Automated trading platform written with Elixir. It uses zerodha's kite trading APIs to track market and place orders.

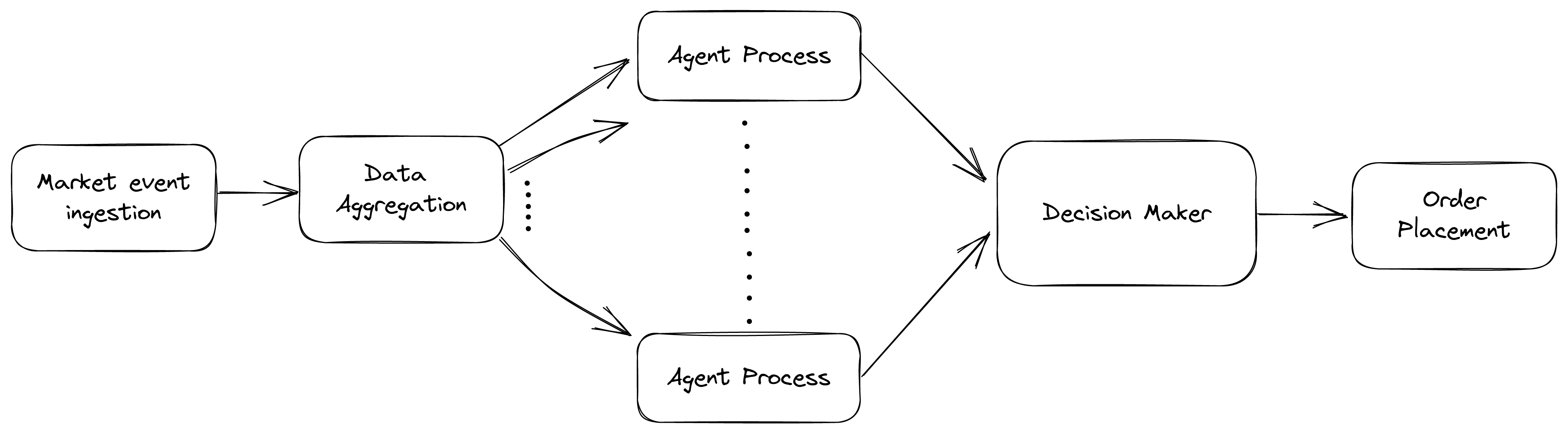

This diagram describes Hftx's architecture at a high level.

The Hftx project contains the following components

- Zerodha Integration

- Worker Process Definitions

- Data Aggregation Strategies

- Trader Strategies

- Decision Making Strategies

- TODO: Persistence

This set of modules contains fns to communicate with Zerodha kite trade APIs.

This module contains the implementation for a websocket process that will listen to the market events from the zerodha's websocket API

The Frame module contains fns that help operate on the binary frame sent by zerodha over websockets

This module acts as a in-memory store for the access_token. This module would be used whenever access_token is require to call the zerodha APIs.

This module describes a Supervisor process that will initialize and supervise the zerodha related processes - TokenStore & WebSocket

These modules contain the definition of worker processes for Trader, DataTransformer and DecisionMaker

A :gen_statem process that simulates a trader as an FSM. This worker will consume aggregate market events for a market instrument and give a suggestion based on the active strategy

These suggestions are then forwarded to the decision maker process for that instrument

In a typical run of the system, there would be multiple traders running for every market instrument under watch. And each of these trader would be implementing a different strategy to evaluate the market events

A GenServer process that transformer the incoming stream of market event into an aggregate data. This process is initialized with a strategy, which determines how the market event stream is converted into an aggregate data struct

The aggregate data structs are then forwarded to all the trader worker processes for that instrument

There would be one data_transformer working on one market instrument

A GenServer process that consumes the suggestions from various traders and takes the final action based on the suggestions. This process is initialized with a decision making strategies

These are set of modules that specify data transformation strategies. The base behaviour can be found here

Operating on a raw stream on market events maybe too computationally intensive. The raison d'etre for these modules is to convert the incoming market event data stream into an aggreagte form. The intent is to create an aggregate data struct, which conveys more or less the same information as the raw market event data stream that it represents. The TraderWorker can then operate on the aggregate rather than the original stream.

An example data transformer strategy can be found here. This strategy converts a list of market event data into CandleStick data struct

These are set of modules that specify the strategies which can be injected in the trader worker processes.

These strategies take a list of aggregate market data event and respond back with a suggestion. The base behaviour for this strategy can be found here

An example trader worker strategy can be found here. This is a dummy strategy that always suggests going :long on the instrument

These are set of modules that specify the decision making strategies. The base behaviour can be found here

These strategies define the algorithm to consume the suggestions generated by the trader worker processes and take the final decision on them.

And example decision maker strategy can be found here. This is a dummy strategy which just picks the latest suggestion by the traders.

TODO

This module doesn't exist yet, when it does it will help persist the orders, the decisions and the circumstances underwhich those decisions were taken.

- Install docker

- Install elixir v1.12 or later

- asdf is a good tool for managing multiple versions of elixir (and other languages for that matter)

Once the local dependencies are met, run the following:

make runmake testThis will run Hftx app against the data in the priv/backtest_data.csv file.

make backtestThe result of the backtest can be obtained by running the following command in the above shell

Hftx.Backtesting.OrderHistory.statement(<instrument_name>)There's also a yfin.py python script that can be used to download 1m interval data for other instruments.