We are going to predict the stock prices using Linear Regression using the Quandl API.

Pre-requisites:

pip install pandas

pip install numpy

pip install quandl

pip install matplotlib

pip instal scikit-learn

Get your quand API Key by signing up on Quandl here

-

Step 1: Get the stock from Quandl. We'll be using WIKI/GOOGL Other alternatives: NSE/OIL.1, WIKI/AAPL.4, EIA/PET_RWTC_D Read here.

df = quandl.get('WIKI/GOOGL', start_date=start_date, end_date=end_date, collapse="daily") -

Step 2: Choose the target and features. For simplicity we have taken the Closed Price as the label and feature as the date (which is converted to integer by using the index function)

-

Step 3: Fitting a Linear Regression Model using Scikit-Learn's Linear Regression.

from sklearn.linear_model import LinearRegression regressor = LinearRegression() regressor.fit(dates, prices) -

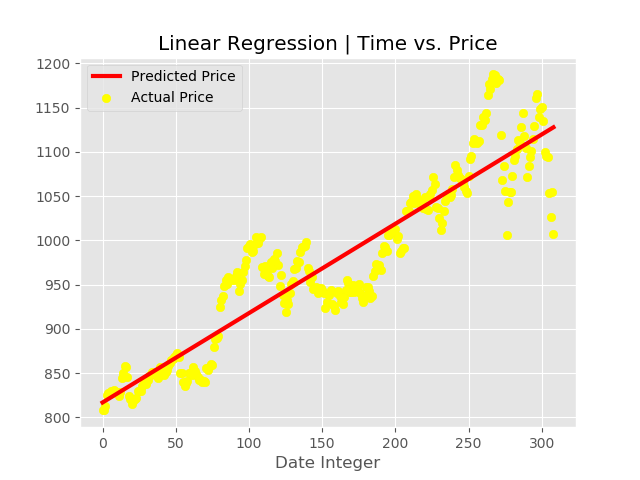

Step 4: Visualizing the Linear Regression model created (Google).

#plotting data points plt.scatter(dates, prices, color='yellow', label= 'Actual Price') #plotting regression line plt.plot(dates, regressor.predict(dates), color='red', linewidth=3, label = 'Predicted Price') plt.title('Linear Regression | Time vs. Price') plt.legend() plt.xlabel('Date Integer') plt.show() -

Step 5: Predict the price using the model created in step 3.

predicted_price =regressor.predict(date)