Supercharge your Robinhood options trading strategy with data-driven insights! 🚀 The Options Trading Analysis Dashboard is a powerful web application designed for options traders who want to understand and improve their trading performance. By securely fetching your options trading data directly from Robinhood, this dashboard provides in-depth analytics, interactive visualizations, and a platform for you to reflect, take notes, and develop better trading strategies.

Whether you're a seasoned options trader or just getting started, this tool helps you:

- Analyze your trading history in detail.

- Visualize profit and loss trends over time.

- Identify your most profitable instruments and strategies.

- Keep track of your thoughts and strategies with integrated note-taking.

🔮 Update

- Chatbot Integration: Interact with a chatbot to get quick answers and assistance on using the dashboard. Knows your data & plots.

- Screenshots stored locally in

backend/screenshotsfolder. - Default model set to

meta-llama/llama-3.2-11b-vision-instruct:freeinbackend/chatbot_service.py. Change as fit.

- Screenshots stored locally in

- 📈 Secure Data Fetching: Log in with your Robinhood credentials to fetch your options trading history within a specified date range.

- 🏆 Comprehensive Analytics:

- Total Profit/Loss calculations.

- Win Rate and Total Trades overview.

- Profit/Loss by Instrument: Identify which assets are driving your performance.

- Profit/Loss by Option Type: Understand whether calls or puts are more profitable for you.

- Revenue Analysis by Instrument.

- Cumulative Profit/Loss Over Time: See how your P/L evolves.

- Top Profitable and Loss-Making Trades: Learn from your best and worst trades.

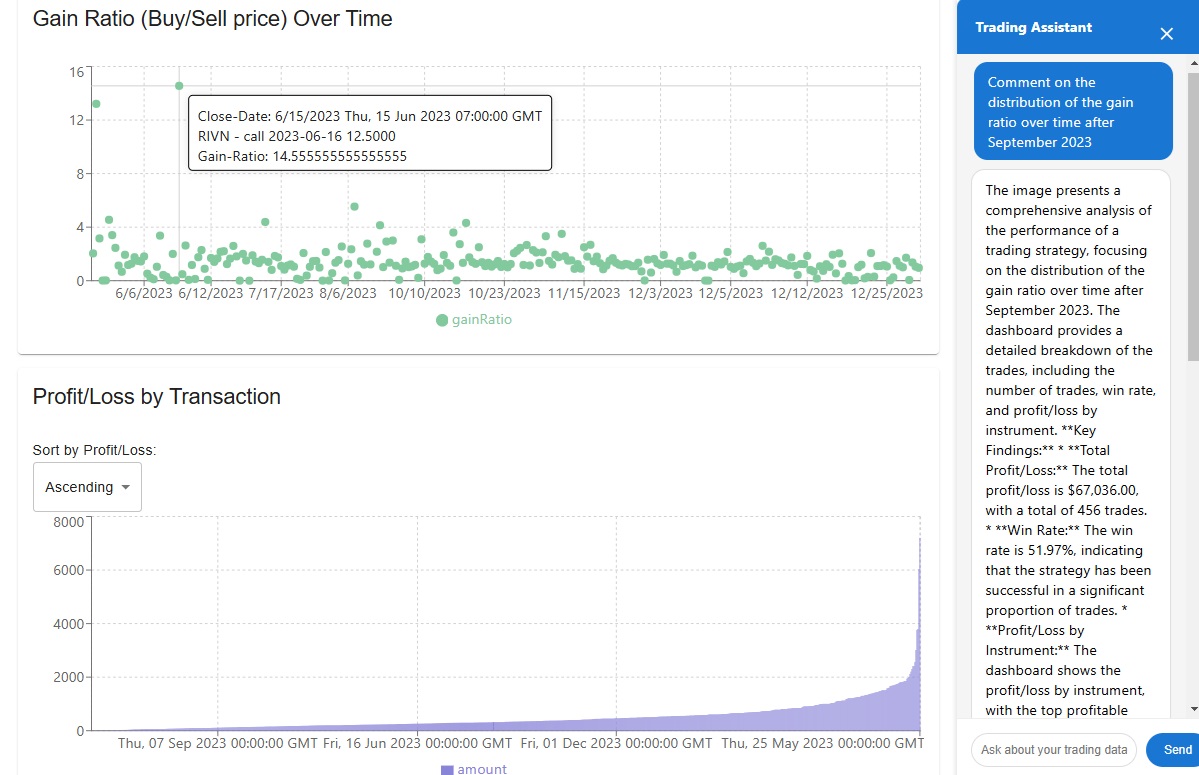

- 📊 Interactive Visualizations: Utilize charts and graphs powered by Recharts for an intuitive analysis experience.

- 🗓️ Customizable Date Range: Focus your analysis on specific periods to see how strategies performed over time.

- 📝 Trading Notes:

- Integrated note-taking section with Markdown support.

- Export notes as Markdown files.

- Save and load notes for continuous strategizing and refer back when needed.

- 💾 CSV Upload Option: Alternatively, upload your trading data via CSV if you prefer not to connect your Robinhood account.

- 💹 Responsive Design: Access the dashboard from desktop or mobile devices.

- Node.js (v14 or higher) -> 18.12.1

- Python (v3.6 or higher)

- Robinhood Account Credentials

-

Clone the repository:

git clone git@github.com:Manojbhat09/optionscope.git -

Install dependencies:

cd optionscope pip install -r backend/requirements.txt npm run build npm install # make sure to use correct nodejs, 'nvm use 18.12.1' & 'npm audit --fix' -

Start the development server:

npm start -

Open your browser and navigate to

http://localhost:3000

-

Enter Credentials:

- Username: Your Robinhood account email.

- Password: Your Robinhood account password.

- Start Date: The beginning date for your trading data.

- End Date: The ending date for your trading data.

-

Fetch Data:

- Click the "Fetch Data" button.

- The app will securely authenticate with Robinhood and retrieve your options trading history.

Once data is fetched:

-

Summary Overview:

- Total Profit/Loss: Net earnings from your trades.

- Total Profit: Sum of all profitable trades.

- Total Loss: Sum of all losing trades.

- Win Rate: Percentage of trades that were profitable.

- Total Trades: Number of trades made.

-

Charts and Graphs:

- Profit/Loss by Instrument: Bar chart showing P/L for each traded instrument.

- Revenue by Instrument: Understand which instruments generate the most revenue.

- Profit/Loss by Option Type: Pie chart comparing calls vs. puts.

- Cumulative Profit/Loss Over Time: Line chart of your P/L progression.

- Holding Period Analysis: Insights into the duration of your trades.

-

Top Trades:

- Top Profitable Trades: Review your best trades.

- Top Loss-Making Trades: Identify and learn from your biggest losses.

Scroll down to view a detailed table containing all your trades, including:

- Activity Date

- Instrument

- Description

- Transaction Code

- Quantity

- Strike Price

- Price

- Amount

-

Edit Notes:

- Click on "Edit" to modify your trading notes.

- Notes support Markdown formatting for rich text features.

-

Save Notes:

- After editing, click "Save" to store your notes locally.

-

Export Notes:

- Click "Export as MD" to download your notes as a Markdown file.

-

Reset or Clear Notes:

- Reset to Default: Restore the original sample notes.

- Clear Notes: Remove all notes.

- Use the row sliders to adjust the range of data analyzed.

- Date range and row numbers are displayed for clarity.

- Click on "Upload CSV" to select and upload a CSV file containing your trading data.

- The CSV should have columns similar to those fetched from Robinhood.

-

Credentials Usage:

- Your Robinhood username and password are used only to fetch your trading data.

- Credentials are not stored on any server or sent to any third party.

- Data fetching happens over secure connections directly with Robinhood's API.

-

Data Privacy:

- All fetched data is processed locally on your machine.

- No trading data is uploaded or stored externally.

-

Important:

- Always ensure you trust the application before entering your credentials.

- Review the source code if in doubt, particularly

backend/app.pyandbackend/get_rh_options_app.py.

We're constantly working to improve the Options Trading Analysis Dashboard. Here are some exciting features on our roadmap:

- 🤖 AI-powered trade recommendations based on historical performance

- 🌐 Integration with multiple brokers beyond Robinhood

- 📱 Mobile app for on-the-go analysis

- 🔔 Real-time alerts for potential profit-taking or loss-cutting opportunities

- 🧠 Machine learning models to predict option price movements

- 🗂️ Custom tagging system for categorizing and filtering trades

- 🔄 Backtesting functionality to simulate strategies on historical data

- 👥 Social features to share and compare trading strategies (anonymously)

- Integration with Other Brokers: Support for TD Ameritrade, E*TRADE, etc.

- Advanced Analytics: Add more metrics like Sharpe ratio, volatility analysis.

- Real-Time Data: Incorporate live data feeds for real-time strategy testing.

- Cloud Deployment: Options to deploy the dashboard on cloud platforms.

We welcome contributions from the community! If you'd like to contribute, please:

- Fork the repository

- Create a new branch for your feature

- Commit your changes

- Push to your branch

- Open a pull request

- Bug Reports & Feature Requests: Open an issue on GitHub.

- Pull Requests: Feel free to fork the repository and submit pull requests.

- Feedback: Your feedback helps improve the tool for everyone.

This project is licensed under the MIT License - see the LICENSE file for details.

- Robinhood API for providing access to trading data

- React for the frontend framework

- Flask for the backend server

- Recharts for beautiful, responsive charts

Happy trading! 📈💰 May your options always be in the money!