Aug 28: All the notes on the methodological part of this course have been uploaded to lecture notes. Special thanks to all the students who help scribe the notes and provide feedbacks! A collection of all the notes can be found here.

July 10: We will have Dr. Jiequn Han to teach a guest lecture on Mean Field Games (MFG) and Heterogeneous Agent Model in Continuous Time (HACT) on July 18.

July 8: Instructions for the final project have been uploaded here.

July 4: The presentation schedule has been uploaded here. Please refer to the slides of the first lecture for instructions.

For all enrolled and auditing students, please sign up here for future notifications.

-

Instructors:

- Weinan E

- Yucheng Yang

-

Time: Tue: 9:00-12:00; Thu: 9:00-12:00; Fri: 10:00-12:00 (9:00-11:00 in Week 1).

-

Location: Room 515, Teaching Building 2

-

Office Hour: By Appointment with yuchengy@princeton.edu

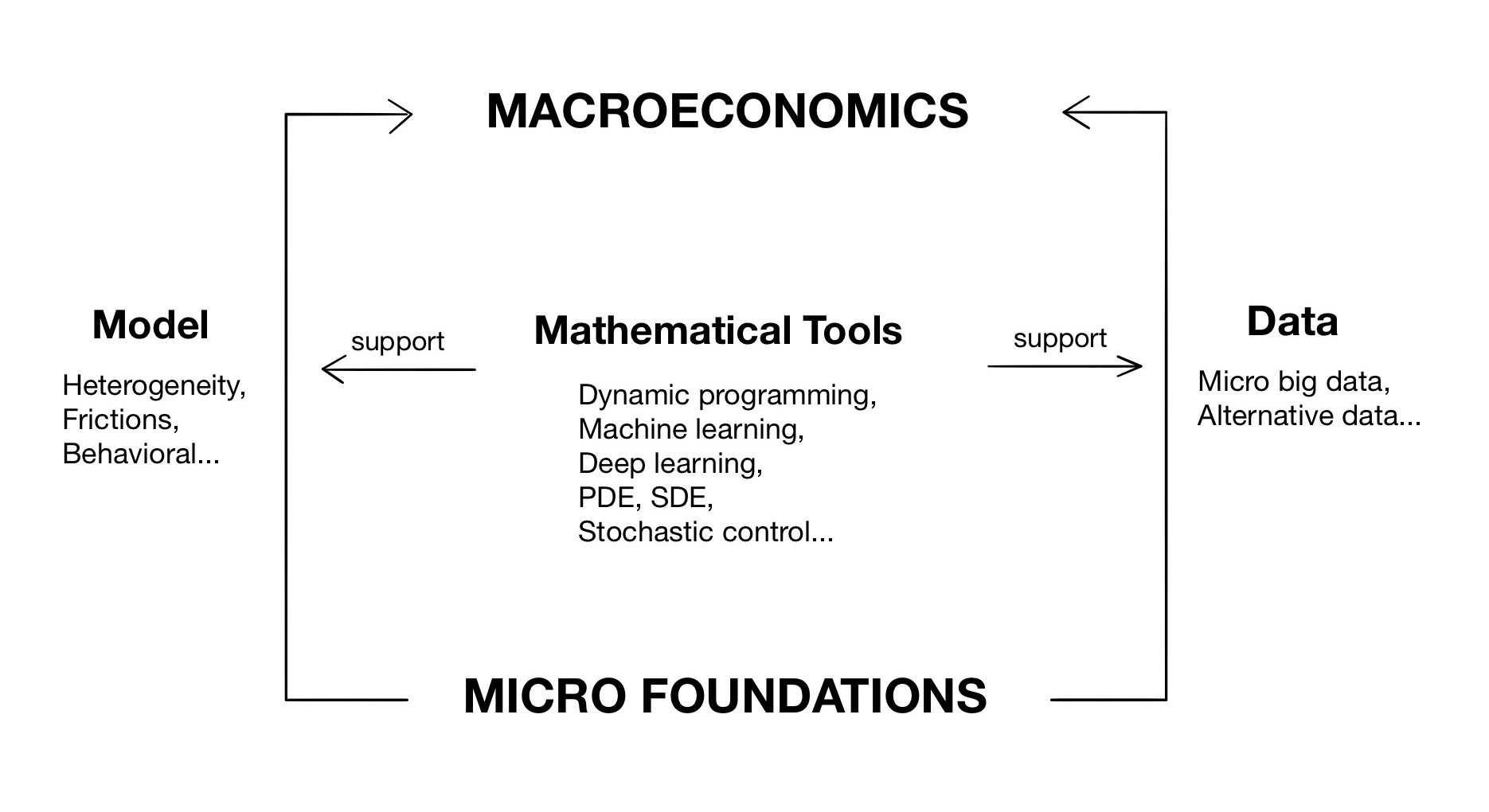

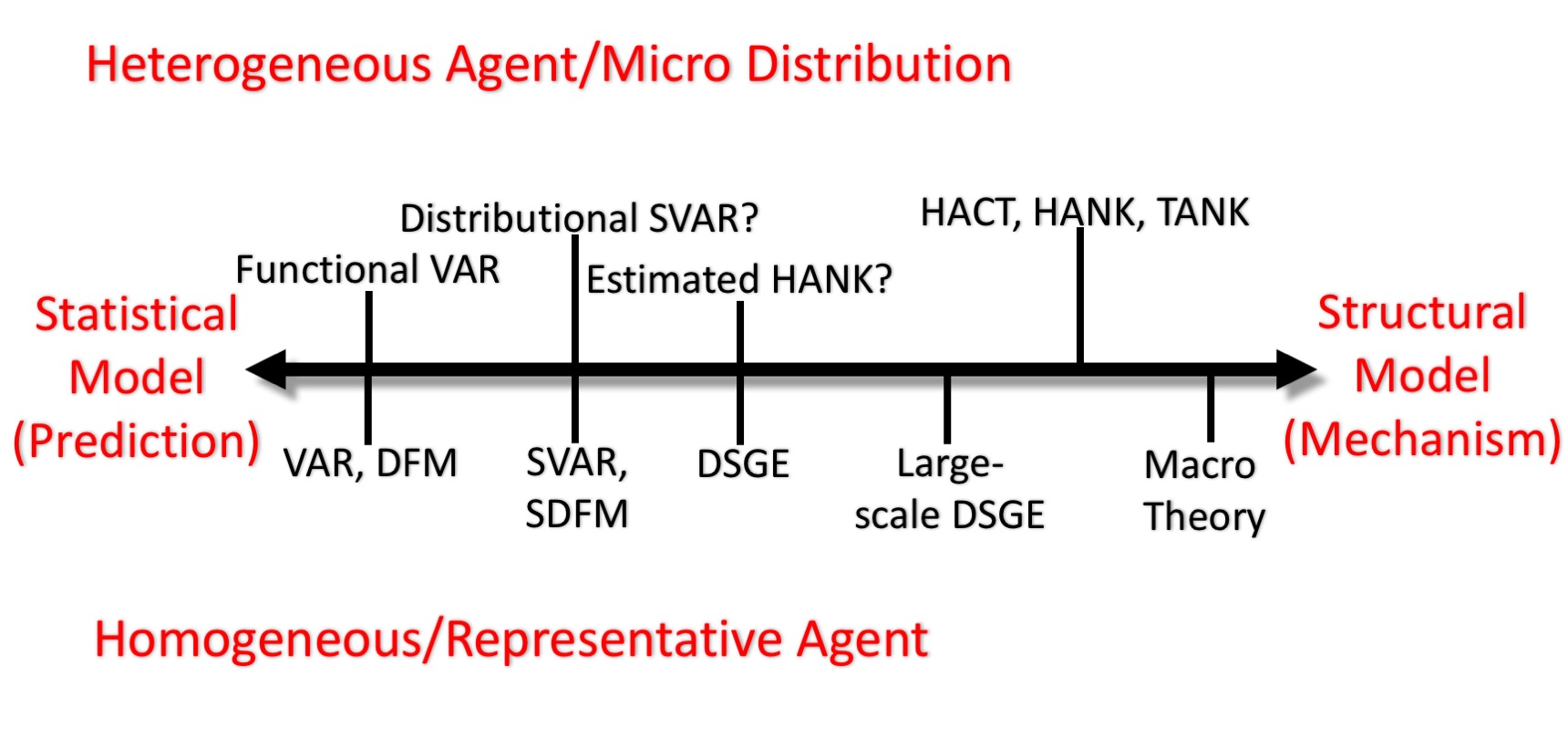

We introduce emerging opportunities in macroeconomics due to the recent booming of big data and the development of machine learning. We will systematically discuss relevant existing work (e.g. state space models, heterogeneous agent models, reduced-form macro models) and a series of recent work. The course will be based on lecture notes by instructors and relevant papers.

1. Overview

1.1 Introduction

1.2 Basics of Machine Learning for Macroeconomics

2. Statistical Model in Macroeconomics and Machine Learning

2.1 Vector Autoregressive Model and Structural VAR

2.2 State Space Model, Filtering Problem and EM Algorithm

2.3 Recurrent Neural Network and LSTM Network

2.4 VAR/SVAR and State Space Model with Distributional Inputs

3. Structural Model in Macroeconomics and Machine Learning

3.1 Representative Agent Model and DSGE

3.2 Heterogeneous Agent Model: Krusell-Smith and variants

3.3 Heterogeneous Agent Model in Continuous Time: HACT and HANK

3.4 Solving High-dimensional Stochastic Control and PDEs using Deep Neural Networks

3.5 Solving Structural Model using Deep Neural Networks

4. Empirical Macroeconomic Analysis with Big Data

4.1 Credit & Consumption Data and the Great Recession

4.2 Tax Data, Inequality and Economic Opportunity

4.3 Scanner Data, Prices and Monetary Policy

4.4 Social Network Data, Economic Behavior and Macro Implications

4.5 Firm Data and Macroeconomic Implications

4.6 Employer-Employee Data, Job Posting Data and Firm Dynamics

4.7 Alternative Data and New Measures of National Accounting

4.8 Textual Data, Uncertainty and Sentiments

Calculus and Linear Algebra, at least one programming language. Students should also be familiar with at least one of the following courses at the advanced level: macroeconomics, statistics, machine learning. Not open to freshmen and sophomores.

50% class participation and presentation. 50% final project. Auditing students are welcome, but should also participate in the in-class presentation. For more details please refer to the syllabus.