Collection of models with optimization algorithms for Time series analysis, algorithmic forecasting, quantitative research and risk-management.

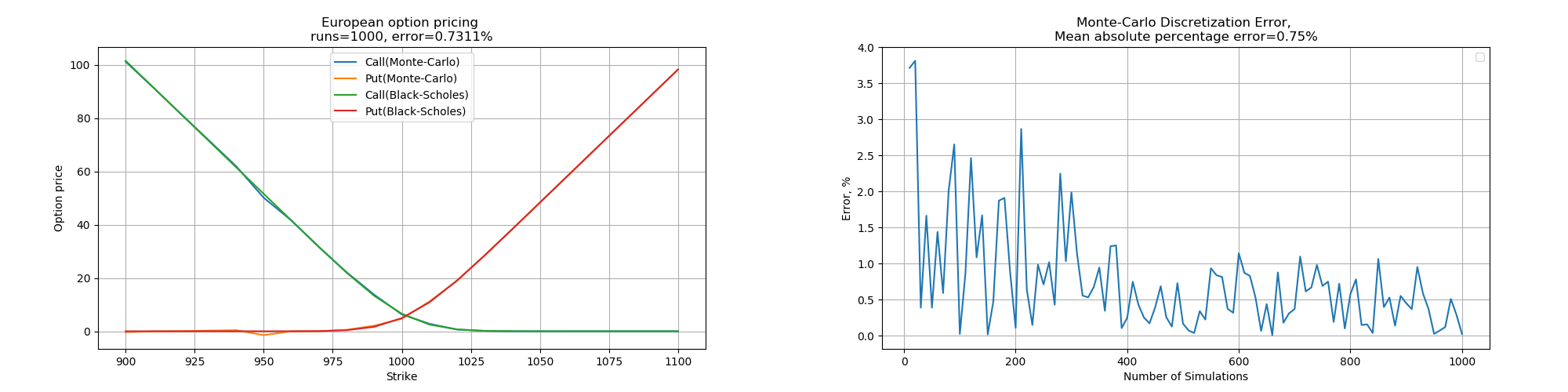

- European option pricing via Monte-Carlo simulation, Black-Scholes model

- discretization error estimate

- sensitivity analysis of option price to strike and volatility

- sensitivity of discretization error to number of simulations

- linear asset pricing: FX income, capital budgeting, floating-rate notes

- univariate concave nonlinear optimization of IRR-YTM using Brent method and binary grid search on subintervals

- available as mixed integer programming problem, ready-to-use on NISQ devices

- Glosten-Jagannathan-Runkle GARCH(p, o, q)

- unsupervised optimization of parameters

- captures asymmetric shocks (leverage effect)

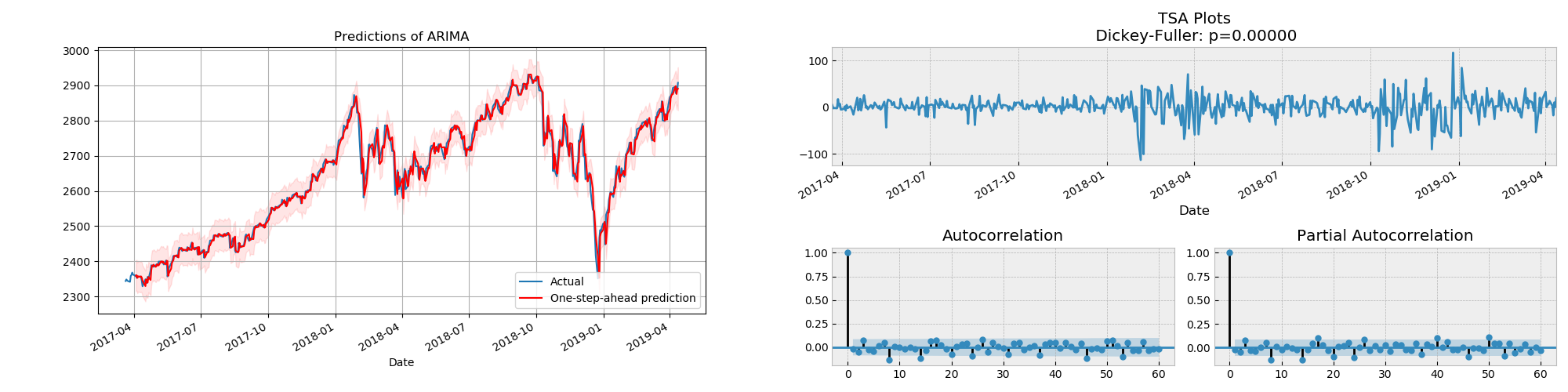

- ARIMA(p, d, q)x(P, D, Q, s)

- unsupervised optimization of AR, MA and Seasonal parameters

- provides one-step-ahead predictions and out-of-sample forecast

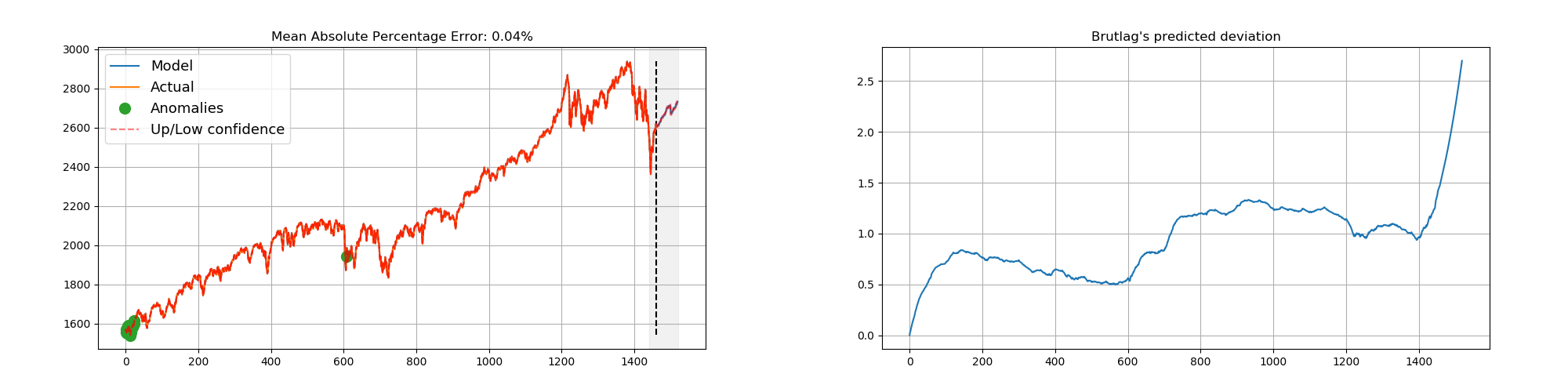

- triple exponential smoothing

- cross-validation via Conjugate gradient, TNC

- in-sample prediction and extrapolation

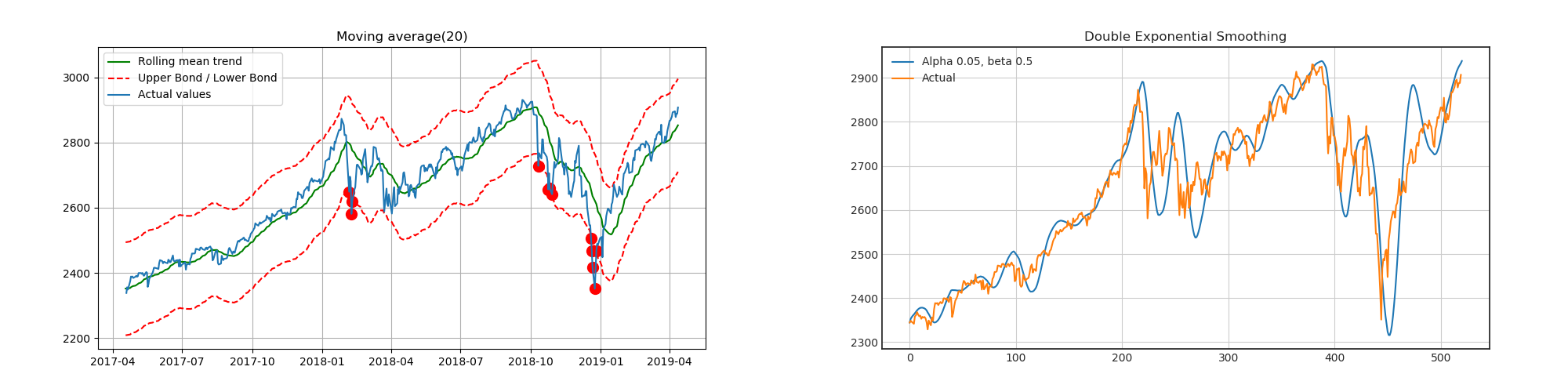

- Moving average

- Exponential smoothing

- Double exponential smoothing

Copyright (c) 2019 Oleksii Lialka

Licensed under the MIT License.