This is a tax calculator for one individual U.S. tax return—Internal Revenue Service form 1040.

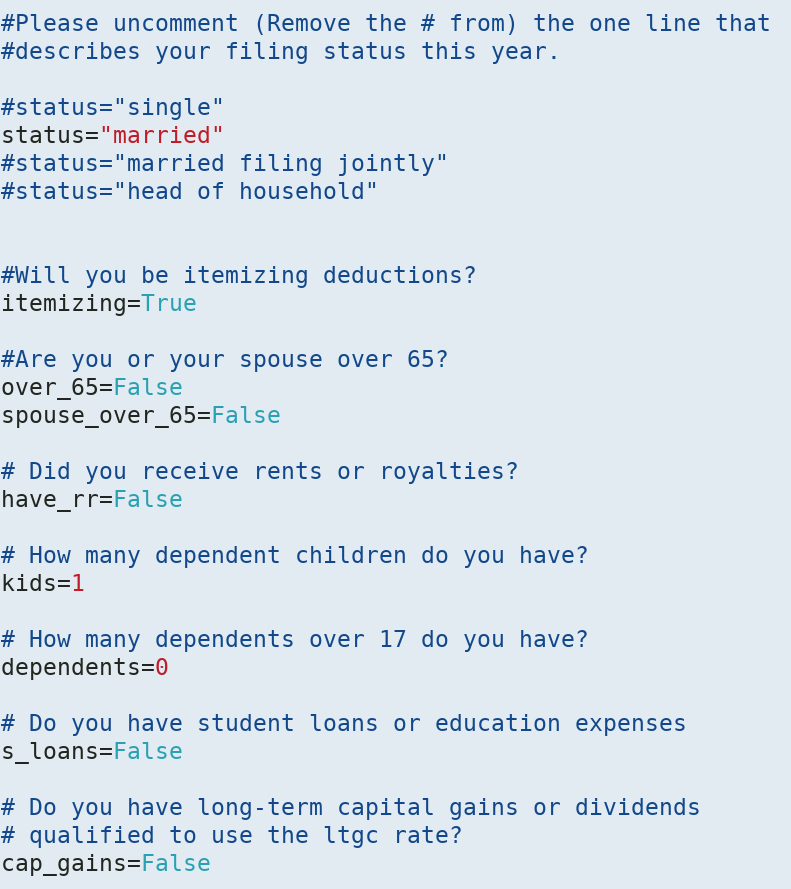

First, you will take a short interview:

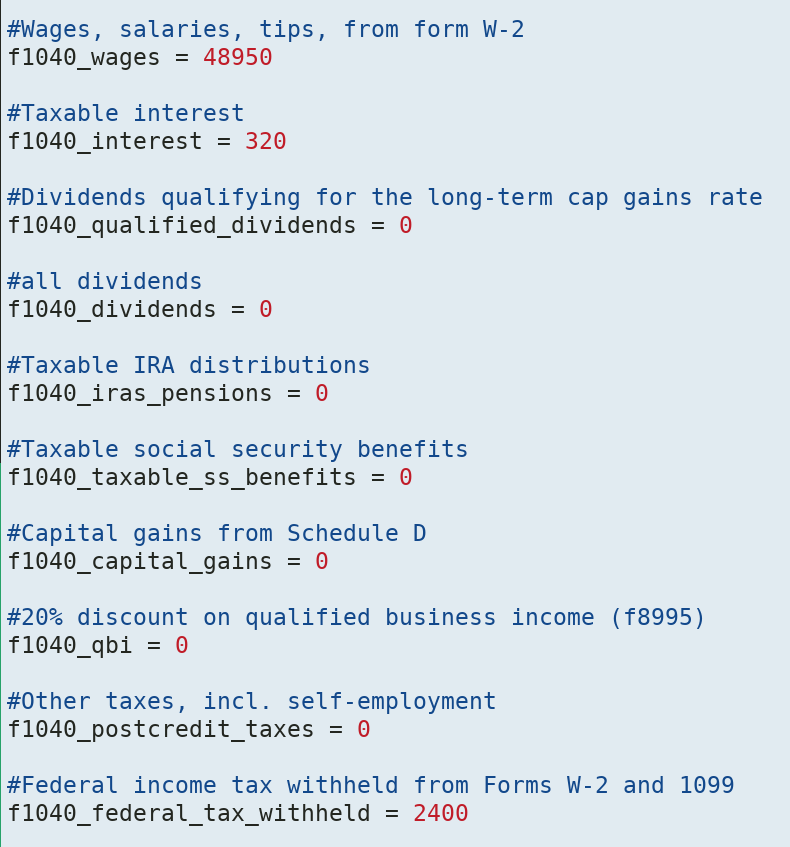

This will generate a personalized list of inputs for you to provide:

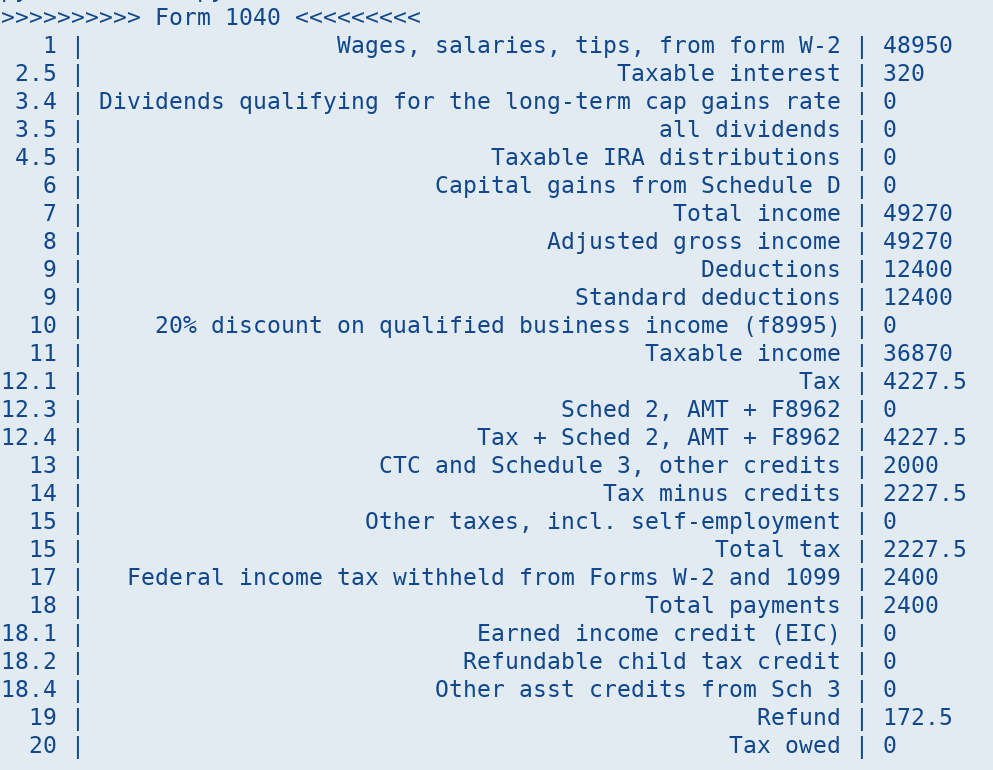

From those, you will get output that roughly follows the tax forms:

- Build it, via

make. This will pull a copy of 1040.js (See https://b-k.github.io/1040.js for the attractive front end), and generate Python versions of the forms. - Run

python3 taxes.py, which will generate a file namedinterview.py. - Open

interview.pyin your text editor, and follow the instructions to provide information about your tax situation. - Run

python3 taxes.pyagain. It will generateinform.py. - Open

inform.pyand fill in the information from your W-2s and other such sources. - Run

python3 taxes.pyagain. It will calculate your taxes and print the line-by-line calculations to the screen.

This program is not a tax tutor or advisor; there are many other sources that can help you optimize your tax situation. This is just a calculator, that may be useful in the process. For example, double-checking the work of another tax system using py1040 may reveal mistakes or even tax opportunities.

There are many elements of the system that are not yet implemented. The lead author is not self-employed and doesn't have a farm, so Schedules C and F are not implemented.

Please note this section from the license, which the license authors felt was important enough to put in all-caps:

THERE IS NO WARRANTY FOR THE PROGRAM, TO THE EXTENT PERMITTED BY APPLICABLE LAW. EXCEPT WHEN OTHERWISE STATED IN WRITING THE COPYRIGHT HOLDERS AND/OR OTHER PARTIES PROVIDE THE PROGRAM "AS IS" WITHOUT WARRANTY OF ANY KIND, EITHER EXPRESSED OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. THE ENTIRE RISK AS TO THE QUALITY AND PERFORMANCE OF THE PROGRAM IS WITH YOU.

This version was first written by BK over the course of a weekend at home, and is therefore not endorsed by or otherwise related to his employer.

Each form is represented as a file holding a dictionary of cells, where each cell

represents a line of the tax code. The cell includes the text to print, the line number,

the calculation to do, whether the cell needs to be part of inform.py, and the list of

the cell's parent cells. That dictionary is at https://github.com/b-k/1040.js , in a

relatively language-independent format that both the Javascript and Python version parse

into functions. [https://github.com/b-k/1040.js/blob/master/Contributing.md] covers all the details.

Adding a form, then, consists of transcribing this information for each needed line. This is straightforward, and has proven to take only a few seconds per line. We considered using the XML schemata here: https://www.irs.gov/Tax-Professionals/e-File-Providers-&-Partners/Schemas-Business-Rules-and-Release-Memo-for-MeF-Form-1040-Series-Tax-Year-2015-Version-3_1 but it turns out to be easier to just cut/paste/modify the lines from the PDF forms.