotiate firmly and fairly to get a good one. A guide like this can’t give you personal advice on what a reasonable offer is, as it depends greatly on your skills, the marketplace of candidates, what other offers you have, what the company can pay, what other candidates the company has found, and the company’s needs and situation. However, this section covers some basics of what to expect with offers, and tips on negotiating an offer.

- Most companies, especially well-established ones, give roughly equal treatment to candidates. But even so, harder negotiators, or ones that are more sophisticated, can often get better offers.

- Many companies will give some flexibility during negotiations, letting you indicate whether you prefer higher salary or higher equity.

- Candidates with competing offers almost always have more leverage and get better offers.

- Salaries at startups are often a bit below what you’d get at an established company, since early on, cash is at a premium.

- For very early stage startups, risk is higher, offers can be more highly variable, and variation among companies will be greater, particularly on equity.

- The dominant factors determining equity are what funding stage a company is at, and your role.

- If no funding has been raised, large equity may be needed to get early team members to work for very little or for free. Once significant funding of an A round is in place, most people will take typical or moderately discounted salaries. Startups with seed funding lie somewhere in between.

- There are no hard and fast rules, but for post-series A startups in Silicon Valley, this table, based on the one by Babak Nivi, gives rough ballparks equity levels that many think are reasonable. These would usually be restricted stock or stock options with standard 4-year vesting schedule. These apply if each of these roles were hired just after an A round and are also being paid a salary (i.e. not already founders or hired before the A round). The upper ranges would be for highly desired candidates with strong track records.

- CEO: 5–10%

- COO: 2–5%

- VP: 1–2%

- Independent board member: 1%

- Director: 0.4–1.25%

- Lead Engineer 0.5–1%

- Senior Engineer: 0.33–0.66%

- Manager or Junior Engineer: 0.2–0.33%

- For post-series B startups, equity numbers would be much lower. How much lower will depend significantly on size of the team and valuation of the company.

- Seed-funded startups would be higher than the above numbers, sometimes much higher if there is little funding.

- One of the best sources of information about what is reasonable for a given company and candidate is to look at offers from companies with similar profiles on AngelList.

- A 2014 survey of AngelList job postings by Leo Polovets has excellent summary of equity levels for the first few dozen hires at these early-stage startups.

For engineers in Silicon Valley, the highest (not typical) equity levels were:

- Hire #1: up to 2%–3%

- Hires #2 through #5: up to 1%–2%

- Hires #6 and #7: up to 0.5%–1%

- Hires #8 through #14: up to 0.4%–0.8%

- Hires #15 through #19: up to 0.3%–0.7%

- Hires #21 through #27: up to 0.25%–0.6%

- Hires #28 through #34: up to 0.25%–0.5%

- Keep in mind much of the above information is heavily biased toward early-stage Silicon Valley tech startups, not companies as a whole across the country.

- Companies will always ask you what you want for compensation. And you should always be cautious about answering. If you name a number that you’ll accept, you can be fairly sure the company won’t exceed it, at least not by much.

- If you are inexperienced and are unsure what a fair offer should look like, avoid saying exactly what you want for compensation very early in discussions. It’s common for hiring managers or recruiters to ask this early in the process, just to take advantage of candidates that don’t have a good sense of their own worth. Tell them you want to focus on the opportunity as a whole and your ability to contribute before discussing numbers. Ask them to give you a fair offer once they understand your worth to the company.

- If you are experienced and know your value, it’s often in your interest to state what sort of compensation and role you are looking for, to anchor expectations. You might even share your expectations early in the process, so you don’t waste each other’s time.

- Discuss what your compensation might be like in the future. No one can promise you future equity, salary, or bonuses, but it should be possible to agree what they will look like if you have outstanding performance and the company has money.

- If you’re coming from an established company to a startup, you may be asked to take a salary cut. This is reasonable, but it’s wise to discuss explicitly how much it is, and when that will be changed up front. For example, you might take 25% below your previous salary, but there can be an agreement that this will be corrected if your performance is strong and the company gets funding.

- Always negotiate non-compensation aspects before agreeing to an offer. If you want a specific role, title, opportunity, visa sponsorship, special treatment (like working from home), or have timing constraints about when you can join, negotiate these early, not late in the process.

- Get all such additional agreements in writing, if they are not in your offer letter.

- If you’re going to be a very early employee, consider asking for a restricted stock grant instead of stock options, and a cash bonus equal to the tax on those options. This costs the company a little extra paperwork (legal costs), but then you won’t have to pay to exercise, and then if you file an 83(b) election, you’re simplifying life, eliminating the AMT issues of ISOs and maximizing chances of qualifying for long-term capital gains tax.

- Getting multiple offers is always in your interest. If you have competing offers, sharing the competing offers can be helpful, if they are good. Dragging out negotiations excessively so you can “shop around” an offer to other companies is considered bad form by some people, so it’s thoughtful to be judicious, and try to time things at once to the extent possible.

- Never accept an offer verbally or in writing unless you’re ready to stand by your word. In practice, occasionally people do accept an offer and then renege, but in the United States, this is considered a very bad thing to do. It puts the company in a difficult position (as they may have declined and lost other candidates based on your acceptance), and will hurt your reputation.

- Robby Grossman gives a good overview of equity compensation and negotiation suggestions.

- Once you have stock options, what are the possible scenarios for exercise? Generally, you should consider these possibilities:

- Exercise and hold: You can write the company a check and pay any taxes on the spread. You are then a stockholder, with a stock certificate that may have value in the future. As discussed above, you may do this “early”, even immediately upon grant, before vesting (if early exercise is available to you), sometime after vesting, or after leaving the company, as long as the exercise window is open. Recall that often the window closes soon you leave a company, e.g. 90 days after termination.

- Wait until acquisition: If the company is acquired for a large multiple of the exercise price, you may then use your options to buy valuable stock. However, as discussed, your shares could be worth next to nothing unless the sale price exceeds the liquidation overhang, since preferred stock is paid up first.

- Secondary market: As discussed above, in some cases it’s possible to exercise and sell the stock in a private company directly to a private party. But this generally requires some cooperation from the company and is not something you can always count on.

- Cashless exercise: In the event of an IPO, a broker can allow you to exercise all of your vested options and immediately sell a portion of them into the public market, removing the need for cash up front to exercise and pay taxes.

- Note that some of these scenarios may require significant cash up front, so it makes sense to do the math early.

- If you are in a tight spot, where you may lose valuable options altogether because you don’t have the cash to exercise, it’s worth exploring each of the scenarios above, or combinations, such exercising and then selling a portion to pay taxes. In addition, there are a few funds or individual investors who may be able to front you the cash to exercise or pay taxes in return for an agreement to share profits.

- Alex MacCaw’s guide includes a few more detailed example scenarios.

This section covers a few kinds of documents you’re likely to see. It’s not exhaustive, as titles and details vary.

- When you are considering your offer from the company, make sure you have all of the documents. This should be:

- Your offer letter, which will detail salary, benefits, and equity compensation.

- An Employee Innovations Agreement or Proprietary Information and Inventions Assignment Agreement or similar, which concerns intellectual property.

- In addition, if you have equity compensation, at some point — possibly weeks or months after you’ve joined — you should get a Summary of Stock Grant or Notice of Stock Option Grant, or similar, detailing your grant of stock or options, along with all details such as number of shares, type of options, grant date, vesting commencement date, and vesting schedule. It will come with several other documents, which may be exhibits to that agreement:

- Stock Option Agreement

- Stock Plan (sometimes called a Stock Option Plan, or Stock Award Plan, or Equity Incentive Plan)

- Code Section 409A Waiver and Release (sometimes this is part of the Stock Option Agreement)

- If you are exercising your options you should also see paperwork to assist with that purchase:

- Exercise Agreement.

- Instructions and template for early exercise and 83(b) election, if applicable.

These are scenarios that can be very costly for you if you aren’t aware of them.

- Do not accept an offer of stock or shares without also asking for the exact number of total shares (or, equivalently, getting the exact percentage of the company those shares represent). It’s quite common for some companies to give offers of stock or options and tell you only the number of shares. Without the percentage, the number of shares is meaningless. Not telling you is a deeply unfair practice. A company that refuses to tell you even when you’re ready to sign an offer is likely giving you a very poor deal.

- If you’re looking at an offer, work out whether you can and should early exercise, and what the cost to exercise and tax will be, before accepting the offer.

- If you join a company right as it raises a new round, and don’t have the chance to exercise right away, they may potentially issue you the options with the low strike price, but the 409A of the stock will have gone up. This means you won’t be able to early exercise without a large tax bill. In fact, it might not be financially feasible for you to exercise at all.

- Vesting starts on a vesting commencement date. Sometimes stock option paperwork won’t reach you for months after you join a company, since it needs to be written by the lawyers and approved by the board of directors. This usually isn’t a big problem, but do discuss it to make sure the vesting commencement date will reflect the true start date of when you joined the company, not when the stock option is granted.

- If you’re going to early exercise, consider it like any investment. Don’t believe every projection about the value of the company you hear. Founders will tell you the best-case scenario. Remember, most startups fail. Do your research and ask others’ opinions about likely outcomes for the company.

- It may not be common, but some companies retain a right to repurchase (take back) vested shares. It’s simple enough to ask, “Does the company have any repurchase right to vested shares?” (Note repurchasing unvested shares that were purchased via early exercise is different, and helps you.) If you don't want to ask, the fair market value repurchase right should be included in the documents you are being asked to sign or acknowledge that you have read and understand. (Skype had a complex controversy related to this.) You might find a fair market value repurchase right in the Plan itself, the Stock Option Agreement, or the Exercise Agreement.

Here are some costly, common errors to watch out for on the taxation side.

- If you are going to file an 83(b) election, it must be within 30 days of stock grant or option exercise. Note that often law firms will take a while to send you papers, so you might only have a week or two. If you miss this window, it could potentially have giant tax consequences, and is essentially an irrevocable mistake — it’s one deadline the IRS won’t extend. When you file, get documentation of from the post office, delivery confirmation, and include a self-addressed stamped envelope for the IRS to send you a return receipt. (Some people are so concerned about this they even ask a friend to go with them to the post office as a witness!)

- One of the most serious tax-related mistakes you can make is to exercise ISOs without first knowing the impact on your AMT obligations. If there is a large spread between strike price and 409A value, you are potentially on the hook for a very large tax bill — even if you can’t sell the stock. This has pushed people into bankruptcy. It also caused Congress to grant a one time forgiveness, but the odds of that happening again are very low. Understand this topic and talk to a professional if you exercise ISOs.

- Thoughtfully decide when to exercise options. As discussed, if you wait until the company is doing really well, or when you are leaving, it can have serious downsides.

- David Weekly, An Introduction to Stock & Options for the Tech Entrepreneur or Startup Employee

- Investopedia, Employee Stock Options: Definitions and Key Concepts

- Dan Shapiro, Vesting is a hack

- Alex MacCaw, An Engineer’s Guide to Stock Options

- Robby Grossman, Negotiating Your Startup Job Offer

- Julia Evans, Things you should know about stock options before negotiating an offer

- Joe Wallin, RSUs vs. Restricted Stock vs. Stock Options

- Joshua Levy and Joe Wallin, The Problem With Immediately Exercisable ISOs

- Barry Kramer, The Tax Law that is (Unintentionally) Hammering Silicon Valley Employees

- Startup Law Blog, Incentive Stock Options vs. Nonqualified Stock Options

- Startup Law Blog, Top 6 Reasons To Grant NQOs Over ISOs

- Investopedia, How Restricted Stock And RSUs Are Taxed

- Investopedia, Introduction To Incentive Stock Options

- Forbes, Ten Tax Tips For Stock Options

- Wealthfront, When Should You Exercise Your Stock Options?

- Wealthfront, The 14 Crucial Questions about Stock Options

- Leo Polovets, Valuing Employee Options

- Leo Polovets, Analyzing AngelList Job Postings, Part 2: Salary and Equity Benchmarks

- Inc, 5 Questions You Should Ask Before Accepting a Startup Job Offer

- GigaOm, 5 Mistakes You Can’t Afford to Make with Stock Options

- Wealthfront, How Do Stock Options and RSUs Differ?

- Mary Russell, Startup Equity Standards: A Guide for Employees

- Mary Russell, Can the Company Take Back My Vested Shares?

- Fairmark, AMT and Long-Term Capital Gain

- NCEO, Stock Options and the Alternative Minimum Tax (AMT)

- Accelerated Vesting, What Is An 83(b) Election and When Do I Make It?

- Fenwick, Section 409A Valuations and Stock Option Grants for Start-up Technology and Life Science Companies

- Venture Hacks, How to make a cap table

- VentureBeat, Beware the trappings of liquidation preference

- Orrick, Startup Forms: Equity Compensation

- Matthew Bartus, Option Grants: Fully Diluted or Issued and Outstanding

- Babak Nivi, The Option Pool Shuffle (and table of equity ranges)

- OwnYourVenture, a simulator illustrating equity dilution

This guide and all associated comments and discussion do not constitute legal or tax advice in any respect. No reader should act or refrain from acting on the basis of any information presented herein without seeking the advice of counsel in the relevant jurisdiction. The author(s) expressly disclaim all liability in respect of any actions taken or not taken based on any contents of this guide or associated content.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.