Credit Risk Analysis is an important process that enables lenders, credit rating agencies, and other financial institutions to evaluate the creditworthiness of borrowers and make informed decisions about extending credit. In this project, we will be using the XGBoost algorithm to predict whether a borrower is likely to default on a loan or not.

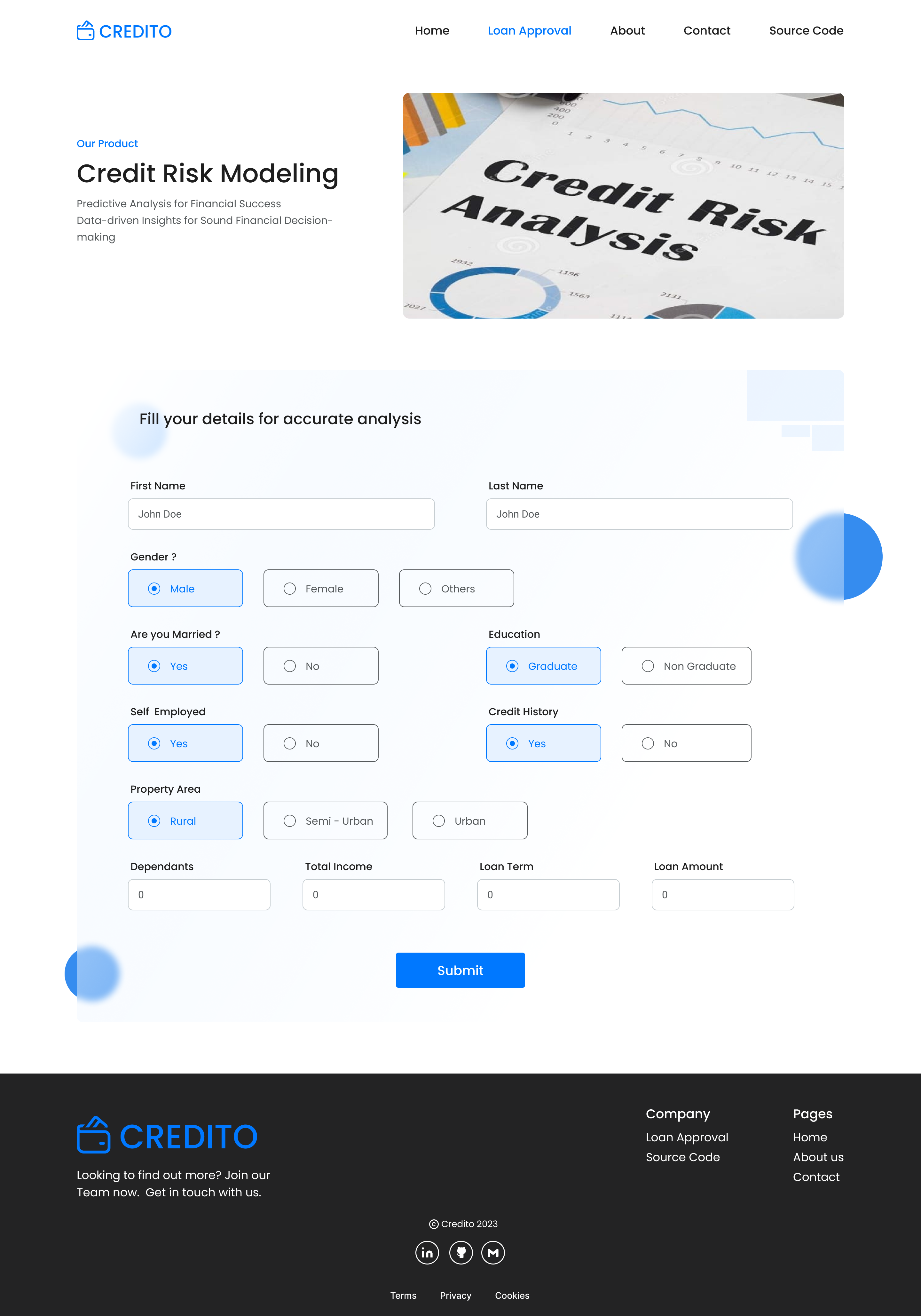

The dataset used in this project contains information about the loan issued including the Loan ID, Gender, Married, Dependents, Education, Self Employed, Applicant Income, Co-Applicant Income, Loan Amount, Loan Amount Term, Credit History, Property Area and Loan Status.

Before building our XGBoost model, the data was preprocessed by handling missing values, converting categorical variables to numerical and Label Encoding some features.

We will be using XGBoost, a popular gradient boosting algorithm, to predict the likelihood of loan default. We will train the model on the preprocessed data and evaluate its performance using metrics such as accuracy, precision, recall, and F1-score.

Our XGBoost model achieves an accuracy of 85% indicating that it is a good predictor of loan default.

In this project, we have demonstrated the use of XGBoost for credit risk analysis. By training a model on the loan dataset, we were able to predict the likelihood of loan default with high accuracy. This type of analysis can be useful for lenders and other financial institutions to make informed decisions about extending credit to borrowers.

- Clone the repository to your local machine:

git clone https://github.com/SannketNikam/Credit-Risk-Analysis.git

- Install the 'requirements.txt':

pip install -r requirements.txt

- To run this project :

python app.py

- Visit your browser at:

http://127.0.0.1:8080