Trading Technical Indicators python library, where Traditional Technical Analysis and AI are met. Version 0.2.2 (stable release)

- Calculate technical indicators (62 indicators supported).

- Produce graphs for any technical indicator.

- Get trading signals for each indicator.

- Trading simulation based on trading signals.

- Machine Learning integration for prices prediction (not included in this release).

Implementation based on the book 'Technical Analysis from A to Z, Steven B. Achelis'. Validation based on the 'A to Z Companion Spreadsheet, Steven B. Achelis and Jon C. DeBry'

API documentation and installation instructions can be found in the project's web-site: Trading Technical Indicators

Change Log

Stable Releases

- 0.2.2: Incompatibilities with the latest pandas release 1.2.0 fixed (#20)

- 0.2.1: Bug fixes, new pandas release causes an exception in some indicators calculation (#20)

- 0.2.0: First stable release, updates described in the following github issues (#2, #3, #14, #15)

Beta Releases

- 0.1.b3: Updates described in the following github issues (#11, #7, #8)

- 0.1.b2: Bugs fixes (#1)

- 0.1.b1: Cosmetic changes in package building file applied (setup.py)

- 0.1.b0: First beta release

Planned Releases

- 1.0.0: Full featured release, including machine learning related features (planned for 01.03.2021).

Indicators supported

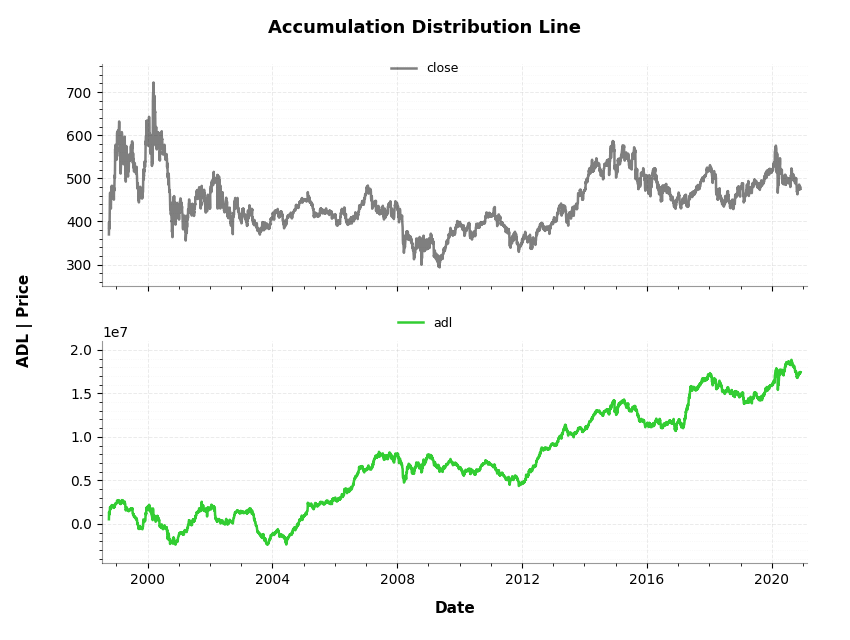

- Accumulation Distribution Line

- Average True Range

- Bollinger Bands

- Chaikin Money Flow

- Chaikin Oscillator

- Chande Momentum Oscillator

- Commodity Channel Index

- Detrended Price Oscillator

- Directional Movement Index

- Double Exponential Moving Average

- Ease Of Movement

- Envelopes

- Fibonacci Retracement

- Forecast Oscillator

- Ichimoku Cloud

- Intraday Movement Index

- Klinger Oscillator

- Linear Regression Indicator

- Linear Regression Slope

- Market Facilitation Index

- Mass Index

- Median Price

- Momentum

- Exponential Moving Average

- Simple Moving Average

- Time-Series Moving Average

- Triangular Moving Average

- Variable Moving Average

- Moving Average Convergence Divergence

- Negative Volume Index

- On Balance Volume

- Parabolic SAR

- Performance

- Positive Volume Index

- Price And Volume Trend

- Price Channel

- Price Oscillator

- Price Rate Of Change

- Projection Bands

- Projection Oscillator

- Qstick

- Range Indicator

- Relative Momentum Index

- Relative Strength Index

- Relative Volatility Index

- Standard Deviation

- Stochastic Momentum Index

- Fast Stochastic Oscillator

- Slow Stochastic Oscillator

- Swing Index

- Time Series Forecast

- Triple Exponential Moving Average

- Typical Price

- Ultimate Oscillator

- Vertical Horizontal Filter

- Volatility Chaikins

- Volume Oscillator

- Volume Rate Of Change

- Weighted Close

- Wilders Smoothing

- Williams Accumulation Distribution

- Williams %R

Code example

"""

Trading-Technical-Indicators (tti) python library

File name: indicator_example.py

Example code for the trading technical indicators, for the docs.

Accumulation Distribution Line indicator and SCMN.SW.csv data file is used.

"""

import pandas as pd

from tti.indicators import AccumulationDistributionLine

# Read data from csv file. Set the index to the correct column

# (dates column)

df = pd.read_csv('./data/SCMN.SW.csv', parse_dates=True, index_col=0)

# Create indicator

adl_indicator = AccumulationDistributionLine(input_data=df)

# Get indicator's calculated data

print('\nTechnical Indicator data:\n', adl_indicator.getTiData())

# Get indicator's value for a specific date

print('\nTechnical Indicator value at 2012-09-06:', adl_indicator.getTiValue('2012-09-06'))

# Get the most recent indicator's value

print('\nMost recent Technical Indicator value:', adl_indicator.getTiValue())

# Get signal from indicator

print('\nTechnical Indicator signal:', adl_indicator.getTiSignal())

# Show the Graph for the calculated Technical Indicator

adl_indicator.getTiGraph().show()

# Execute simulation based on trading signals

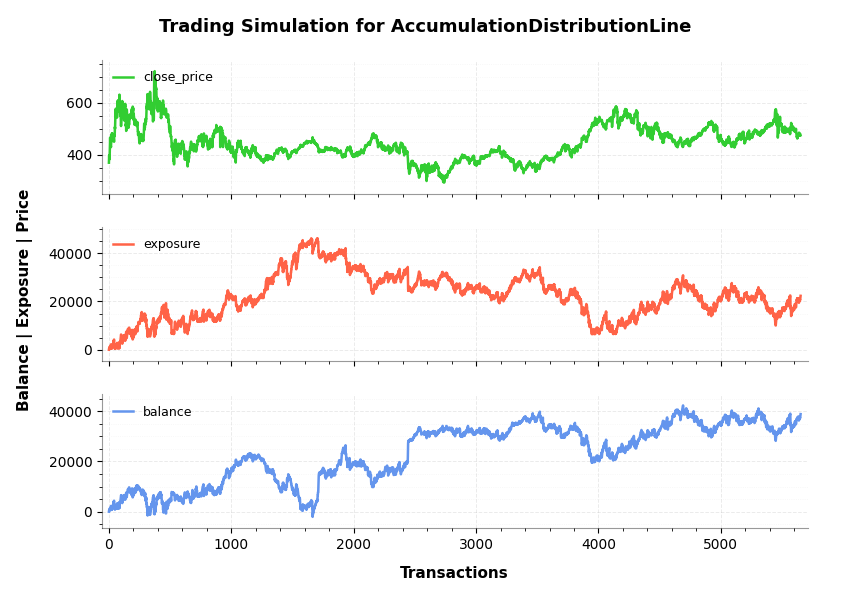

simulation_data, simulation_statistics, simulation_graph = \

adl_indicator.getTiSimulation(

close_values=df[['close']], max_exposure=None,

short_exposure_factor=1.5)

print('\nSimulation Data:\n', simulation_data)

print('\nSimulation Statistics:\n', simulation_statistics)

# Show the Graph for the executed trading signal simulation

simulation_graph.show()Output

Technical Indicator data:

adl

Date

1998-10-05 5.346066e+05

1998-10-06 9.788753e+05

1998-10-07 1.377338e+06

1998-10-08 1.251994e+06

1998-10-09 1.108012e+06

... ...

2020-11-30 1.736986e+07

2020-12-01 1.741746e+07

2020-12-02 1.737860e+07

2020-12-03 1.741683e+07

2020-12-04 1.742771e+07

[5651 rows x 1 columns]

Technical Indicator value at 2012-09-06: [8617026.854250321]

Most recent Technical Indicator value: [17427706.42639293]

Technical Indicator signal: ('buy', -1)

Simulation Data:

signal open_trading_action ... earnings balance

Date ...

1998-10-05 hold none ... 0 0

1998-10-06 buy long ... 0 385.138

1998-10-07 buy long ... 13.264 411.666

1998-10-08 buy long ... 13.264 777.644

1998-10-09 buy long ... 19.159 795.329

... ... ... ... ... ...

2020-11-30 buy long ... 19817.2 37577.2

2020-12-01 hold none ... 19817.2 37577.2

2020-12-02 buy long ... 19817.2 38019.2

2020-12-03 buy long ... 19817.2 38385.1

2020-12-04 buy long ... 19817.2 38837.2

[5651 rows x 7 columns]

Simulation Statistics:

{'number_of_trading_days': 5651, 'number_of_buy_signals': 4767, 'number_of_ignored_buy_signals': 0, 'number_of_sell_signals': 601, 'number_of_ignored_sell_signals': 0, 'last_stock_value': 475.5, 'last_exposure': 22340.73, 'last_open_long_positions': 40, 'last_open_short_positions': 0, 'last_portfolio_value': 19020.0, 'last_earnings': 19817.21, 'final_balance': 38837.21}

Output graphs